Here’s why the crippto market and price of gold parted before liberation

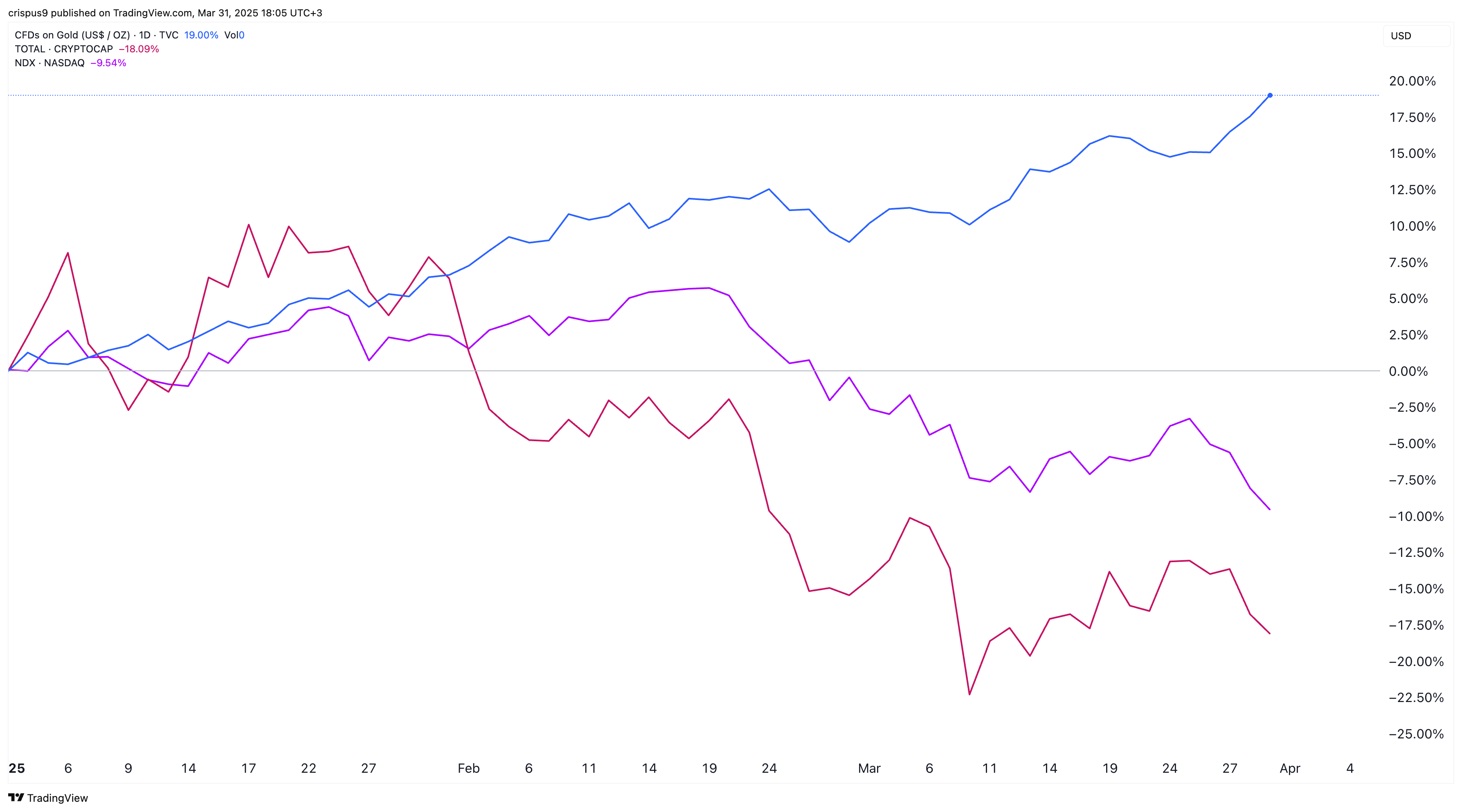

The Market Krypto came under pressure this month, continuing the training that began in the fourth quarter of last year.

Bitcoin (Btc) fell from all times of $ 109,300 in January to $ 82,000, while Etherum (El) Dropped off $ 4,100 in November to $ 1,800.

Other Altcoys withdrew, with blue names like Solana (Salt), Cardano (Ada) and a polkadot (Dot) falling with double digits from their highest level 2024. years.

Criptocurrencies have largely moved into synchronization with the American stock exchange, which entered correction. The technical US 100 index dropped by 350 points on Monday and fell to the lowest level since September.

Similarly, Russell 2000, S & P 500, and Dow Jones all decreased by double digits from their top of their own years earlier.

On the other hand, gold prices remained gleamed this year. Metal gathered five consecutive weeks and is now in all the weather high of $ 3,120. It is more than 20% this year, while the greatest Golden ETFs like GLB and IAUM see a significant inflow.

Gold can be seen as better secure assets of cripto-a

There are an increase in gold prices, together with price prices and curingcurancing prices, suggests that investors look gold as a top safe deposit property in the middle of growing risk.

Investors see the upcoming Donald Trump Release tariffs Like a black swan of a lap event that could lead on the recession.

Trump has already announced care of tariffs for the last week. Last week, he discovered 25% tariff on imported cars to the United States. He also imposed 25% tariff on import from Canada and Mexico.

His liberation plan involves reciprocal tariffs in most countries operating with the US hopes to encourage domestic investments and reduce trade deficit.

The challenge, however, is that tariffs are effective, which could reduce consumer consumption and push the American economy in the recession.

On the positive side, the recession is likely to reduce interest rates and launched quantitative alleviation, which could initiate renewal demand for risky means such as actions and cryptocurries.

Furthermore, Trump is also counted on the Mar-A-Lago agreement, which aims to devalue the US dollar to make American goods more competitive abroad. The weaker dollar would be a bull for gold, crypt and supplies.

https://crypto.news/app/uploads/2025/02/crypto-news-Donald-Trump-option26.webp

2025-03-31 18:23:00