Boeing shares jump 3.5 % after announcing a $ 10 billion plane purchase deal – configurations for the encryption market | Flash news details

The stock market witnessed a significant increase in the Boeing share price today, with the increase of BA $ +3.5 % during the trading session on May 8, 2025, after the US Minister of Trade Lutnick announced. The news, which was shared via a post on X by Kobeissi, at approximately 2:30 pm EST, confirmed that the United Kingdom has committed to the purchase of Boeing aircraft worth $ 10 billion, a deal that emphasizes the renewal of confidence in the space giant. This development comes at a pivotal time for Boeing, who has faced challenges in recent years due to delaying production and safety concerns. The demand of only $ 10 billion not reinforced the Boeing request book, but also indicates potential stability in the global aviation sector, which can have ripples across relevant industries. From the perspective of encryption, this huge deal in the traditional stock market often affects risk morale, which leads to capital flows to or outside the most dangerous assets such as cryptocurrencies. Since institutional investors re -evaluate their governor in light of this news, the encryption market can face indirect fluctuations, especially in the symbols associated with the technology and innovation sectors. This event also highlights how total economy ads can affect the dynamics of crossed market, creating unique trading settings for smart investors who monitor both stocks and digital assets.

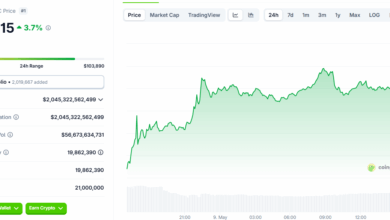

Dive into trading effects, Boeing shares high at around 2:30 pm EST on May 8, 2025, as Kobeissi’s speech stated, stimulates the short -term momentum in the encryption markets, especially for symbols that are presented to technology -paid accounts. For example, Bitcoin (BTC/USD) has seen a short increase from +1.2 % to $ 62,800 within an hour of fracture news at 3:30 pm EST, which reflects risk morale according to data from Coinmarkcap. Likewise, ETHEREUM (ETH/USD) increased +1.5 % to 2450 dollars during the same window, indicating that institutional funds may revolve into high -growth assets. The shares related to encryption also interacted such as Coinbase (Coin), and gained +2.1 % to $ 215.30 by 4:00 pm EST, according to Yahoo’s funding. This link indicates that positive news in traditional markets can leak into encryption, which creates purchase opportunities for merchants. However, the risks remain that if the arrows in Boeing fade fade, achieving profits may lead to a reflection of encryption gains. Traders should monitor BTC/USD and ETH/USD pairs to get signs of weak momentum, especially if the trading volume decreases to a 24 -hour medium at 1.2 million BTC and 8.5 million ETH, and supported at 5:00 pm EST.

From a technical perspective, the reaction of the encryption market on Boeing News on May 8, 2025 shows interesting patterns. The Bitcoin price movement was tested to $ 62,800 at 3:30 pm EST, average moving resistance for 50 days, which is a decisive level of upward continuation, as it was followed in TradingView. Meanwhile, ETHEREUM contacted its resistance of $ 2,450 with the RSI index of 58 at 4:00 pm EST, indicating a room for more bullish trend before excessive conditions in the peak, for all Codingcko data. Trading volumes increased significantly, as BTC/USD recorded a 15 % increase to 1.38 million BTC traded within 24 hours after the news, while ETH/USD witnessed a 12 % jump to 9.4 million Eth, based on Binance standards at 5:00 pm EST. Data on the series of Glassnode at 6:00 pm EST also revealed a 7 % increase in the activity of Bitcoin, indicating the retail and institutions. The connection across the market between the BA and Crypto assets such as BTC and ETH is still clear, with a 0.65 link coefficient against the S&P 500 during the past week, for all the data of the Bloomberg Station that was reached on May 8, 2025.

Finally, the institutional impact of the $ 10 billion Boeing deal for encryption traders cannot be overlooked. Since traditional markets accommodate these news, hedge funds and asset managers may re -customize capital, with a possible flow in traded investment funds such as GBTC, which saw price increased by 1.8 % to $ 58.20 by 4:30 pm on May 8, 2025, according to Grayscale updates. This indicates that institutional funds are looking to encrypt as hedging against traditional market fluctuations. The shares related to encryption, such as Microstrategy (MSTR), also increased by +2.3 % to $ 1,280 by 5:00 pm EST, for all data on the Nasdaq Stock Exchange, which enhances the interdependence between these markets. Traders should remain vigilant to increase fluctuations in BTC/USD and ETH/USD pairs if the stock market morale turns, using the narrow stopping of major support levels such as $ 61,500 for Bitcoin and $ 2,400 for ETAREUM, as it was observed on May 8, 2025, at 6:00 pm on TradingView.

Instructions:

What does Boeing shares increase bitcoin trading?

Increasing Boeing +3.5 % shares on May 8, 2025, after a $ 10 billion a plane in the UK, led to a risk feeling in the market, prompting Bitcoin an increase +1.2 % to $ 62,800 by 3:30 pm East US time. This indicates short -term purchase opportunities in BTC/USD, although traders should monitor the repercussions if the momentum of the shares fade.

How does encryption shares interact with Boeing news?

Co -related shares such as Coinbase (Coin) and Microstrategy (MSTR) have witnessed gains +2.1 % to $ 215.30 and +2.3 % to $ 1,280, respectively, by 5:00 pm East US time on May 8, 2025, indicating a positive difference from traditional market news to encryption.

https://image.blockchain.news/features/DC3788979712BF4DFF603597AAC46E7C52F8B5EF76BC21453D757F37CDB271FE.jpg