Bitcoin declines as Trump’s euphoria gives way to caution about the Fed

(Bloomberg) — Bitcoin extended its slide from this week’s record high to nearly 15% as hawkish signals from the Federal Reserve prompted traders to sell assets that have more than doubled this year.

Most read from Bloomberg

The native cryptocurrency fell as much as 5% to $92,600 on Friday morning in New York after hitting an all-time high above $108,000 earlier in the week. The downturn affected smaller tokens ranging from Ethereum to Dogecoin more severely, and came as stock trading in Asia and Europe declined as well.

A group of U.S. exchange-traded funds that invest directly in bitcoin on Thursday snapped a 15-day streak of inflows to record a record outflow of $680 million, according to data compiled by Bloomberg, underscoring the shift in sentiment.

This increased volatility comes after crypto assets witnessed a rise following Donald Trump’s victory in the US presidential elections on November 5. Positions have become “excessively bullish,” according to QCP Capital, leaving digital assets vulnerable to a change in the tone of the Federal Reserve, which is intensifying its focus on bringing inflation back to its target level.

Uncertainty in cryptocurrency markets looks set to continue through the holidays as Trump prepares to take office, settling threats of tariffs against US allies as well as its adversaries. With the Fed likely to slow the pace of easing, the focus is shifting to how quickly traditional financial companies can embrace the asset class.

“The interplay between monetary policy, institutional adoption, and political developments suggests that Bitcoin will remain sensitive to both macro and cryptocurrency-specific catalysts through 2025,” Hani Abu Aqla, senior market analyst at XTB, said in a note on Friday.

Open interest for Bitcoin futures at CME Group Inc. from a record high on Tuesday but has diminished since then.

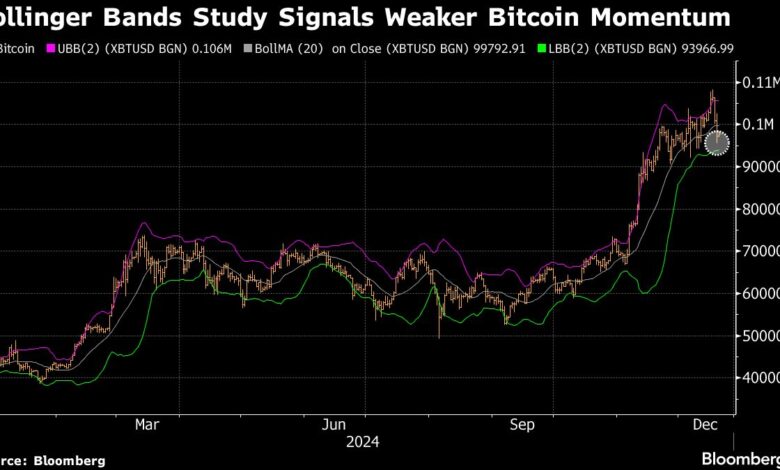

“Technically, caution is warranted in the short term,” Chris Weston, head of research at Pepperstone Group, wrote in a note. “This does not mean that we are set to see a price collapse any time soon, but it is clear that the momentum has run out of this move and buyers have lost dominance and control of the tape.”

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

https://media.zenfs.com/en/bloomberg_markets_842/7be2121c10e065addfe7bdb4159442d9