Ada Rallies, Bitcoin looks forward to Powell Certificate in Congress

Written by omkar GodBole (at all times ET unless it is indicated otherwise)

ADA is trading from Cardano higher, backed by the last Grayscale app, while Bitcoin (BTC) is still wandering in the dull encryption market where we are trembling for the testimony of Jerome Powell, the head of the Federal Reserve on Congress.

Powell takes the stage At Capitol Hill later on Tuesday for its semi -annual update from monetary policy. He will start with the Senate and repeat his performance in the House of Representatives on Wednesday.

It is likely that a little certificate is not done to revive the BTC’s height. The consensus is that Powell will support its data -based approach, while emphasizing that the central bank is not in a hurry to reduce interest rates any time soon and is keen to monitor more progress with inflation.

The data shared by Bloomberg Lisa Abramovich He appears The inflation rates that were emptied in the market increased during the two years to the next five to the highest levels since early 2023. At the same time, President Donald Trump’s tariff may support inflation. the CME’s Fedwatch The tool is currently showing that traders expect only 50 basis points in discounts by the end of next year, much less than the FOOC Open Market Committee (FOC) shown in December expectations.

However, there is a glimmer of hope: If the release of the Consumer Prices Index (CPI) on Wednesday comes weaker than expected, it may create some upward fluctuations.

In other news, Japanese mobile game studio Jome said It plans to buy Bitcoin with a value of 1 billion yen ($ 6.6 million), after the Metaplanet listed in Tokyo’s progress. Metaplanet started buying BTC last year and its stocks Rise Amazing 4,800 % in 12 months.

Social media continues The duct with the discussion Because of the imbalance in the echerum ecological system, the Layer-2 scale products retain most of the revenues created with only a small percentage of only a small percentage to the basic layer. Solana, and at the same time, It continues to excel ETHEREUM and other smart nodes groups in trading volumes in decentralized exchange and revenues.

In traditional markets, gold takes a bull while copper, which is often seen as a global economic health agent, is declining, and picks up a series of winning for six days. Stay on alert!

What do you see?

- Encryption

- Macro

- February 11, 10:00 am: Federal Reserve Chairman Jerome Powell submits his semi -annual report to the American Senate Committee for Banking Services, Housing and Urban Affairs. Livestream link.

- Feb 11, 2:30 pm: The sub -committee for financial services in the United States (“digital assets, financial technology and artificial intelligence”) hearing Entitled “The Golden Age of digital origins: drawing a path forward.” Among the witnesses are Jonathan Jashim, the Deputy General Adviser to Karkan. Livestream link.

- February 12, 8:30 AM: The American Labor Statistics Office (BLS) launches a consumer price index report in January (CPI).

- The basic inflation rate is Ami Pets. 0.3 % against the previous. 0.2 %

- Yoy Est. 3.1 % against the previous. 3.2 %

- The rate of inflation is 0.3 % against the previous. 0.4 %

- Yoy EST inflation rate. 2.9 % against the previous. 2.9 %

- February 12, 10:00 am: Federal Reserve Speaker Jerome Powell submits his semi -annual report to the American House of Representatives for Financial Services. Livestream link.

- February 13, 8:30 am: The American Labor Statistics Office (BLS) launches the product price index report (PPI).

- The basic ppi mom 0.3 % against the previous. 0 %

- Basic ppi yoy estt. 3.3 % against the previous. 3.5 %

- PPI mom EST. 0.3 % against the previous. 0.2 %

- PPI yoy prev. 3.3 %

- February 13, 8:30 am: The US Department of Labor launches the weekly request for unemployment insurance for the week ending February 8.

- Initial unemployment allegations. 216K against the previous. 219k

- Profits

- February 11: Exit Movement (exit), After the market, $ 0.14 (2 ESTS.)

- February 11: Digital Cell Techniques (cell), Post -market, -0.15 dollars

- February 12: Cotton 8 (hut), Before the market, $ 0.05

- February 12: Irene (Irene), Post -market, -0.01 dollars

- February 12: Redit (RDDT), After the market, $ 0.25

- February 12: Robinhood Markets (Hood), after the market, $ 0.41

- February 13: Coinbase Global (currencyAfter the market, $ 1.89

- February 14: Remixpoint (Tyo: 3825)

Symbolic events

- Voices of governance and calls

- AAVE DAO discusses Acknowledgment of spasm AAVE friendly shoes published on the Evm Hyperleliquid series, as well as AAVE V3 post on the ink, Kraken Layer-2 Rollup.

- Sky Dao is discussing, among other things, Onboarding is one To the spark liquidity layer, increasing the limits of the PSM2 rate on the base and accommodating $ 100 million from Susds to a base to accommodate growth on the network.

- Morpho Dao discusses 25 % Decrease On both Ethereum and Al Qaeda after another reduction, it entered into force on January 30.

- Dydx Dao votes on Dydx Treasury Subdao Take Control Stdydx Within the treasury of the protocol community and any symbols that accumulate through automatic vehicle bonuses.

- February 12 in the evening: Display (offer) to Broadcasting of Amnesty International Discord Ama session.

- to open

- February 12: Aethir (ATH) to open 10.21 % of the $ 23.80 million trading offer.

- February 14: The sand box (sand) to open 8.4 % of the trading offer of $ 80.2 million.

- February 16: Arbi (ARB) to open 2.13 % of the trading offer of $ 42.93 million.

- February 21: Fast code (FTN) to open 4.66 % of $ 78.8 million trading offer.

- Launching the distinctive symbol

- February 12: Avalon (AVL) to be included on the Bybit.

- February 12: Game7 (G7) to be included on the Bybit, Gate.ioHashkey, Mexc, XT and Kucoin.

- February 13: ETHEREUMPOW (ETHW) and MATAC are no longer supported in Deribit.

Conferences:

Coindsk consensus in occurrence Hong Kong on February 18-20 In Toronto from 14 to 16 May. Use today’s code and save 15 % on passes.

Locate the location of the derivatives

- The high price of Litecoin of 10 % in the past 24 hours is accompanied by an increase of 18 % in permanent future contracts. HBAR, UNI has also seen noticeable increases in open attention, according to VERO data.

- When talking about permanent financing rates, Sol, SUI sees negative readings in a sign of bias to fill short jobs.

- By 11 %, the Future CME foundation for ETH is larger than BTC’s, which may attract pregnancy traders, which leads to a strong absorption of the ETHER Spot qualifiers.

- BTC, ETH Put tapes on Deribit slightly reduced. The flows have been kept.

Market movements:

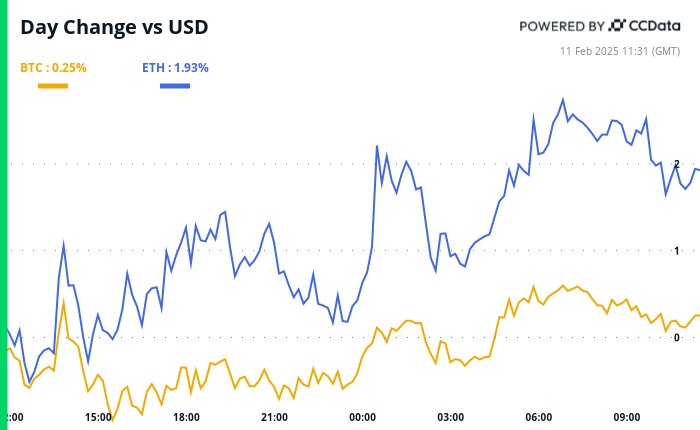

- BTC increased by 0.62 % from 4 pm East to 97,989.64 dollars (24 hours: +0.27 %)

- ETH 0.53 % increased at 2,702.45 dollars (24 hours: +2.07 %)

- Coindesk 20 increases by 1.79 % to 3,269.36 (24 hours: +1.77 %)

- ETHER CESR 8 -bit up to 3.05 %

- BTC financing is 0.01 % (10.95 % annual) on Binance

- DXY did not change at 108.31

- Gold rises 0.58 % at $ 2,931.2

- Silver decreased 0.74 % to $ 32.15/ounces

- Nikkei 225 closed unchanged at 38,801.17

- Hang Seng -1.06 % closed in 21,294.86

- Fots did not change at 8,767.36

- EURO Stoxx 50 is 0.1 % to 5,363.27

- Djia closed on Monday +0.38 % in 44,470.41

- S & P 500 closed +0.67 % in 6,066.44

- Nasdak closed +0.98 % in 19,714.27

- Closed S&P F/TSX Complex +0.85 % at 25,658.9

- S & P 40 Latin America closed +0.77 % in 2,428.87

- The closet rate has not changed for 10 years at 4.49 %

- E-MINI S & P 500 futures contracts decreased 0.33 % to 6,068.5

- E-MINI NASDAQ-100 Futures decreased by 0.47 % at 21,743.5

- The E-MINI Dow Jones Industrial Indust Futured Index fell 0.21 % to 44,488

Bitcoin Statistics:

- BTC dominance: 61.21 % (-0.59 %)

- ETHEREUM ratio to Bitcoin: 0.02752 (0.77 %)

- Hashrate (Seven Day Average): 802 EH/S

- Hashprice (spot): $ 53.19

- Total fees: 4.58 BTC / 445,648 dollars

- Cme Futures Open benefit: 166,695 BTC

- BTC at gold price: 33.3 ounces

- BTC market roof against Gold: 9.46 %

Technical analysis

- BTC’s monthly graph is an excellent illustration for how the lines that are extracted from the main price points are support levels.

- Over the past two months, the negative side has been constantly crowned with about $ 90,000. This level is defined by the direction line that connects the twin peaks from 2021.

Encryption

- Microstrategy (MSTR): closed on Monday at $ 334.62 (+2.16 %), an increase of 0.15 % at $ 335.11 in the pre -market.

- Coinbase Global (COIN): Closed at $ 280.22 (+2.09 %), an increase of 0.23 % at $ 280.86 in pre -market.

- Galaxy Digital Holdings (GLXY): Closed at $ 27.24 Canadian dollars (+1.3 %)

- Mara Holdings (MARA): Closed at $ 16.76 (unchanged), an increase of 0.36 % at $ 16.82 in pre -market.

- Riot platforms (RIOT): closed at $ 11.63 (-0.1 %), a decrease of 0.1 % to $ 11.62 in pre-market.

- Core Scientific (Corz): Closed at $ 12.82 (+2.07 %), an increase of 0.1 % at $ 12.83 in pre -market.

- Cleanspark (CLSK): Closed at $ 11.18 (-1.32 %), a decrease of 0.54 % to $ 11.12 on the market before the market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 23.50 (+1.51 %), unchanged at $ 23.5 in the market before the market.

- Semler Scientific (SMLR): Closed at $ 49.61 (+0.83 %), an increase of 2.6 % at $ 50.90 in the market before the market.

- Exit (exit) movement: closed at $ 51.18 (+5.81 %), a decrease of 2.31 % to $ 50 in the market before the market.

Etf flows

BTC Etfs Stain:

- Net daily flow: -186.3 million dollars

- Cutting net flow: 40.52 billion dollars

- Total BTC Holdings ~ 1.177 million.

ETH ETFS spot

- Daily net flow: -22.5 million dollars

- Cutting net flow: 3.16 billion dollars

- Total Eth Holdings ~ 3.791 million.

source: Farside investors

It flows overnight

Today’s scheme

- The Solana -based decentralized stock exchanges have hosted the volume of trading more than ETHEREUM since October.

While you sleep

- The ether was weak, but the total closed value on Ethereum rises: Citi (COINDESK): Citi Research Paper says ETHER has given Bitcoin this year, although ETHEREM’s basics, the closed total value (TVL), the continuous ETF flows and the possibility of the US friendly regulating the encryption.

- Hedge boxes are the future of the ether CME as it has not happened before. Do you carry trade or explicitly extreme bets? (CoINDESK): Hedge boxes retain the future shorts shorts on CME, as a basis for pregnancy trades that benefit from the difference between Sot ETH ETF and ETH FUTERES. Hepbody bets may also contribute.

- Trump determines a 25 % tariff on steel, aluminum, and the expansion of the trade war (Bloomberg): President Trump put a 25 % tariff on all imported steel and aluminum, on March 12, with the aim of enhancing local production and creating new job opportunities.

- Chinese companies do not know where to put their money – and it raises a record height in profit payments (CNBC): Chinese companies offer record profits and shares, which are encouraged by government reforms to improve shareholders ’returns.

- BoE Redter, who voted for Big Cut, says (Financial Times): Catherine Man, an external member of the Bank of England’s monetary policy committee, said that she voted in favor of 50 prices in prices last week, noting that the pressure of inflation has decreased.

- Wazirx 85 % of the money of the stolen users with the expiration of the balance ends (CoINDESK): Indian Crypto Exchange Wazirx, which was penetrated last year, hopes to start distributing the initial funds in April, with the aim of returning 85 % of the value of encrypted users, with more at a later time.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/763473e6642716ab731f5afb30811b0d1bc5fd36-700×430.png?auto=format