Bitcoin Today: BTC decreases to 95 thousand dollars despite the increase in the investor’s interest – beyond the collapse?

Bitcoin struggles extend below $ 100,000 to the third week of February 2015, after sending them the third consecutive day from losses to $ 95,000.

Disappointing business pools, despite the increasing interest among institutional investors.

Since losing a fist of $ 100,000 on the first weekend of February 2025, multicul Bitcoin has been organized – albeit that is Unscat gatherings Towards this price level.

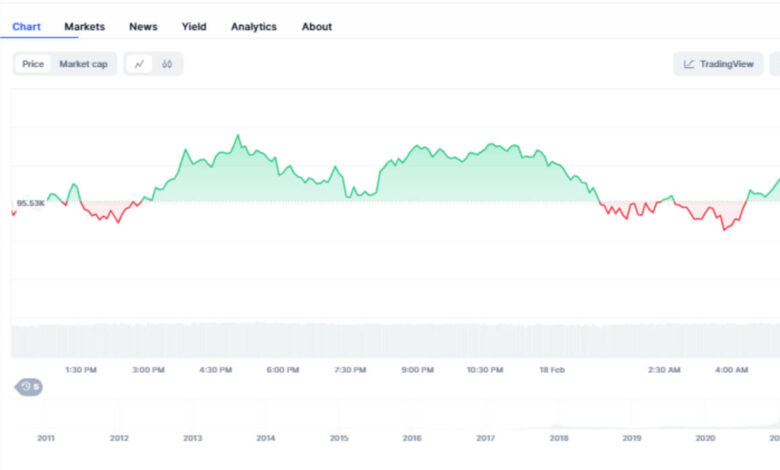

Over the past 24 hours, the old currency has decreased by approximately 2 % of yesterday’s height of $ 98,000 to its lowest levels between 95,111 dollars, according to what it said. Coinmarketcap. This was the third day of straight losses, which he saw was less than the support level of $ 95500 and decreased less than the main resistance level of $ 98,000.

Increased optimism and the interest of the investor in bitcoin?

During the recent past, an increasing number of institutional investors rushed to purchase the decline. For example, the Microstrategy strategy recently acquired $ 720 million from Bitcoin this month.

Bitcoin Etf also increased steadily over the first four weeks of the year. Many other companies have also started adding Bitcoin to their public budgets, including metaplanet Recently got 269 BTC.

Invested and experimental optimism towards the old digital currency is high.

Bitcoin long -term expectations Wide thunderbolt, with proverbs Cathy Woods of Alex Investments It states that it expects the BTC price to be attracted about $ 1.5 million by 2030.

Why is Bitcoin disrupted and to what extent can BTC fall?

The threat of a comprehensive trade war on Trump’s tariff had the greatest influence on the recent measures achieved by Bitcoin.

It contains FUD at the market level, which explains why the lowest dumping address has a significant impact on BTC prices.

This may be attributed to the increasing hybrid trends towards Bitcoin that the MACD graph has not only printed the red tapes but the MACD line and the signal line are present in the negative lands.

The decline in the relative power index is from 39 emerging forces as Bitcoin approaches the sales zone.

In addition to the Trump tariff, the cautious Federal Reserve, as well as the uncomfortable major economic data, such as the consumer price index, which recently came higher than expected has led to the intimidation of investors.

🚀 Don’t miss the next big encryption step!

He received our excellent members Alerts in real time On large encryption courses before they happen. Will you be ready for the next one?

🔴 The latest alerts from the inside:

⏳ Limited spots available – insure you now!

https://investinghaven.com/wp-content/uploads/2025/02/Bitcoin-2-1.jpg