After liquidation of $ 300 million, BTC, ETH, XRP prices on the edge while Trump speaks on cryptomite

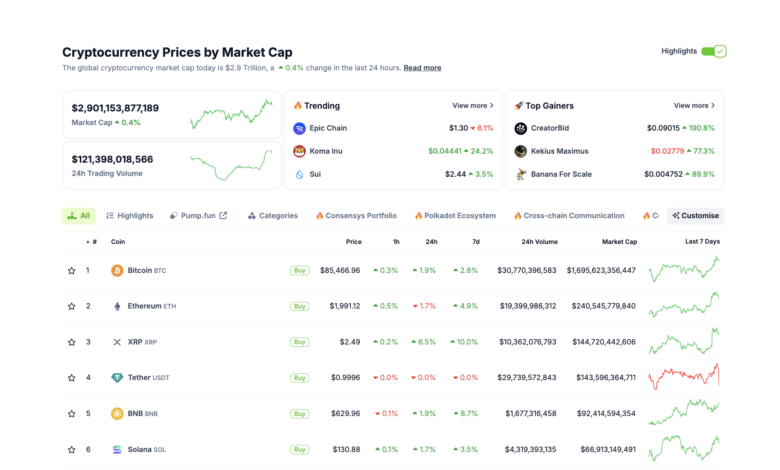

- The evaluation of the cryptocurnity assessment was consolidated on Thursday to $ 2.9 trillion after stopping at the market rate.

- Liquidations were in the last 24 hours in the last 24 hours, with $ 207 million in short contracts closed for almost 60% losses.

- The Bitcoin ETFS spot took another $ 11 million, which makes it over $ 527 million BTC purchases in four consecutive days.

Market updates Bitcoin:

- The Bitcoinic price reached $ 87,550 before the river 1.7% according to the level of $ 8,500 at the time of Thursday.

- Bitcoin ETFS recorded another $ 11 million on Wednesday, extending the purchase with four consecutive days.

Bitcoin ETFS | Sassoved

From last Friday, Bitcoin ETFS has gained over $ 520 million in BTC in four consecutive days of inflow.

This is harmonized with the narrative that the cooling of inflation is, which testifies the Federal Reserve (Fed) on Wednesday, has raised the BTC market, especially among American corporate investors.

Bitcoin Holding above $ 85,000 support, suggests that strategic traders are set for more upside-down signaling such as trading session on Thursday takes place.

ALTCOIN updates: What is the CRIPTO market today?

Altcoyni has made a significant recovery in the last 24 hours, with Bull traders who capitalize multiple Bikovatimatimatics from the US:

Wednesday are expanding markets received the initial incentive when US Fed announced a decision on interest rate unchanged to 4.5%, aligning with market expectations.

Ripple CEO also confirmed that on Wednesday he confirmed that the Securities and Stock Exchange Commission dropped all costs, which ended 5-year bear overhang.

The American President Donald Trump is charged to speak at the Digital Association Summit in New York Household in New York.

Chart of the day: salt, XRP, Ada All who have key support levels as Fed Pause and Trump Speech enhances market prospects

Altcoyni lay recovery, float by a recent aid macro and regulatory development.

- The price of Etherum is 2%, traded for $ 1,990, because bears make the furious effort to prevent the interruption above $ 2,000.

However, the latest data on the market show that Solana (SOL), KSRP and Cardano (ADA) are all who have key levels of support, signal resistance to re-renewed optimism investors after the supply rate.

-638780822834141291.png)

Performance Cripto Market, 20. Marta | Coongecko

- The price price increased by 6.5% narrative of $ 2.49, because traders reacted positively to the news that Sex fell all the remaining charges against Ripple. The long-term legal battle was the main wind for KSRP, and this resolution encouraged the renewed interest rate purchase.

- Solana (salt) increased by 1.7% in the last 24 hours, which is currently traded from $ 130.88. The recent announcement of the first Solana Futures ETF has launched salt, which is as much as $ 136 earlier during the day.

- Cardano (ADA) also showed strength, increasing 4% to settle over $ 0.70, the wider Altcoin assemblies are used.

These superior allcoins that have key support levels indicate that traders currently take access to sites and watch, waiting for the next catalyst on the market.

With the president of Donald Trump, which speaks at the digital asset summit (DAS) in New York, many traders hold their positions, predict potential influence on the market.

American President Donald Trump speaks at the BlockWorks Digital Action Summit, 20. Marta 2025

The attitude to fluctuating policies from Trump declared that the United States will not sell its BTC funds early, it could provide additional tail winds for crypto markets in the coming days.

News updates Cripto:

Kraken buys NinjaTrader in a contract for $ 1.5 billion to expand American Futures Trading

Kraken announced the purchase of $ 1.5 billion Ninjatrader, a leading American retail trade platform.

An agreement, which is expected to close in the first half of 2025. years, signifies one of the largest integrations between traditional finances and crypts.

Kraken aims to take advantage of the futures futures store ninjatrader to expand their presence in the American derivative market and improves multi-resource trading opportunities.

“Traditional markets operate on banking systems from 1950s and exchanges, exchanges that close at 4 pm and disposal of settlements that last the days for solving.

The CRIPTO rails have set these issues, working with efficient and real infrastructure.

But until today, the finances and crypto remained outdated, the remained ecosystems remained.

This transaction is the first step in our vision of the Trade Platform where any property can be traded, anytime, “said Arjun Sethi, Kraken General Manager.

NinjaTrader currently serves nearly two million traders and is a trademark for registered CFTC, will continue to act independently towards Kraken, which expands the search for trade and payment applications.

-

Pakistan moves to legalize cryptocurritude to reinforce a foreign investment

Pakistan develops a legal framework for the cryptocurrency to attract international investments and strengthens his digital asset ecosystem.

The Corrupt Pakistan, who led bin Sakib, is the development of regulatory guidelines to ensure clarity and security for investors.

The country already has a strong presence of the crypt, ranking ninth worldwide in adoption with estimated 15-20 million users.

The initiative aligns with regional trends and reflects the growing global interest in digital property.

The Pakistani move also invokes the influence of international regulatory strategies, including recent events on the American crypto market. Officials aim to post country as a competitive hub for innovation and investment blockain

-

Moonpay provides a $ 200 million credit from a galaxy to manage liquidity management

Moonpay provided 200 million credit lines of $ 200 million from the investment company galaxy to deal with sudden spikes in the scope of the transaction.

This move comes after the company struggled to meet liquidity requirements during the launch of Donald Trump, which required $ 160 million of urgent funds.

The new entire Moonpay Ivan Soto-Vright said that a credit line will be intended for short-term capital access during extreme liquidity events, not for long-term debt.

This means the first credit line of Moonpay, despite completion of 2024. Such as cash flow positively with 112% of the year-annual revenue growth.

The company was in 2021. year valued to $ 3.4 billion, she chose to provide additional liquidity after dealing with banking restrictions during starting the Trump Memons.

“The traditional banking system works on Monday to Friday, nine to five, and Crypto operates 24 hours a day,” Soto-Vright said, emphasizing the need for instant funds outside banking hours.

Declaration of responsibility: for informational purposes only. Last performance are not indicative for future results.

2025-03-20 18:45:00