Bitcoin ETF flows increase by $ 420.92 million, as ISHARES leads to $ 529.5 million: May 6 update the encryption market | Flash news details

From the perspective of trading, the large flows indicate to Bitcoin’s investment funds to a strong accumulation stage, probably driven by institutional confidence in Bitcoin as a store of value amid unconfirmed economic conditions. This may represent short -term trading opportunities for Bitcoin couples such as BTC/USD and BTC/ETH, especially with Bitcoin’s dominance index to 58.3 % on May 6, 2025, indicating its superior performance for Altcoins such as ETHEREUM. On the contrary, the external flows of Ethereum Etfs indicate the risks of the ETH/USD and ETH/BTC, as the sale pressure can increase if the institutional feelings remain declining. Traders should monitor the main support levels of Ethereum about $ 1700, as a lower break from this threshold can lead to more liquidation. In addition, the connection between the stock market indicators and the encryption assets remains related, as Bitcoin often moves along with heavy technology indicators such as NASDAQ, which gained 0.3 % on May 6, 2025. This indicates that any sudden shifts in the appetite of the stock market can be transferred to the encryption markets. For example, the long situations learned on BTC/USD can be seen if the stock market gains persist, while hedge strategies with ETH/BTC shorts may reduce the risks associated with the performance of ETHEREUM.

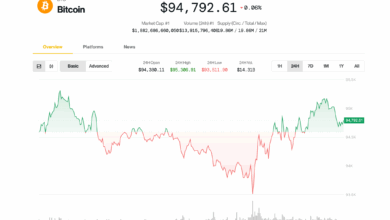

Dive into technical indicators and size data, trading volume increased by 24 hours by 12 % to $ 38.5 billion via major stock exchanges from 18:00 UTC on May 6, 2025, reflecting the increasing market participation after ETF news. BTC/USD has reached 62 years, indicating the bullish momentum without entering its arrest area. The scales on the chain supported this view, with the unrealized profit/loss of Bitcoin to 0.58, a sign of the increased pregnant confidence according to Glassnode data. Meanwhile, ETHEREUM trading volume decreased by 8 % to $ 14.2 billion in the same period of 24 hours, with RSI in 44, indicating that the neutral momentum. ETHEREUM’s activity on the series also showed a decrease in daily active headlines, decreased to 412,000 from 435,000 per week, hinting to a decrease in the use of the network. Regarding the connections committed in the stocks, the 30 -day bitcoin relationship with the S&P 500 was 0.65 as of May 6, 2025, indicating a moderate positive relationship, while Ethereum’s association is I ampest at 0.48. This indicates that Bitcoin is more sensitive to the stock market movements, and it is a decisive factor for merchants in the budget of the governor through asset categories.

Finally, institutional funds flow to the Bitcoin investment funds, especially the dominant Blackrock flows, are on the increasing direction of traditional financing that integrates with encryption markets. This can reinforce codes such as Coinbase (COIN), which saw price increases by 2.1 % to $ 223.50 on May 6, 2025, along with a 15 % increase in trading volume to 9.8 million shares. These movements highlight the rotation of institutional capital from traditional stocks to exposure to encryption, which creates ripple effects across the markets. Traders must remain vigilant for macroeconomic advertisements or federal reserve policy updates, because the transformations of interest rates can affect stock and encryption reviews, which affects ETF flows and comprehensive market morale.

Common Questions section:

What do Bitcoin ETF flows mean for encryption traders?

Bitcoin ETF flows, such as 4,462 BTC (420.92 million dollars) registered on May 6, 2025, usually indicate a strong institutional purchase interest, and often leads to prices in bitcoin. Traders can take advantage of this by entering long locations on BTC/USD or BTC/ETH pairs, while monitoring resistance levels for possible profit achievement areas.

Why do you see ethereum etfs external flows recently?

The flows outside the ETHEREUM ETF, such as a clear loss of 211 ETH ($ 373,000) on May 6, 2025, indicates a decline in institutional confidence, and perhaps due to fears of the expansion of the network or the competition from class 1.

https://image.blockchain.news/features/DC3788979712BF4DFF603597AAC46E7C52F8B5EF76BC21453D757F37CDB271FE.jpg