BTC, ETH prices may not recover at the available speed

Written by omkar GodBole (at all times ET unless it is indicated otherwise)

The encryption markets are a red sea with increased aversion to the risks in traditional markets, and the Trump tariff is blaming. Late Friday, the president imposed a 25 % tariff on imports from Canada, Mexico and 10 % on China, provocation Revenge measures Which raised the trade war reminds us in 2018.

The consensus on social media and the analyst community is that this segment caused by the customs tariff in the encryption market is temporary and that Bitcoin (BTC) will return quickly. However, there are reasons for the belief otherwise.

First, Trump destroyed the encryption market that he is looking to pump markets and uses only small definitions as a negotiating tactic. In fact, he has It threatened to increase customs duties If the commercial partners are lacking. Since Canada and Mexico responded with their own measures, the possibility of increased customs tariffs has increased.

Geo Chen, Macro merchant and author of the famous newsletter -based newsletter, Videnza MacroHe participated in his point of view in an email to subscribers: “My point of view is that it will remain in effect for several months with the risk of the increase, as Canada pledged revenge and China began a lawsuit against the United States in the World Trade Organization. These responses can climb the situation.

Chen stressed that the customs tariff is driven by fears of commercial deficit instead of the Fintanel crisis, as Trump loves to photograph it, adding that the markets may take days or weeks to understand this, which leads to continuous fluctuations. Moreover, the latest tariff on a basis of $ 1.3 trillion of goods imported by the United States from the three countries, which is seven times the value of the first value launched in 2018.

All this makes the last episode seem more stable stability than that at the time, when the S&P 500 initially decreased by 9 % of its peak in March before the bounce quickly. In other words, potential pain may be larger this time, which is a challenge to assets of risk like BTC.

“Although talking about deals, this step does not feel temporarily.” Stay on alert!

What do you see?

- Checks:

- Macro

- February 3, 9:45 AM: The final report for the manufacture of the S&P GLOBAL S & P in January.

- February 3, 10:00 AM: The ISM Institute (ISM) is launched by the Procurement Manager Index in January on business.

- February 4, 10:00 am: The US JoleTs Survey Report.

- Job opportunities 7.88m against the previous. 8.098m

- The start of the previous job. 3.065m

- February 5, 9:45 AM: Global S&P Global Services Services Report in January (Final).

- February 5, 10:00 AM: The ISM Institute (ISM) launches ISM Services report in January on business.

- PMI EST services. 54.3 against the previous. 54.1

- Services previous commercial activity. 58.2

- Previous recruitment services. 51.4

- Services new orders are caused. 54.2

- Previous services prices. 64.4

- Profits

- February 5: Microstrategy (Mstr), After the market, $ 0.09

- February 10: Canaan (He can), Before the market

- February 11: Digital Cell Techniques (cellAfter the market

- February 11: Exit Movement (exit), After the market, $ 0.14 (2 ESTS.)

- February 12: Cotton 8 (hutBefore the market, C 0.01 dollars

- February 12 (TBA): Metaplanet (Tyo: 3350)

- February 12: Redit (RDDTAfter the market

- February 13: Cleanspark (CLSK), $ -0.05

- February 13: Coinbase Global (currency), After the market, $ 1.61

- February 18: Coinshares International Ltd (Sto: cs), Before the market

- February 18: Seemler Scientific (Smlr), After the market, $ 0.26 (1 EST)

- February 20: Bloc (Xyz), After the market, $ 0.88

- February 26: Mara Holdings (Mara), $ -0.15

- February 26 (TBA): Sol Strategies (Cse: hodl))

- February 27: Riot platforms (Riot), $ -0.18

- March 4: Cracking (Cifr), $ -0.09

- March 6 (TBA): bitfarms)house))

- March 17 (TBA): BTBT Bit

- March 18 (TBA): Terawulf (WULF))

- March 27 (TBA): Bitdeer Technologies Group (Btdr))

- March 28 (TBA): Defi Technologies (Neo: Defi))

- March 31: Galaxy Digital Holdings (Tse: GLXY))

- April 11 (TBC): Kulr Technology Group (Coller))

- April 22: Tesla (TimingAfter the market

Symbolic events

- Voices of governance and calls

- Dow’s compound is discussion Create a Moro lending cellar on the sponsorship of the glove. Polygon Labs is scheduled to offer $ 1.5 million in Pol, and is compatible with $ 1.5 million in companies to stimulate use.

- Dow’s arbitrary is Voting About if 1,885 ETH will be transferred in NOVA transaction fees to its treasury through the infrastructure to collect modern fees shown in the OVA fee proposal.

- AAVE DAO is close to the end vote When publishing AAVE V3 on Sonic, a new layer of Layer-1 ETHEREUM Virtual Machine (EVM) with high treatment productivity.

- Feb 4, 1 pm: Ton Dao and Cryptoquant Goverting the network review Dive into performance, adoption and main standards.

- February 4, 12 pm: Star to Host A quarter of an annual quarterly review.

- to open

- February 5: XDC (XDC) network to unlock 5.36 % of $ 75.9 million in offer.

- February 9: Movement (move) to open 2.17 % of the trading offer of $ 30.06 million.

- February 10: APTOS (APT) to open 1.97 % of the trading offer of $ 64.92 million.

- Launching the distinctive symbol

- February 4: Karma (Karma), Pew Protocol (Pio), Sands (swarms), and SVM (Sonic) to be inserted on Kraken.

Conferences:

Distinguished symbol speech

Written by Shuria Malwa

- Excessive liquid noise keeps the market strongly, with a 5 % jump over the past 24 hours.

- The decentralized stock exchange has achieved approximately $ 4 million of fees over the past 24 hours, and part of the revenues are used to buy noise again, which helps to support its price in a declining market.

- Elsewhere, Jeo Body (Boden) has increased for a long time, which is a billion dollar Joe Boden simulation simulation in PEAK, up to 300 % in the past 24 hours.

- Trading volumes exceeded $ 8 million, the highest since July 2024, without immediate reason, which rapidly turned the price of one day that was 3.5 million dollars.

Locate the location of the derivatives

- The main altcoins such as ETH, XRP, BNB, Sol, Doge and Ada are seen negative permanent financing rates, and a sign of short positions.

- The distinctive symbols of the om and Hype are highlighted with the modified cumulative Delta represented by the flat interest, indicating a neutral flow. Other symbols show negative cardiovascular diseases, which means net sale.

- BTC, ETH, brief options that show eth bias, as ETH reflects larger negative concerns for BTC.

- The block flows included a large short site in the BTC call of $ 120,000 on March 28, and the bear spreads in ETH $ 2.8 thousand and 2.5 thousand dollars.

Market movements:

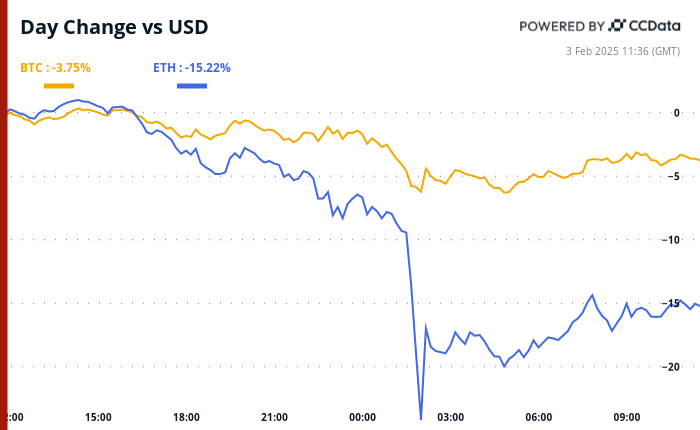

- BTC decreased by 6.3 % from 4 pm on Friday at 95,631.55 dollars (24 hours: -3.25 %)

- ETH decreased by 21.9 % at 3,734.92 dollars (24 hours: -15.28 %)

- Coindesk 20 decreased by 15.9 % in 3,154.76 (24 hours: -10.32 %)

- Cesr 3 -bit compound survey rate is 3.03 %

- BTC financing is 0.0036 % (3.97 % annual) on Binance

- DXY is 0.95 % in 109.41

- Gold did not change at $ 2,801.09/ounces

- Silver decreased 0.31 % at $ 31.28/ounces

- Nikkei 225 closed -2.66 % to 38,520.09

- Hang Seng closed unchanged at 20,217.26

- FTSE 1.17 % decreased in 8,572.04

- Euro Stoxx 50 decreased by 0.4 % in 5,203.52

- Djia closed on Friday -0.75 % to 44,544.66

- S & P 500 closed -0.5 % to 6,040.53

- Nasdak closed +0.83 % in 19,480.91

- S & P/TSX Board -1.07 % to 25,533.10.10

- S & P 40 Latin America -0.73 % closed to 2,370.49

- The Treasury has not changed for 10 years at 4.54 %

- E-MINI S & P 500 Futures decreased 1.38 % at 5,983.50

- E-MINI nasdaq-100 futures decreased by 1.59 % at 21,247.00

- The E-MINI Dow Jones Industry Indust Futured Index decreased by 1.23 % at 44,149

Bitcoin Statistics:

- BTC dominance: 61.62 (1.35 %)

- ETHEREUM ratio to Bitcoin: 0.02725 (-7.22 %)

- Retail (seven -day moving average): 833 EH/s

- Hashprice (Stain): $ 55.93

- Total fees: 4.56 BTC / 435,584 dollars

- CME FUTERES Open benefit: 177,260 BTC

- BTC at gold price: 33.9 ounces

- BTC market roof for gold: 9.65 %

Technical analysis

- BTC wore from Dual summit Support line at $ 91,384, trim losses.

- However, the red candles chain indicates that the path is less resistant on the bottom side at the present time.

- Utc Midnight below the support line will lead to the presence of a dual dual mode. Open the doors To a possible decrease to $ 75,000.

Encryption

- Microstrategy (MSTR): closed on Friday at $ 334.79 (-1.56 %), a decrease of 5.37 % to $ 316.81 in the market before the market.

- Coinbase Global (COIN): Closed at $ 291.33 (-3.31 %), a decrease of 5.69 % to $ 274.74 in pre-market.

- Galaxy Digital Holdings (GLXY): Closed at $ 28.48 (-2.90 %)

- Mara Holdings (MARA): Closed at $ 18.34 (-4.38 %), a decrease of 5.34 % to $ 17.36 in pre-market.

- Riot platforms (RIOT): closed at $ 11.88 (-0.17 %), a decrease of 4.21 % to $ 11.40 in the market before the market.

- Core Scientific (Corz): Closed at $ 12.27 (+0.08 %), a decrease of 6.68 % to $ 11.45 in the market before the market.

- Cleanspark (CLSK): Closed at $ 10.44 (-4.83 %), a decrease of 5.08 % to $ 9.91 in pre-market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 22.55 (+0.22 %), a decrease of 6.34 % to $ 21.12 in the market before the market.

- Semler Scientific (SMLR): Closed at $ 51.96 (-0.36 %), a decrease of 6.08 % to $ 48.80 in the market before the market.

- Exit (exit) movement: closed at $ 49.88 (-18.74 %), an increase of 2.25 % at $ 51 in the market before the market.

Etf flows

BTC Etfs Stain:

- Daily net flow: 318.6 million dollars

- Cutting net flow: 40.50 billion dollars

- Total BTC Holdings ~ 1.172 million.

ETH ETFS spot

- Daily net flow: 27.8 million dollars

- Cutting net flow: $ 2.76 billion

- Total Eth Holdings ~ 3.634 million.

source: Farside investors

It flows overnight

Today’s scheme

- ETHEREUM has seen the highest amount of clear flows through encryption bridges in the past 24 hours, while the usual leadership base, Solana, has witnessed the expression most external flows.

- This is a classic behavior of the risk investor, as it moves to the oldest and largest Blockchain smart contracts, and expects to fain the deeper market.

While you sleep

- XRP, Dogecoin drowns 25 % with encryption references across $ 2.2 billion on LED DOMP tariffs (Coinsk): On Sunday, the main cryptocurrencies including XRP, DOGE and Ada fell with the US tariff in Canada and Mexico announced on Saturday the fears of the trade war and $ 2.2 billion in future references.

- The chance for bitcoin tanks to 75 thousand dollars is multiplied with the Trump tariff that ignites the trade war, the ONSAIN DERIVE’s Onchain Market (CoINDESK): DERIVE.XYZ options now indicate that Bitcoin will decrease to 75 thousand dollars by March 28-double the possibility of last week.

- Usde is stable despite the fluctuations of trade war (Coindsk): ETHENA’s Stable Stablecooina has maintained $ 1 in the volatile encryption markets, which is likely to be supported by the mechanism of generating return.

- The dollar rises, the shares decrease as Trump imposes the definitions: market wrap (Bloomberg): The definitions announced on Saturday announced the dollar to the highest level of two years, as global stocks, the future of American stocks and encryption prices decreased amid increasing fears of high inflation and economic disruption.

- Beijing is preparing for her opening attempt to speak with Trump (The Wall Street Journal): According to what was reported, China will compete for the Trump tariff by 10 % through the World Trade Organization and the resumption of commercial talks to revive the first stage deal through a pledge to increase US purchases and investments.

- The Bank of England is expected to reduce interest rates again with the recession of the UK economy (Financial Times): With stagnant growth and inflation, England is expected to reduce prices by 0.25 % this week, although high energy costs and commercial tensions may lead to stagnation.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/cd6dd41f6e73e78c95e8133d6b5c78bbacb5e4df-700×430.png?auto=format