Bitcoin faces 70% of the odds of the second drop-down drop in April the terrifier fears of the stamp, says Nansen

As the risk of uncertainty related to tariff still exists in the second quarter, the crypto market could face another drop after recent correction in March, analysts on Nansen say.

Like the industry moves in April, Bitcoin (Btc) And the broader crypto market could stare another lifting because uncertainty surrounding tariffs and American trade policy can cause further instability.

According to Nansen’s Analysts, There’s a Chance That The Market May Face Another Correction In The Weeks After April 2. In Fact, The Researchers Believe There’s A 70% LikeLiHood That Another Price Dip Will Occur After This Date.

President Donald Trump He previously promised that 2. April turned new tariffs, calling him at the key times for economics just a few weeks after the lapse of shaking markets and caused the recession concerns.

In a recent interview with Crypto.News, Aurelie Barthere, the main research analyst at Nansen, shared his prospects in the market, stating that after 2. April, the market expects to stabilize and perform the way for future growth.

“In my main scenario, 70% subjective probability, I expect another leg in the CRIPTO priced after 2. After we reached the local bottom in mid-March. After this second correction, we will be the bottom for the rest of the year (continuing the BIK and Revedit Ath for BTC).”

Aurelie Barthere

However, it didn’t all fail and the dark for the crypt market. While another DIP is not excluded, Barre suggests that after this, Bitcoin could recover, benefit from a supporting macro, including the growing adoption of the crypt in the US and the lack of a recession signal. Still, Barrere remains cautious because the remaining 30% “was that we had already had a bottom or if it was just dead cats for American acts and crypt,” she said.

“For the remaining 30%: It would be already the bottom or if it was just a dead cat to bounce on American capital and crypts, which is not my basic case, only slows down from 3% to 1.5-2%).”

Aurelie Barthere

Insecurity can take a long time in x2

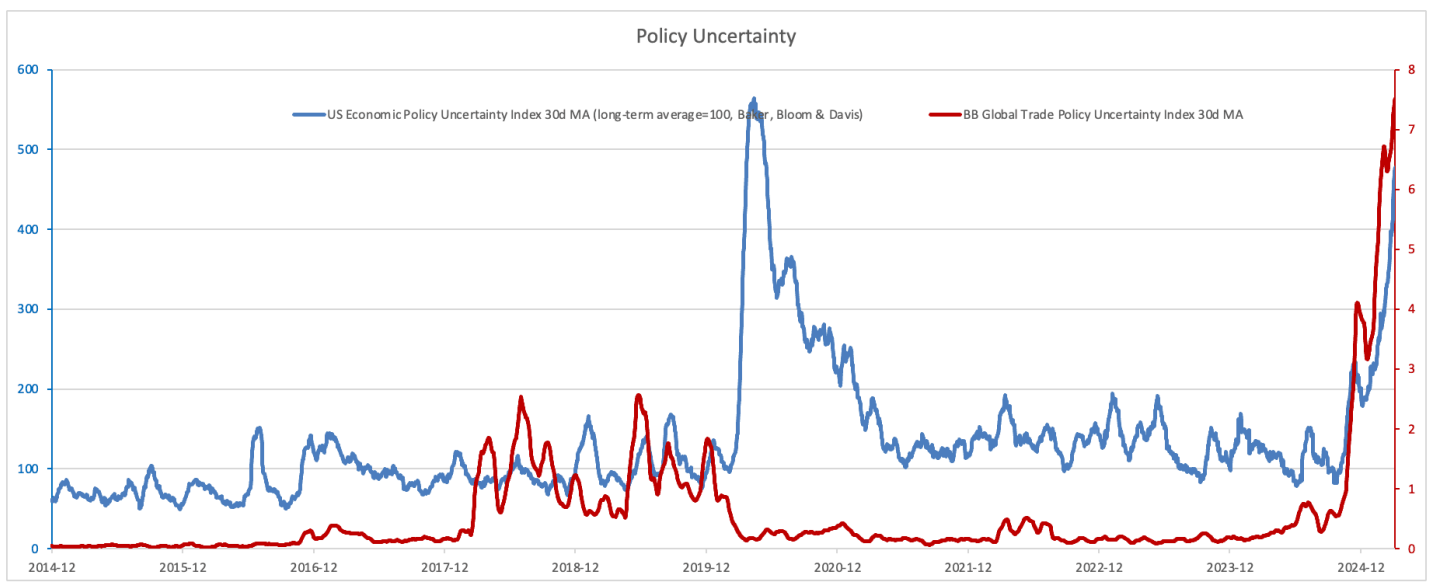

The tariff situation is a significant driver of market instability, with the index of American politics that reaches new heights. Trade discussions have become a key source of investor anxiety, but Nansen believes that uncertainty could be found soon.

As the Secretary for the Treasury recently mentioned, many American trading partners have already negotiated to lower their own trade barriers, which helped calm some fears. Even Trump recently hinted on potential tariff “exceptions” in certain circumstances. But as Barteo pointed out, while these conversations could result in long-term growth benefits for the United States, long-term uncertainty can long-term good in K2.

“Currently, I think we experience corrections in the crypto. Why I still keep the croppling in the US and 2) by slowly” recession “, and this is my only main scenario and I will continue to watch data and signs for signs that it is correct reading.”

Aurelie Barthere

As Barster, he put, there is a “50/50 chance that we brought the peak of trade policy uncertainty”, adding that the true impact of these tariff negotiations may not be completely clear until mid-year. “We continue to see this peak uncertainty, which is more likely between April and June, especially with the beginning of discussions about the packages of the cut packages,” she wrote in the research report.

According to Nannin’s research, insecurity could start another short-term correction in Bitcoin and American actions.

There is no evidence of recession

However, there is a reason for optimism. The report mentions that technicals show encouraging signs. “Drop is bought, for BTC and American acts,” says Barteo, adding that the Bitcoin ETF site recorded a “seven-day stripe net inflows, and first of the CRYPTO prices reached its peak.

One way or another, it is clear that the market remains caution. A lot of people enroll whether crypto bull runes still goes strongly or if we approach the climax. If the history of any indications, the time of economic uncertainty has often lined off the crashes on the market, making investors even more carefully.

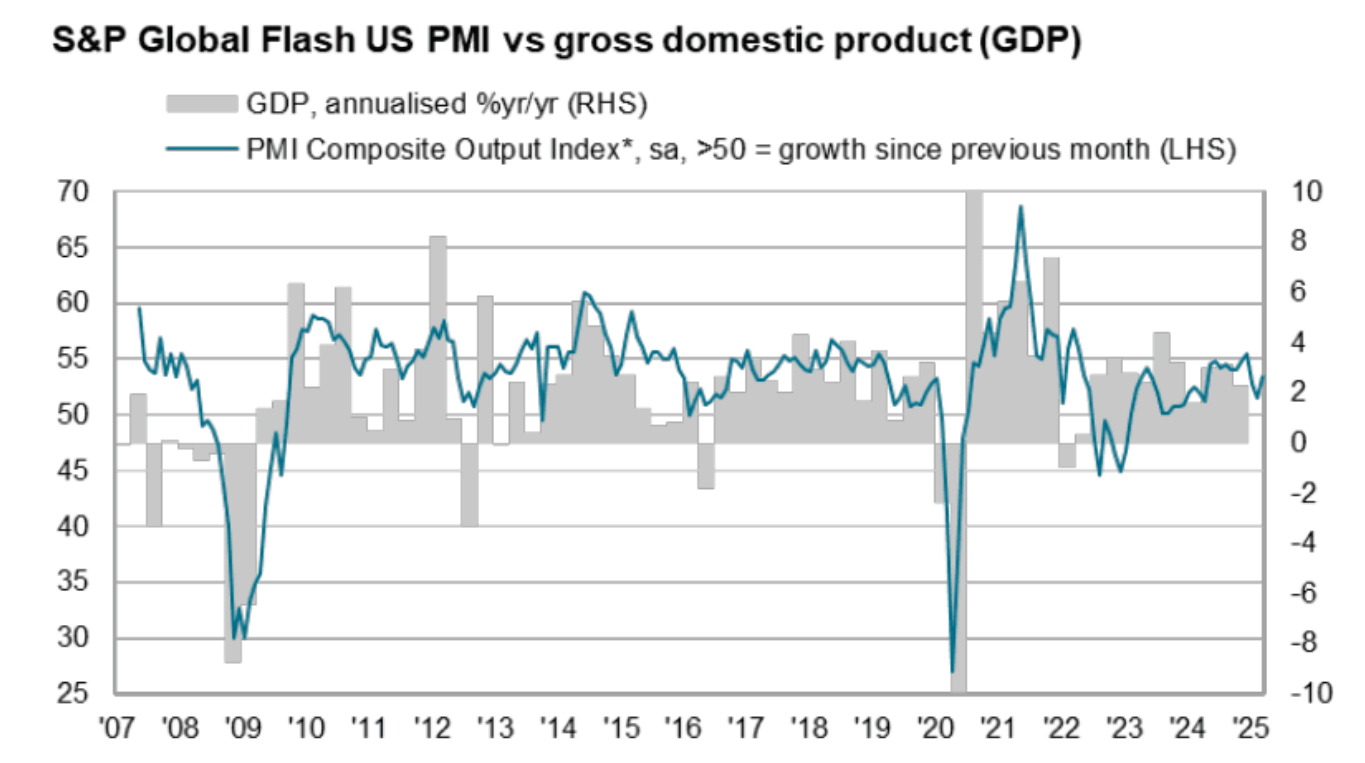

After a market feeling, he hit extreme fear last week, and some investment banks set the probability of the American recession at 40% this year, severe economic data was facilitated by these concerns. The latest PMI report in the United States shows 53.5 result, highest in three months, suggesting 1.9% of the annual growth rates. However, the growth of the entire quarter is lower to 1.5% due to weaker data in January and February.

Barre stressed that it has so far, no serious evidence of recession, because “most data weaknesses were in sentimental indicators, while strong economic data was maintained.” She added that “there is no evidence of recession at this stage, so there is no evidence that we crossed the bear market.”

Although the coming months can bring more UPS and falls, Nansen’s report suggests that the entire bull market remains in the game. As Barteo puts, the market is “probably to see correction, but then we will go according to the new top.”

https://crypto.news/app/uploads/2025/02/crypto-news-price-action-crashes-option02.webp

2025-03-27 19:25:00