Bitcoin Cup and Dress for the hand Stals below 115K goals, Anironst

Bitcoin is currently trading in a narrow range between short-term supply and demand, next week of severe sales pressure sent by Shockvasses through the wider crypto market. After you lose over 29% since January, BTC is now looking for direction. The bulls must reinforce and regain the $ 90,000 level to rebuild confidence and confirm the beginning of recovery rally. Until then, uncertainty remains a dominant theme.

The addition of this cautious feeling is broader macroeconomic background, with trade fears and global financial instability in investor confidence. Volatility in capital and geopolitical tensions spilled into the crypt of space, she cleaned up that Bitcoin would make it harder to establish a clear trend.

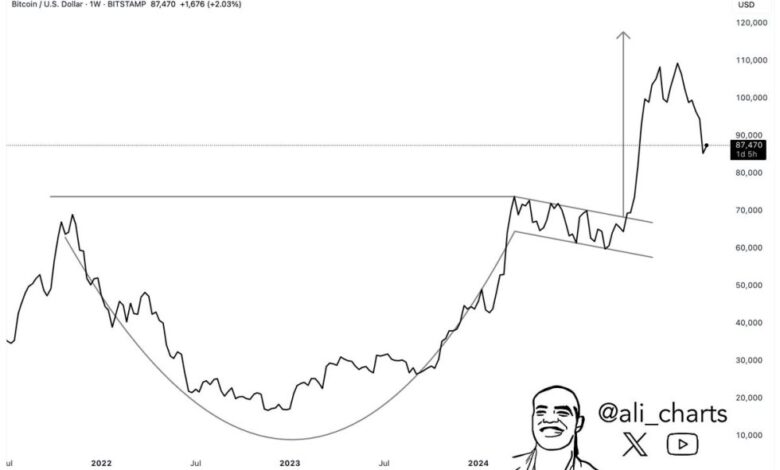

Top Cripto Analytic Ali Martinez shared a technical analysis in X, revealing that Bitcoin might end up a classic creation of cup and handles, dressing to about $ 109,000. However, this does not necessarily have no longer appear. Instead, it points out that Bitcoin is currently without defined direction.

For now, Bitcoin holds its country, but whether the next move is an interruption or interruption will depend on how the market reacts in the coming days.

Bitcoin faces a pivotal test after 13% of recent

Bitcoin gathered quietly over 13% of his 11. Marta low near $ 76,600, with bulls who now set their landmarks to return level $ 88,000. This recent rush brought careful optimism on the market, but the way in front remains uncertain. Bitcoin is currently facing critical technical and psychological test, because it struggles to recover from a sharp trend that began after his January high time.

The sense of investors is mixed. Many entered 2025. Year with the expectations of strong baking, but recent price and growing macroeconomic concerns asked for some analysts to call the beginning of the bear. According to Martinez, Bitcoin may have already finished a classic handle pattern and a dressing of about $ 110,000 – only $ 5,000 shy feet of $ 115,000. If this technical draft applies true, current correction can simply be part of the wider consolidation phase.

This view is meant with the idea that Bitcoin must be stabilized before its next big move. The bulls must defend the current levels and build a swing for a gurgle for the past 90,000 dollar barriers. Until then, BTC seems to be in a pattern for holding, caught up between hope for continuing multitudes and fear of deeper precipitation.

BTC price hovering at 84k $ 84K as bulls face critical resistance

Bitcoin currently trades $ 84,100 after a few days of narrow consolidation and slow price action around this level. The market participants carefully watch this range, because it is a key short term battlefield between bulls and bears. For each significant recovery, the bulls must regain the level of $ 87,300, which also matches the 4-hour 200-day average average (MA) and 4-hour 200-day exponential movement of the average (EMA).

The decisive move above these indicators are likely to cause renewed pressure according to $ 90,000, a psychological and technical barrier that could confirm the beginning of the short-term bullogue trend. However, a failure to denounce $ 87,300 and maintaining the power above $ 84,000 could lean balance in favor of bears.

If BTC loses $ 84,000 support, the next probable target sits below $ 81,000, where lower demand zone can play. This would strengthen continuous insecurity in the market and increased the risk of deeper correction. As traders are waiting for the direction, all eyes are on the BTC’s ability to regain swing and support resistance. The next few sessions could be crucial for the short-term price structure of bitcoin.

Featured image from Dall, Graph from Tradingview

Declaration of responsibility: for informational purposes only. Last performance are not indicative for future results.

2025-03-24 03:30:00