Bitcoin is buzzing with anticipation ahead of Trump’s inauguration

By Omkar Godbole (All times are Eastern time unless otherwise noted)

The world of cryptocurrencies is buzzing as the inauguration of President-elect Donald Trump approaches. Bitcoin holds over $100,000 and altcoins like SOL, ADA, LINK, XRP, and LTC are shining, as it’s not just about a potential strategic Bitcoin reserve anymore. Reports indicate that Trump may declare cryptocurrencies as a political priority.

Things are heating up for ether as well. A blockchain address linked to Trump’s Worldwide Freedom Finance (WLF) project took in nearly $10 million in ETH this week, according to Arkham Intelligence. And keep your eyes on the first layer of the Near Protocol’s NEAR blockchain. Token supply dynamics look bullish, with the ratio of staked to unstaken NEAR rising, according to data source Flipside.

Overall, the outlook for the cryptocurrency market is bullish, as Wednesday’s US CPI report eased inflation concerns, allowing traders to focus on Trump’s swearing-in. On-chain analysis 21Shares shows that there is still plenty of upside left for BTC.

However, consider the possibility of lower prices if a big announcement is not made on Trump’s first day.

“The macroeconomic backdrop remains supportive, with unemployment trending lower, inflation showing signs of easing, and the market riding a wave of enthusiasm associated with Trump’s inauguration,” BRN analyst Valentin Fournier said. “We maintain a bullish outlook for the first quarter, although a correction could occur this week if the new management does not outline a strong business plan.”

Note that BTC is trading at a discount on Coinbase compared to Binance in a sign of weak demand from US investors. Additionally, Arkham Intelligence data shows that a whale transferred more than $1 billion worth of Bitcoin to Coinbase on Thursday. Transfers to exchanges usually represent an investor’s intention to sell.

And watch out for inflation fears creeping back in. The US Producer Price Index, which shows rising price pressures ahead, rose above the CPI in December for the first time since 2022. Stay tuned!

What to watch

- encryption

- January 17: Oral arguments in the Court of Appeals for the District of Columbia in KalshiEX LLC v. CFTC, in which the CFTC appeals the district court’s ruling in favor of Kalshi’s congressional oversight contracts.

- January 23: The first deadline for a decision by the SEC on NYSE Arca is December 3 an offer To list and trade shares Solana grayscale box (GSOL)A closed-end trust, such as an ETF.

- January 25: First deadline for SEC decisions on proposals for four new Solana spot ETFs: Bitwise Solana ETF, Canary Solana ETF, 21Shares Core Solana ETF and Van Eyck Solana FundWhich is sponsored by Cboe BZX Exchange.

- February 4: MicroStrategy (MSTR) reports Q4 earnings before the market opens.

- Macro

- January 17, 8:30 a.m.: The U.S. Census Bureau releases its December report Monthly report on new residential construction.

- Building Permits Corporation (Primary) 1.46 million compared to the previous one. 1.493 m.

- Previous monthly building permits (initial). 5.2%.

- Bedaya Housing Foundation. 1.32 million versus the previous one. 1.289 m.

- Housing Start Monthly Previous. -1.8%.

- January 17, 8:30 a.m.: The U.S. Census Bureau releases its December report Monthly report on new residential construction.

Symbol events

- Governance votes and calls

- ApeChain votes on a revamped governance process to direct 75% of the on-chain treasury to DAO treasury nodes and the remaining 25% to the Ape Foundation for management and support purposes. Voting began on January 17 and will continue for 13 days.

- Aave DAO is discussing a joint incentive program with Polygon that would require $3 million to boost liquidity and Aave’s adoption of the Polygon blockchain.

- It opens

- January 17: ApeCoin (APE) releases 2.16% of circulating supply worth $18.1 million

- January 17: QuantixAI (QAI) releases 4.79% of its trading supply, worth $21.28 million.

- January 18: Ondo (ONDO) releases 134% of its traded supply worth $2.19 billion.

- January 21: Fasttoken (FTN) to open 4.6% of circulating supply worth $76 million.

- Launch tokens

- January 17: Solv Protocol (SOLV) will be listed on Binance.

Conferences:

Symbolic discussion

Written by Oliver Knight

- Litecoin (LTC) led the pack over the past 24 hours after Nasdaq 19B-4 filing paved the way for the introduction of an LTC exchange-traded fund (ETF). The token rose 17% to surpass Bitcoin Cash (BCH) in terms of market capitalization.

- Ethereum developers certain The Pectra mainnet upgrade will take place in March, with a series of hard forks planned on Ethereum testnets in February. The upgrade will improve the wallet’s functionality and increase the original storage limit to 2,048 ETH from 32 ETH. This increase means that large stakeholders like Coinbase and reauthentication protocols will be able to control fewer validators, reducing complexity. Coinbase currently has tens of thousands of validators.

- Altcoin whales have been aggressively buying Solana Coin (SOL) in the run-up to Donald Trump’s inauguration. One particular wallet, I mentioned before LoconchineSOL bought $2.49 million worth and withdrew an additional $3.94 million from Binance. It then deposited a total of 144,817 soles ($30.4 million) into lending platform Camino before borrowing $20 million in stablecoins. This effectively results in taking a long position on SOL, because when the value of the underlying asset rises, the user will have to pay less stablecoin.

Determine the position of derivatives

- Litecoin is the best performing coin in terms of futures open interest growth and positive CVD readings implying net buying pressure.

- HYPE stands out as frenetic, with annual funding rates in excess of 100%, according to Velo Data. A high funding rate indicates crowding in bullish bets.

- The annualized one-month futures basis for BTC on the CME exchange rose above 12%, surpassing 11% for ETH. However, open interest for BTC and ETH CME futures was little changed and well below their December highs.

- BTC and ETH options on Deribit show a call bias.

Market movements:

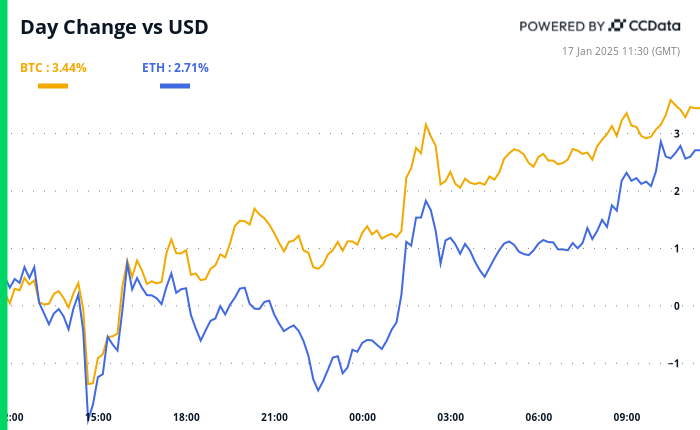

- Bitcoin is down 2.17% from 4pm EST on Thursday at $102,319.71 (24h: +3.15%)

- ETH price rose 3.13% to $3,424.04 (24h: +3.22%)

- CoinDesk 20 was up 1.36% at 3,960.57 (24h: +4.36%)

- The signature yield on Ether remains unchanged at 3.1%.

- The BTC funding rate is 0.0092% (10.12% per year) on Binance

- DXY was unchanged at 109.02

- Gold rose 0.67% to $2,730.60 per ounce

- Silver fell 1.3% to $31.28 per ounce

- The Nikkei 225 index closed down 0.31% to 38,451.46 points.

- The Hang Seng Index closed 0.31% higher at 19,584.06.

- The FTSE rose 1.06% to 8,481.19

- The Euro Stoxx 50 index rose 0.66% to 5,140.87 points

- The Dow Jones Industrial Average closed Thursday down 0.16% to 43,153.13

- The Standard & Poor’s 500 index closed down 0.21% to 5,937.34 points.

- The Nasdaq index closed down 0.89% to 19,338.29 points

- The S&P/TSX Composite Index closed 0.23% higher at 24,846.2

- The S&P 40 Latin America index closed 1.41% lower at 2,230.95.

- US 10-year Treasury bonds fall 2 points to 4.6%

- E-mini S&P 500 futures were unchanged at 5,993.50.

- E-mini Nasdaq-100 futures fell 0.32% to 21,332.25.

- E-mini Dow Jones Industrial Average futures were unchanged at 43,496.00

Bitcoin statistics:

- Bitcoin Dominance: 57.49

- Ethereum to Bitcoin ratio: 0.0334

- Hash rate (seven-day moving average): 784 EH/s

- Retail price (spot): $57.0

- Total fees: 7.34 BTC/$731,223 USD

- CME futures open interest: 178,755 BTC

- Bitcoin price in gold: 37.8 ounces

- BTC vs. Gold Market Cap: 10.75%

Technical analysis

- The Dollar Index (DXY) has halted its rise, but the uptrend line marking an uptrend from 100 remains in place.

- A renewed bounce from trend line support could create headwinds for risk assets.

Crypto stocks

- MicroStrategy (MSTR): Closed Thursday at $367 (+1.77%), up 3.26% at $378.98 pre-market.

- Coinbase Global (COIN): Close at $281.63 (+2.44%), up 2.68% at $289.28 pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$28.77 (+3.01%).

- MARA Holdings (MARA): closed at $18.3 (+0.83%), up 3.17% at $18.88 pre-market.

- Riot Platforms (RIOT): Close at $13.29 (-1.29%), up 3.24% at $13.72 pre-market.

- Core Scientific (CORZ): Close at $14.63 (+0.69%), up 1.71% at $14.88 pre-market.

- CleanSpark (CLSK): Close at $11.18 (-0.18%), up 3.58% at $11.58 pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.60 (+0.12%), up 2.93% at $25.32 pre-market.

- Semler Scientific (SMLR): closed at $58.24 (+3.8%), up 2.76% at $59.85 pre-market.

- Exit Movement (EXOD): Close at $37.87 (+7.1%), up 5.62% at $40 pre-market.

ETF flows

Spot Bitcoin ETFs:

- Net daily flow: $527.9 million

- Cumulative net flows: $38.04 billion

- Total BTC holdings ~ 1.14 million.

ETH ETFs

- Net daily flow: $166.59 million

- Cumulative net flows: $2.64 billion

- Total ETH holdings ~3.57 million.

source: Persian investors

Night flows

Today’s chart

- The chart shows trends in the circulating supply of NEAR staked or locked in the blockchain in exchange for rewards, versus unrestricted supply.

- The rate at which NEAR holders are staking their coins is increasing, creating a bullish supply and demand dynamic for the token.

While you were sleeping

- Bitcoin’s ‘Coinbase Premium’ has gone silent amid reports of Trump’s plans to designate cryptocurrencies as national policy (CoinDesk): President-elect Trump reportedly plans to prioritize cryptocurrencies with executive order, but the Bitcoin price difference between Coinbase and Binance indicates a lack of enthusiasm among US investors ahead of his January 20 inauguration.

- XRP volume exceeds Bitcoin on Coinbase as US investor interest grows (CoinDesk): XRP accounted for 25% of Coinbase’s trading volume in the past 24 hours, driven by surging US interest and speculation around the XRP ETF.

- JP Morgan says Bitcoin miners start 2025 on a strong footing (CoinDesk): JPMorgan notes that 12 out of 14 mining stocks under its watch delivered stronger returns than bitcoin early this year, supported by a 51% year-over-year increase in hash rate.

- The Bank of Japan is likely to keep its hawkish policy pledge and raise interest rates next week, sources say (Reuters): Markets expect an 80% chance that the Bank of Japan will raise interest rates to 0.5% next week, the highest level since 2008.

- China meets 5% GDP target but Trump’s tariffs threaten further growth (Bloomberg): China achieved 5% GDP growth in 2024, driven by stimulus and strong exports. Upcoming US tariffs and weak domestic demand may hamper future progress.

- European markets are approaching all-time highs ahead of earnings season (Euronews): European stocks rose this week, with the German DAX index hitting record levels over the past two sessions. The Euro Stoxx 600 rose 0.81%, driven by strong luxury and technology earnings and expectations for looser European Central Bank policy.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/1e89a98bb0e39093dd9271028ecb90941d664796-700×430.png?auto=format