Bitcoin closer break, enters the technical situation: analyst

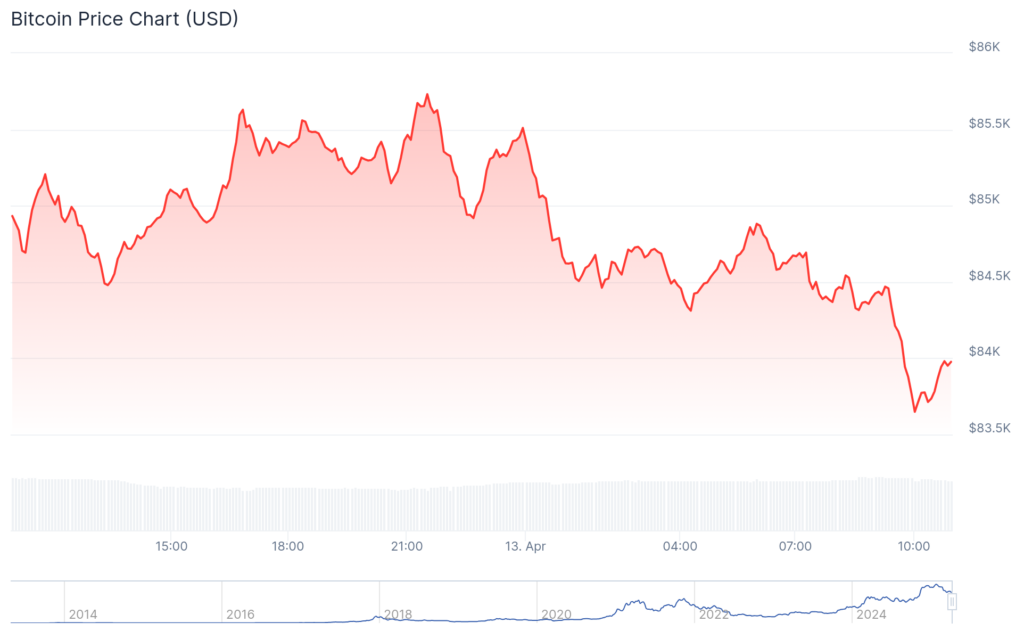

Bitcoin becomes ready for technical burglary from its multi-six-time trend after a weekly of $ 74.77 at below $ 84,000 on the last check on Sunday.

Cripto Analytic Rect Capital exaggeration that bitcoin (Btc) is “mere hours away from performing initial but crucial steps to fully confirming the passage through a multi-sixern trend.”

The analyst also stressed that when Bitcoin successfully spoils the technical trend, it establishes a new poptrend phase.

This technical analysis comes as Bitcoin passes through a challenging period. She fell 22.3% of their all times of $ 108,786, reached 20. January.

Despite this correction, the data on the chain suggests strong accumulation activities at the critical price level.

Over 40,000 bitcoin accumulated at $ 79,000

Pronouns data highlights view bitcoin accumulation at the support level of $ 79,000, with approximately 40,000 BTC purchased in this zone. The market also successfully worked through a larger cluster at $ 82.080, where approximately 51,000 BTC was accumulated. These accumulation levels often act as strong support for technical analysis.

According to Slocnode, the next test of Bitcoin will be at $ 83,500, where 48,500 BTC is another 48,500 BTC. The break and retention above this level could speed up his instinct.

One analyst, which runs Moniker “Merline Merchant”, identified additional big signals. He noted that Bitcoin broke out of the drop-down meal of a wedge with aid divergence formed at current indicators. This combination often precedes significant price movements, and analyst has set a potential goal of $ 102,000.

“Through trends,” Merlinijan said.

In the technical analysis, the fall pattern is deemed to create a beech reversal that characterizes the converging line of trends downwards.

When the price breaks over the upper line of the trend, it usually signals the exhaustion of pressure sales and a potential crossing to buying swing.

The current technical setting comes after Bitcoin has experienced significant volatility in recent months, primarily under the influence of broader macroeconomic factors. However, the basic accumulated forms suggest that institutional and retail investors continue to review the pricing entries as a purchase opportunity.

The chain data further support this opinion, as the long-term supply owner reached a historical level despite recent price correction. This shows confidence in the Bitcoin long-term offer among investors with historical low weather preferences.

If Bitcoin confirms the interruption from the multi-succumbent trend, as the analysts suggest, the next main resistant, which will appear at $ 93,500 psychological levels and $ 100,000.

https://crypto.news/app/uploads/2025/03/crypto-news-US-Bitcoin-reserves-option03.webp

2025-04-13 18:00:00