Solan Foundation to Reduce Support for “Valiators Online Only” in Decentralization

In an effort to increase decentralization, the Solana Foundation aims to reduce “validators only in the name”, which relies only on the share of the basis.

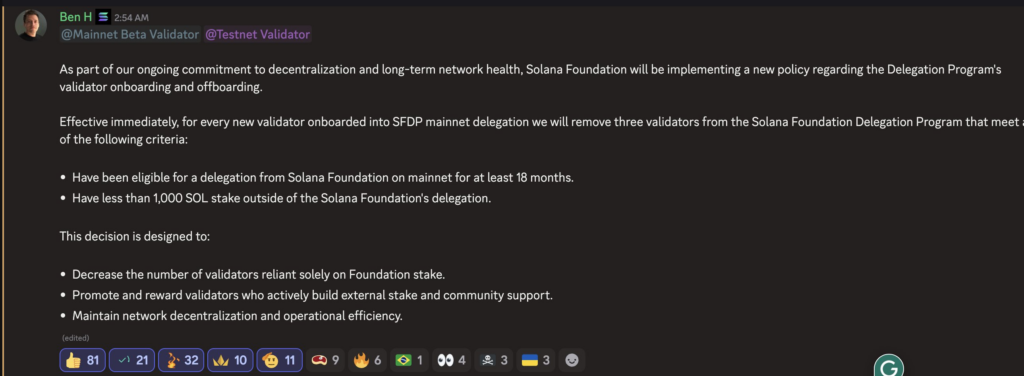

Solana (Sol) It brings changes that aim to interfere with how the program of its path for the delegation works. Wednesday, 23. April, Ben Havkins, the head of the Ecosystem trail at the Solan Foundation, discovered That they will start cutting validators with a low number of external roles.

In particular, for each new validator that enters the delegation program, the Foundation will reduce three more low-external propellent validators. This refers to validaires less than 1,000 elders, outside those within the delegation program. They can be reduced if eligible for a delegation at least 18 months.

Solana faces concentrations for roller

The decision aims to reduce the number of validators that rely exclusively on the Solan Foundation for their validation. At the same time, the Foundation wants to promote the validors who grow the community for placing in Solana.

Due to the high computer costs, the performance of the Solana coffins is extremely expensive. According to some estimates, the costs of starting the server moves from 45,000 to $ 68,000 Annually, which does not include hardware costs.

This means that only large validators can be hoped to earn from working nodes, assuming that there is no support for the Foundation. In contrast, this situation leads to the centralization of risk, because smaller validators cannot join the network.

However, thanks to large rewards for placing, Solana has one of the highest actions of stable tokens among the main chains. Right now, 65% Solana The supply of circulation is locked in constant basins. In comparison, only 28% of ETE and 21% of BNB are set.

According to coinbazia, users can earn 5.84% of annual yield of percentage per cent on Solana. However, this return is denominated in salt, not USD, which gives yields to be significant volatility.

https://crypto.news/app/uploads/2024/12/crypto-news-Solanas-DEX-transactions-belong-to-Pump.fun-option01.webp

2025-04-23 19:57:00