Bear Market Rallly Vs Bull Market Trap: Jeff Dorman analyzes Crypto work trends | Flash news details

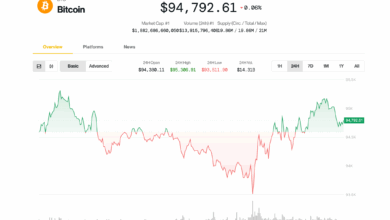

From the perspective of trading, the effects of this discussion are at this rise or a deep proud of all of the participants in the encryption market and the market. If this is a rare in the bear market, as Dorman suggested during May 6, 2025, BTC can face resistance at a level of $ 69,000, which is a major psychological barrier tested at 10:00 UTC on May 5, 2025, with the trading volume to 1.2 million BTC through major exchanges such as Binance and Coinbase during a 24 -hour period. On the contrary, if this is a trap in the Taurus market, a lower collapse than the level of support of $ 65,000-which was seen at 15:00 UAE time on May 6, 2025-can lead to a series of sale orders, which is likely to run altcoins such as ETHEREUM (ETH) by 4-5 %, as the ETH/BTC trading chairs show 0.92. For stock market traders, the inability of the S&P 500 to seize 5200 points starting from May 6, 2025, 16:00 UTC, indicates the weakening of momentum, which can ripen to the encryption markets given the institutional overlap. It is worth noting that the shares related to encryption such as Microstrategy (MSTR) witnessed a decrease of 2.7 % to $ 1,580 per share by May 6, 2025, 13:00 UAE, which reflects the decline associated with the BTC decline. Dynamic market provides trading opportunities, such as MSTR or BTC shortening at resistance levels while monitoring the appetite of the stock market risk to confirm. In addition, institutional flow data indicates a net flow of $ 320 million of investment funds circulating in Bitcoin between May 3 and May 5, 2025, hinting a decrease in confidence between senior players, a trend that may exacerbate negative risks if stock indicators stumble.

Dive into technical indicators and size data, the RSI (RSI) relative index stood on the daily chart in 62 as of May 6, 2025, 18:00 UTC, indicating excessive but not yet extremes to confirm the reflection. The moving average was for 50 days, currently at $ 64,800, as a dynamic support during the last decrease at 12:00 UAE time on May 6, 2025, where the immediate trading volume reaches 450,000 BTC in the previous 48 hours, an increase of 15 % over the previous week. The scales on the series also reveal that the volume of Bitcoin network transactions increased by 18 % to $ 12.3 billion per day on May 5, 2025, indicating the user’s continuous activity despite the fluctuation of prices, according to the data that it participates in Milk Road. In terms of connections to the market, ETH reflected BTC movements with an increase of 4.8 % to 3,150 dollars by May 5, 2025, 14:00 UTC, before declining 2.9 % to 3,060 dollars by May 6, 2025, 17:00 UTC, while trading in the size of ETH/USDT on Binance amounted to 2.1 million in 24 hours. Crypto inventory is still clear as the NASDAC compound, which is significantly likely to technical stocks, has decreased by 1.5 % to 16200 points by May 6, 2025, 15:30 UAE, which led to a decrease in the morale of destructive technology symbols such as Solana (SOL), which decreased 3.2 % to $ 142 in time. The institutional impact is clear with reports of hedge funds that re -customize capital from Crypto ETF to traditional stock boxes, with a net $ 200 million registration on May 5, 2025, indicating risk behavior that may pressure encryption prices if stock markets continue to promote. For merchants, the BTC Support Monitoring of $ 65,000 and the S&P 500 500 500 levels over the next 48 hours will be very important to locate.

In short, the discussion by Jeff Dorman on May 6, 2025, on May 6, 2025, is the complex link between the encryption markets and securities, in short, the very discussion by Jeff Dorman on May 6, 2025, on May 6, 2025, highlights the complex link between the encryption markets and securities in short, in short, the discussion that Jeff Dorman is highlighted On May 6, 2025, the discussion by Jeff Dorman on May 6, 2025 sheds light on the complex link between encryption and stock markets. With BTC and S&P 500 show of simultaneous fluctuations and institutional flows towards caution, traders must adopt a data -based approach, take advantage of technical levels and volume trends to take advantage of short -term movements while staying in flexibility transformations in the wider market. Market opportunities, such as hedging with encryption stocks such as MSTR or diversity in Stablecoin spouses during increased fluctuations, remains viable strategies in this unconfirmed scene.

Instructions:

Is the current Bitcoin Rally sustainable based on modern data?

The sustainability of Bitcoin is not confirmed as of May 6, 2025. While BTC increased by 5.2 % to $ 68400 by May 5, 2025, 20:00 UTC, the subsequent decrease by 3.1 % to $ 66,300 by May 6, 2025, 12:00 UTC, along with RSI 62 indicating excessive cases of beer. Traders must see the support level of $ 65,000 closely.

How does securities market movements affect encryption prices now?

Securities market movements, especially the S&P 500 decrease by 1.2 % to 5,187 points by May 6, 2025, 14:00 UTC, are closely related to the encryption price currency, with 0.85 correlation coefficient over the past thirty days. This contributed to the decline of BTC and the declining feeling of shares related to encryption, such as Microstrategy, a decrease of 2.7 % in the same period.

https://image.blockchain.news/features/DC3788979712BF4DFF603597AAC46E7C52F8B5EF76BC21453D757F37CDB271FE.jpg