Bitcoin high exceeds $ 100,000: main trading levels and the effect of the encryption market Flash news details

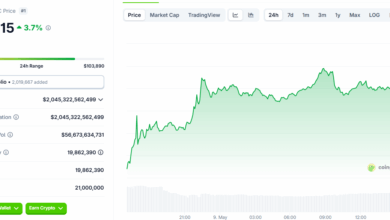

In the huge development of the encrypted currency market, Bitcoin (BTC) has regained a $ 100,000 sign, a psychological and technical sign that ignited great attention between traders and investors. As Crypto Rover reported on Twitter on May 8, 2025, Bitcoin rose to this critical level, which represents a historical moment for the leading cryptocurrency. This penetration occurred at approximately 14:30 world time, with BTC/USD trading at $ 100,125 on Binance, which reflects an increase of 4.7 % during a 24 -hour period. Trading volume rose to more than $ 3.2 billion via major stock exchanges such as Binance, Coinbase and Kraken during this time frame, indicating strong participation in the market. The increase is compatible with the growing institutional interest and the positive feeling in the broader financial markets, including a gathering in technical and technical stock indicators such as the Nasdaq Stock Exchange, which gained 1.8 % on the same day as the data from Yahoo financing. This momentum across the market indicates an increased appetite for risks among investors, which is likely to turn capital into high -growth assets such as bitcoin. This event also coincides with an increase in the activity on the series, as more than 450,000 BTC transactions have been recorded during the past 24 hours, indicating the use of a strong network and investor confidence.

The trading effects of bitcoin breaking 100,000 dollars, especially when displayed through the lens of cross market dynamics. For encryption traders, this penetration offers multiple opportunities across various trading pairs. For example, BTC/ETH witnessed a 2.3 % increase from 15:00 UTC on May 8, 2025, with ETHEREUM trading at $ 3450 against Bitcoin, indicating the relative strength in BTC. Meanwhile, Altcoins, such as Solana (Sol) and Cardano (ADA), recorded 5.1 % and 4.8 %, respectively, against the US dollar in the same time, and a wave of bitcoin momentum. From the perspective of the stock market, the relationship between bitcoin and technology shares remains clear, as companies such as Microstrategy (MSTR) witnessed an increase of 3.2 % at the share price to $ 1780 by 16:00 UTC on May 8, 2025, which reflects the investor optimism about the impact of corporate budgets on corporate budgets. This gathering can attract more institutional funds to encryption, and it is clear from a $ 1.1 billion flow in the Bitcoin investment funds during the past week, according to Coinshares data. Merchants should monitor potential decline operations, as achieving profits can appear near this level of psychological resistance, but the total ups of the budgets provide opportunities to fill long jobs in BTC and relevant assets.

From a technical perspective, the basic procedure for Bitcoin shows about $ 100,000, the main indicators that support more upward trend. RSI on the graph for 4 hours in 72 as of 17:00 UTC on May 8, 2025, indicating excessive conditions at its peak but constant momentum. The moving average for 50 days (MA) at $ 92,500 provided strong support during the climb, while the next resistance level sits at $ 105,000 based on the historical data of TradingView. Size analysis reveals an increase of 35 % in immediate trading activity on Binance, as it reached 1.8 billion dollars between 14:00 and 18:00 UTC on May 8, 2025, which confirms the strong benefit of the buyer. The scales on the series support this trend, as Glassnode has reported a clear flow of 12,500 BTC in the exchange portfolios over the past 48 hours, indicating the accumulation of big players. Regarding the connection between the stocks, the NASDAC profit by 1.8 % on May 8, 2025 reflects the Bitcoin Rally, highlighting an environment on the risk. Institutional flows are also evident, as Grayscale’s Bitcoin Trust (GBTC) recorded a $ 250 million flow on the same day, according to their official report. This rapprochement between technical power, nails of size, and institutional support indicates upward expectations, although merchants should remain vigilant to volatility around this main level.

In short, Bitcoin Restore of $ 100,000 on May 8, 2025 is a pivotal event with long -term effects of both encryption and securities markets. The interaction between the increase in bitcoin and the stock market gains emphasizes a broader transformation in investor morale towards risk assets. For merchants, current market conditions provide implementable opportunities in BTC pairs and coding shares, while institutional flows indicate interest. By closely monitoring technical levels and trends of size and relationships across the market, merchants can put themselves to take advantage of this historical landmark with the management of the underlying risk.

https://image.blockchain.news/features/DC3788979712BF4DFF603597AAC46E7C52F8B5EF76BC21453D757F37CDB271FE.jpg