Bitcoin stumbles as Fed policy outlook weighs on Trump’s cryptocurrency trade

(Bloomberg) — Bitcoin and the broader cryptocurrency market have had a shaky start to the year, hurt by speculation that the Federal Reserve’s window for further interest rate cuts is about to close.

Most read from Bloomberg

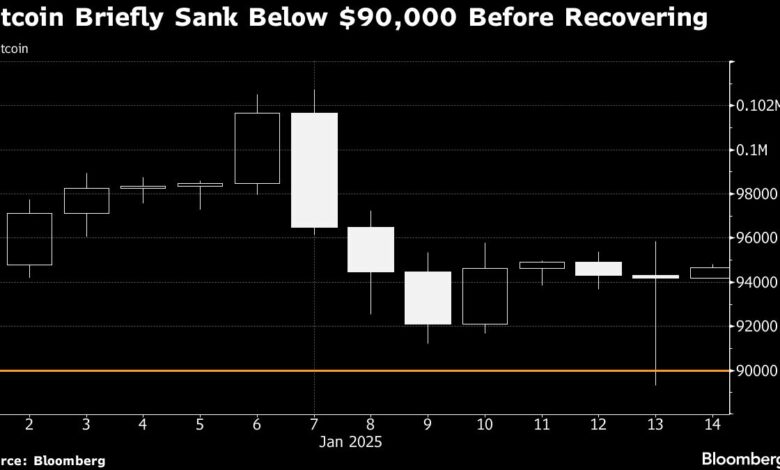

The digital asset briefly fell below $90,000 on Monday — a roughly 5% drop compared to the start of 2025 — before rebounding, leaving it flat for January. Small tokens like Ether are posting losses for the month so far.

Investors are rallying around the possibility of a long pause in the federal funds rate due to the resilience of the US economy and the risks of inflationary tariffs and immigration policies from President-elect Donald Trump, who will be sworn into office next week.

As a result, Treasury yields rose, cooling some of the enthusiasm for cryptocurrencies sparked by Trump’s pledge to make the United States the global capital of digital assets by creating friendly regulations and rolling back the Biden administration’s crackdown.

Traders are also unloading stocks as a sell-off in Treasuries spreads across global markets. For example, the S&P 500 erased much of the gains from Trump’s election victory on November 5.

“It makes no sense to try to call a turnaround until markets get a sense of what the new administration will really mean,” Charlie Morris, chief investment officer at Asset Management at ByteTree, wrote in a note. He added: “We can assume that it is pro-cryptocurrencies, but we cannot escape the fact that the major financial markets are highly priced, with the technology sector exposed to a decline.”

Bitcoin, which reached a record high of $108,316 last month, was trading at about $94,800 as of 9:23 a.m. Tuesday in Singapore. The token’s lead since Election Day has dropped to nearly 40%.

Many in the cryptocurrency community remain optimistic about the continued prosperity under Trump. MicroStrategy Inc. announced Just announced its tenth consecutive weekly purchase of crypto assets, bringing its stock to about $41 billion.

Currently, the largest digital assets are still in a “correctional phase,” according to Fairlead Strategies LLC technical analyst Katie Stockton. She said chart trends indicate the possibility of testing the “bearish” support at $87,500.

Most read from Bloomberg Businessweek

©2025 Bloomberg LP

https://media.zenfs.com/en/bloomberg_politics_602/e6c0238b50eb6db759194222679a2d21

2025-01-14 04:41:00