Bitcoin drops below $100,000 as economic data prices rise

(Bloomberg) — Bitcoin’s surge above $100,000 was short-lived. The symbol fell by the most in more than two weeks on Tuesday, joining a decline in US stocks, as new economic data sent Treasury yields higher.

Most read from Bloomberg

The native cryptocurrency lost 5% to $96,525 at 2:40pm in New York after surpassing $100,000 on Monday for the first time since December 19. Most other major coins were also down, with Ethereum down 7.5% and XRP down nearly 6%.

Bitcoin extended its losses on Tuesday morning as stocks fell after a two-day advance. The Institute for Supply Management’s better-than-expected report on US service providers included a measure of prices paid that reached the highest level since early 2023, while other data showed that US job opportunities increased more than expected. Treasuries fell across the curve, sending the 10-year bond yield to the highest level since May, after a $39 billion bond sale generated the highest yield since 2007.

Bob Walden, head of trading at digital assets firm Abra, said the ISM data led to a sell-off in stocks “which spilled over into cryptocurrencies due to the growing correlation between digital assets and the Nasdaq.” He said the decline “was accompanied by take-profit and stop-loss triggers on new crypto long trades over $100,000.”

Walden added that renewed headlines surrounding President-elect Donald Trump’s changing stance on tariff talks have “added another layer of volatility to the market,” while price action in the Treasury market is helping to fuel cautious sentiment surrounding Bitcoin.

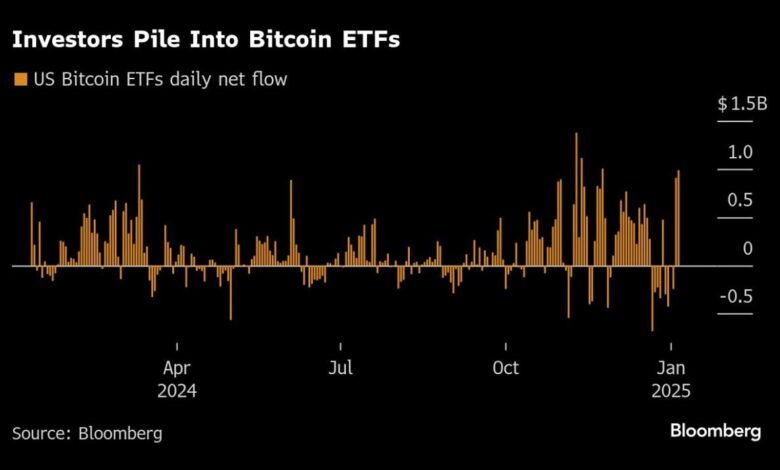

The shift in prices on Tuesday came after investors pumped a net $987 million into bitcoin exchange-traded funds on Monday, the largest single-day inflow since November, according to data compiled by Bloomberg. This comes after about $908 million flowed into funds in the previous session.

Bitcoin’s record rally in 2024 ran out of steam in late December as investors looked to take profits. Optimism that a pro-crypto Trump White House would galvanize a supportive ecosystem in the US had earlier helped push the token to an all-time high of $108,315 in December.

Bitcoin’s prospects in 2025 will depend in part on how well Trump sticks to his cryptocurrency pledges, which include creating a national stockpile of bitcoin. Some doubt whether this rise can continue. In a January 6 MLIV Pulse poll that asked which investments were winners in 2024 and which were likely to turn losers in 2025, 39% of respondents chose Bitcoin, giving it the largest share of votes.

https://s.yimg.com/ny/api/res/1.2/fghwdvzqatjV1SxMwKaNJA–/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD03MTI-/https://media.zenfs.com/en/bloomberg_markets_842/e063407132c3e0482ff3b43e562b6437