Bitcoin stifled “aggravating emergency pressure” from short-term holders: report

Bitfinex Analysts said the Bitcoin customer with purchases in the last month the most difficult hit during recent crippto market sink.

Bitcoin (Btc) Like 13.5% of its value in the last 30 days and reduced over 29% of its all time together in January, the largest correction of the current bull cycle, according to Bitfinek Alpha report published 17. Marta.

The past cycles were witnesses similar to withdrawals ranging from 30% to 50%. However, some were expected a different outcome this time due to the new institutional adoption through the Spot Spot BTC stock funds at Wall Street.

The US Spot BTC ETFS recorded a blitz to over 100 billion dollars under management within a year, because the traitors were attracted to the mass inflows of capital and loyalty.

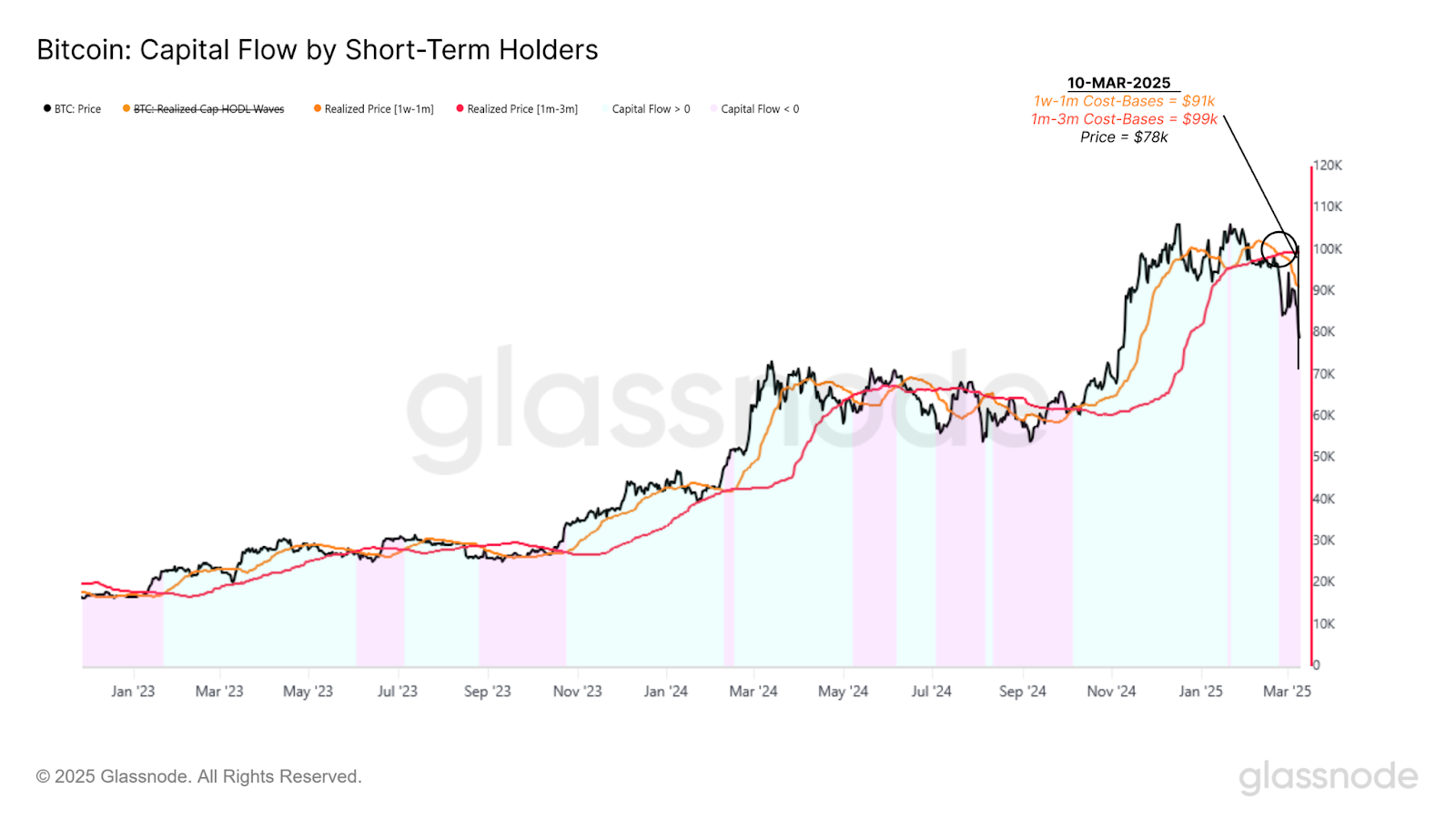

Short-term holder Bitcoin Capitulation

The money assigned to this EFTS has changed in the last few weeks, while consecutive outflows have now set the records. Last week, almost a billion dollars pulled out These products, signal that “institutional customers have not yet returned with enough power to combat pressure sales,” Bitfineks were written.

The race price of shares also ruled the crypto sentiment. Indexes such as Fear & AEPE Index fell on multi-year orders, “Deterioration of sales pressure” as a short-term holder capitulated, in accordance with Befiniks report.

Data from IntoTheBlock supported the claim from Bitfinek analysts. METRIĆ “Global U / Van Money” showed 20% of all BTC holder in unrealized losses. Most of these customers bought their Bitcoin between 85,700 and $ 106,800 per intotleblocating.

Historically, when a fresh capital influx is slow and cost, it moves, it signals the environment for weakening demand. This trend is becoming all visible as a bitcoin struggle to keep above key levels. Without new customers, Bitcoin risks extended consolidation, or even further, such as lower-handed hands continue to come out of their positions.

Bitfinek Analysts

Possible to turn

Furthermore, the price of the Padgene price can also continue as financial markets that forced the result of Trump Tariffs and Macro data about us.

Although inflation is cooled and the job market has shown signs of resistance, an increase in unemployment and macro uncertainty has encouraged the practical approach to many investors. However, Bitfinex analysts believe that the toast of bacara remains possible if the facts are made aligns.

The key factor for viewing is whether long-term holders or institutional demand occurs again at these lower levels. If deeper pocket investors will start the absorption of supply, it could signal switch to accumulation, potentially stabilizing prices and reversal.

https://crypto.news/app/uploads/2024/08/crypto-news-bear-bitcoin-option07.webp

2025-03-17 22:44:00