Bitcoin trading in six numbers shows BTC ready to carry “Baton” gold-Fidelity Exec

Main meals:

-

Sharp Bitcoin is close to gold, indicating similar returns, which supports its role in its store.

-

Gold outperformed Bitcoin in the first quarter of 2025 by increasing the price of 30.33 % compared to 3.84 % of Bitcoin, driven by economic certainty.

-

Bitcoin ETF flows are recovered, and analysts expect BTC to reach $ 110,000 – $ 444,000 in 2025.

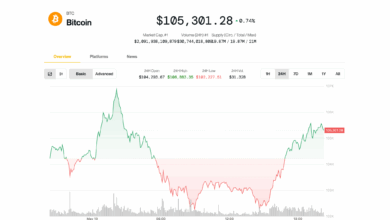

Bitcoin (BTC) Price maintains more than $ 100,000, and is the director of Velileti Global Macro, Gorian Timmer, to say that encryption assets can regain their position as a leading value competitor.

The last Timmer analysis highlights the rapprochement of the Sharpe ratios of Bitcoin and Gold, indicating that the assets can be increasingly compared to modified returns by risk. The Sharpe rate measures the rate of return provided by the investment of the risks taken, by comparing its performance with a risk -free standard for its volatility.

The graph below, which follows the weekly data between 2018 and May 2025, shows Bitcoin (1X) revenues that reach gold (4X), with gold at $ 22.48 and bitcoin at $ 15.95 in relative performance conditions.

From the allocation point of view, Timmer recommended 4: 1 from gold to Bitcoin to store value, highlighting interesting monitoring. Timer said,

“I am still fascinated by the fact that the most attached assets negatively for Bitcoin are gold. For players in the same value store, this is not what I expect to see. The rate of risk in Bitcoin continued to persuade them. There are no other assets like them!”

While Bitcoin’s SOV data improves more than $ 100,000, Ecoinometrics, a large economy that focuses on Bitcoin NEWSSSterterHe indicated that it was not the smooth sailing in Q1 2025.

In 2024, the trading circulating on the Stock Exchange (ETFS) witnessed a clear exchange of $ 35 billion, the purchase of 500,000 BTC and the leadership of a return of 120 %. However, 2025 started a different note. The first four months witnessed Bitcoin ETF flows drop to less than a third compared to 2024, while the investment funds circulated in gold attracted more capital.

The newsletter noted that this transformation can be attributed to uncertainty in the first quarter surrounding the policy of federal reserves, commercial policy and the American economy. The mentioned ecoinometrics,

“Between a solid prize, gold and bitcoin, it is easy to know why the capital goes to the haven.”

Gold, with an increase in the price of 30.33 % in 2025 compared to Bitcoin 3.84 %, benefited from its stability during the economic assumption. In addition, the analysis added that bitcoin was better like a high beta growth origin, “which flourishes in increased liquidity environments and flams.

Modern developments indicate a shift: the clarity of the American trade policy, the most softened federal reserve position, and the mitigation of financial conditions that have pushed fixed flows to the investment funds circulating in Bitcoin.

Related: Bitcoin and Tranard Resport Arter

Bitcoin on the right path to the highest new level in 2025

The highest Sharpe ratio is a positive scale for bitcoin, which greatly increases the possibility of reaching its highest levels ever above $ 110,000 in May. According to Bitcoin Suisse, a Cheap Corporation, a high -level Sharp of BTC has allowed to flourish in risk environments and stop risk since the American presidential elections.

With more than 88 % of its profit supply, BTC is currently acting a highly condemnation, as the possibility of the “acceleration phase” moves. Bitcoin Suisi, head of research, Dominic Wip He said,

“In this environment, Bitcoin has emerged as the origin of the Swiss army knife. Whether the arrows or bonds are collapsing, BTC is trading on the basics of demand and demand, providing a profitable profile for both sides that traditional assets cannot be provided simply.”

Likewise, Cointelegraph I mentioned This bitcoin has a “decent opportunity” to reach $ 250,000 or more in 2025, driven by its interaction with gold, according to gold -based expectations. The report uses a frame on its golden -style scenario to reassess the potential Bitcoin as an unpleasant solid origin.

If the value of the Bitcoin network, measured by gold, tracks the energy curve, and gold maintains its current value, analysts indicate that it may reach $ 444,000 in 2025. However, a more conservative estimate by Bitcoin Apsk32 analyst indicates a “reasonable” goal of $ 220,000 per year.

Related: Altcoins is about to “the most powerful rally” since 2017 – analyst

This article does not contain investment advice or recommendations. Each step includes investment and risk trading, and readers must conduct their own research when making a decision.

https://images.cointelegraph.com/cdn-cgi/image/format=auto,onerror=redirect,quality=90,width=1200/https://s3.cointelegraph.com/uploads/2024-11/019349e1-6c83-7383-8e14-0b146b962d99