“A Wave of Fear” – A tariff of definitions disrupted by fuel prices. Fears of Bitcoin, Ethereum, XRP and Crypto

02/03 update below. This post was originally published on February 2

Bitcoin and encryption prices stopped after a higher rise after the American presidential victory Donald Trump –With fears that suddenly appeared, the $ 4 trillion encryption bubble can be about to pop.

Open more than $ 3000 in NFT, Web3 and Crypto Perks – I offer now!

Bitcoin price increased to approximately $ 110,000 per bitcoin, with the help of Eileon Musk plans to leak to encrypt at the White House.

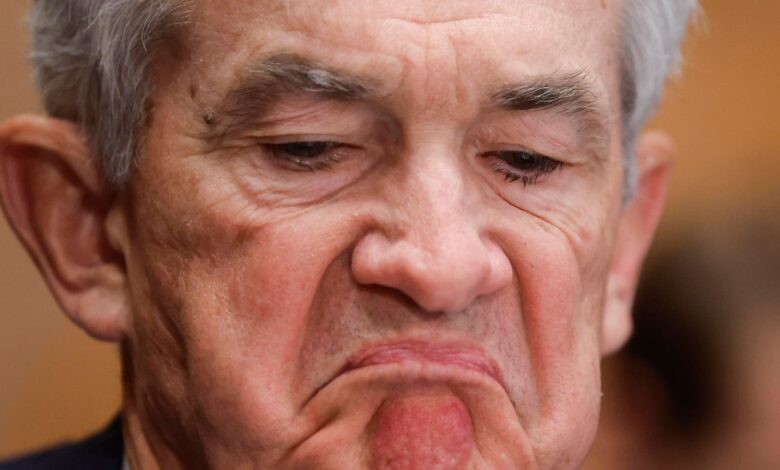

now, The legendary Bitcoin merchant also warns of the “financial crisis” that is looming on the horizon, “ Jerome Powell, head of the Federal Reserve, opened the door to Wall Street for further adoption of bitcoin and encryption.

Subscribe now for the free time Cryptocodex–A five-minute news message for traders, investors and Crypto-Curious, which will make you update and keep you advanced on Bitcoin and Crypto Market Bull Run

US Federal Reserve Chairman Jerome Powell told the banks to be allowed to provide bitcoin and … [+]

“The banks are fully able to serve the encryption customers as long as they can understand and serve the risk,” Powell He said At a press conference this week after the Federal Reserve stopped the interest rate reduction course.

Powell added that the Wall Street banks “must be completely sure” Bitcoin and Crypto activities “safe and voice.”

02/03 update: encryption prices have taken a large step, as it eradicates about 300 billion dollars from the joint market that it was exposed to severely through the rapidly increasing trade war sparked by US President Donald Trump’s shot on the goods that enter the United States from China, Canada and Mexico.

These definitions, which are scheduled to enter into force on Tuesday morning, have reached global stock markets, while investing investors in the possibility of more strict trading conditions.

“The sole of fear of tides and suspicions has been launched through the cryptocurrency market after announcing the tariff for US President Donald Trump on Friday,” Peter Quakov, CEO of Merkorio Corporation, said in the comments via e -mail.

“The possibility of high interest rates has rocked all global markets. While Bitcoin has decreased to less than $ 100,000, King of Crypto again proves that in his own category in a remarkable contradiction with Altcoins, which bleeds dark red in all fields .

Bitcoin has decreased overnight to a little more than $ 91,000, a decrease of approximately 10 % at its lowest level, before its recovery to about 95,000 dollars. Other major cryptocurrencies have seen a significant decrease, as Ethereum fell about 20 % before it recovered slightly, Ripple’s XRP and Ethereum Cardano Trading around similar levels.

Solana, the largest competition of Ethereum, delivered only 6 % only 6 % and fears between Etherum holders can be seized on the Altcoin crown.

However, encryption traders chanted from the analysis of the BitWise Jeff Park investment teacher, to publish To X, whose thesis explained why the upcoming trade war is good for Bitcoin.

“The definitions may be just a temporary tool, but the permanent conclusion is that Bitcoin not only rises – but faster,” adding, adding: “While both sides of the commercial defect equation will want Bitcoin for two different reasons, the end of the result is the same: higher, Fast violently – because we are in war.

The Giants of Wall Street, led by the world’s largest asset manager in the world, have bent to Bitcoin and encryption during the past year with a fleet of funds circulating in Bitcoin exchange (ETFS) that helps to normalize bitcoin and encryption between the financial institution.

Powell’s comments define a major shift in feelings during the Trump era from the previous Biden administration, which was hostile to encryption.

According to Biden, Bitcoin and Crypto complained of an informal policy of “Doving” for them, reducing basic financial services and making it impossible to work – which has become known as “Operation Choke Point 2.0”, in reference to the policy of the previous United States government to cut the industries that It is believed to be at risk of fraud and money laundering.

Subscribe now CryptocodexFree daily news message for encryption

Bitcoin price has risen over the past year, reaching $ 100,000 per bitcoin and leadership … [+]

Trump’s adoption of Bitcoin and encryption- which begins through unique unique code groups, grows to support Bitcoin National stocks and its climax reached the controversial launch of the Trump brand- technology opposition.

Meanwhile, Trump continued his promise to put a very declining tariff on the goods coming to the United States from Canada, Mexico and China, which paves the way for a commercial war that can spread all over the world.

Trump’s executive will be imposed on a 25 % tariff on imports from Canada and Mexico, with a 10 % tariff on Canadian energy and oil, and an additional 10 % tariff in China, due to the implementation on Tuesday morning.

“Gold, silver and bitcoin may crash”, Robert Keusaki, investor and author of the advice book Dad wealthy poorand to publish To X, referring to Trump’s tariff as a catalyst. “Good. You will buy more after prices are broken. The real problem is debts, which will get worse. Accidents mean assets on sale. It’s time to get more richer.”

https://imageio.forbes.com/specials-images/imageserve/63020d5a58234c4b60fa8c68/0x0.jpg?format=jpg&crop=3073,1729,×0,y351,safe&height=900&width=1600&fit=bounds