Bitcoin faces severe sharp crash: Crypto Rover Signals in 2025 | Flash news details

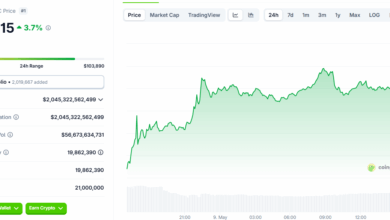

The cryptocurrency market is escalating with speculation after a recent tweet from a prominent encoding effect, Crypto Rover, which was suggested on May 7, 2025, that Bitcoin may be about to a great collision. This statement, which was shared via a widely published post on social media, has sparked discussions between traders and investors, especially given the recent price movements in Bitcoin and the dinner of the broader market. As of 10:00 am World time on May 7, 2025, Bitcoin (BTC) (BTC) was traded by about $ 58,200 on major stock exchanges such as Binance and Coinbase, which reflects a 3.2 % decrease over the past 24 hours, according to CoinMarketcap. This low prices are in line with the increasing fluctuations in the encryption space, with the BTC/USDT trading volume on Binance, which extends by 18 % to more than $ 2.1 billion in the same period of 24 hours. Meanwhile, the stock market, especially the NASDAQ Technology Index, witnessed a 1.5 % decrease from the closing bell on May 6, 2025, driven by fears of high interest rates, according to Bloomberg. It seems that this wider financial uncertainty leaks to the encryption markets, where they face risk assets in all fields of sale pressure. The relationship between Bitcoin and traditional markets was a decisive focus point for merchants looking to measure the potential depth of any imminent correction. Since institutional investors are increasingly treating bitcoin as risk assets, any additional slowdown in stock can exacerbate BTC losses, making this pivotal moment for the analysis of the cross market.

From the trading perspective, the warning of potential Bitcoin crashes opens all the risks and opportunities for encryption investors. The implicit meaning is a possible decrease in the price of BTC, with the main support levels to watch $ 55,000 and $ 52,000, as defined by technical analysts in TradingView as of May 7, 2025, at 11:00 am UTC. If these levels collapsed, we may see a consecutive effect across Altcoins, where ETHEREM (ETH) has already decreased by 4.1 % to $ 2900 in the last 24 hours as of the same time in Coingecko. Trading pairs such as ETH/BTC also reflect the Habbudian feelings, with a 0.8 % decrease in the value of the pair during the same period on Binance. For traders, this offers short selling opportunities or an opportunity to accumulate at lower levels in the event of a reflection. In addition, the contraction of the stock market can push capital flows from encryption, as institutional investors may burn safer assets such as bonds or cash. According to a report issued by Coindsk on May 7, 2025, the data on the series of Glassnode shows a 12 % increase in bitcoin flows from stock exchanges between May 5 and May 7, 2025, indicating possible profits or fear among retailers. This cross dynamic emphasizes the need to closely monitor all of the metrics for encryption and macroeconomic indicators.

When going into technical indicators, the RSI is sits on the daily chart at 38 as of 12:00 pm UTC on May 7, 2025, for all TradingView data, which indicates excessive conditions that may either bounce or further sell if the declining momentum continues. MacD also shows a landmark, with a decrease in the signal line down the MACD line as the same in the same time, a classic sign of downward pressure. The scales on the series reveal a 9 % decrease in the active daily Bitcoin addresses from May 4 and May 6, 2025, according to Glassnode, indicating a decrease in network activity and potential attention. Regarding the relationships on the market, the 30 -day correlation coefficient for Bitcoin with NASDAQ is 0.68 as of May 7, 2025, for all data from Coinmetrics, with a highlight of a strong correlation between encryption stocks and technology. This relationship indicates that any other sale in stocks, especially in coding stocks such as Coinbase Global (COIN), which decreased by 2.8 % on May 6, 2025, according to Yahoo financing, can affect BTC. The flow of institutional money is another decisive factor; A report issued by Grayscale on May 7, 2025 indicated a 5 % decrease in flows to the investment funds circulating in Bitcoin during the past week, indicating a feeling of caution among the big players. For merchants, these data points collectively draw a picture of the increasing risks, which requires narrow stopping and diverse exposure.

In the context of the dynamics of the stock market, the last NASDAC decreased, and bitcoin conflicts reflect wider feelings of risk from May 7, 2025. Historically, when the stock markets face turmoil, Bitcoin often reflects these movements because of their conception as speculative origin. This is evident in the 24 -hour declines in both markets, with the S&P 500 also decreased by 1.2 % as of May 6, 2025, close, per Reuters. The shares associated with encryption and traded investment funds, such as the Prosthares Bitcoin Etf (BITO) strategy, has increased 15 % on May 6, 2025, according to Marketwatch, indicating an increase in the investor activity amid uncertainty. Institutional flows between stocks and encryption remain a major driver; With ETF flows and potential margin calls in stocks, merchants must expect more fluctuations in bitcoin and cocoes. Market opportunities may arise through these limited situations that use options or future on platforms like Deribit, as the volume of BTC options has increased by 22 % over the past 48 hours as of May 7, 2025, for all deviant data. Mobility in this landscape requires great attention to both developments in encryption and wider financial trends.

Instructions:

What are the main support levels for Bitcoin now?

As of May 7, 2025, at 11:00 AM UTC, the main support levels of Bitcoin are determined by $ 55,000 and $ 52,000, based on technical analysis of TradingView. A break without these levels can lead to more negative side.

How does the decrease in the stock market affect Bitcoin?

NASDAC and S&P 500 decrease by 1.5 % and 1.2 %, respectively, as of May 6, 2025, contribute to a feeling entitled “Bitcoin compressed”, which decreased by 3.2 % to $ 58,200 by May 7, 2025, at 10:00 AM UTC, which reflects a strong correction with stock marks.

https://image.blockchain.news/features/DC3788979712BF4DFF603597AAC46E7C52F8B5EF76BC21453D757F37CDB271FE.jpg