Slow encryption market eyes are slow to BTC Reserve

Written by omkar GodBole (at all times ET unless it is indicated otherwise)

The encryption market has turned into sadness, with large cryptocurrencies like Bitcoin (BTC), Ether (ETH), Solana (SOL), Binance (BNB) and Chainlink (Link) trading 3 %, amid slow -slow frustration Progressing the establishment of the American BTC Strategic Reserve and signs of tightening liquidity in dollars.

Geo Chen, a Macro trader and author of the famous newsletter at Fidenza Macro, suggested that the market has been suspended in the hope that Trump will intervene and “buy everyone’s bags”, but this is unlikely to achieve soon. Consequently, the market is subject to the risk of aversion that is driven by continuous tariff discussions.

“The encryption will not be avoided in risk fluctuations that followed, and I expect that many coins will decrease by 50 % or more than their highest levels in January.” Chen wrote.

When talking about Sol, Tracker for Amberdata Options revealed a large bear about its spread that includes a long position in a situation of $ 200 and a short location in $ 120, each ending on February 28. This strategy is betting on a decrease to at least $ 120 a month -which increases pessimistic look.

Feelings are still extreme as well. ETH has already decreased by 15 % this month and reached its lowest level in four years against Bitcoin. Joe Macan, founder and CEO of Asymmetric, noted that “ETHEREUM’s main mode has weakened. The Solana Ecological System expands quickly, provides higher productivity and stronger performance, which makes the historical evaluation of Ethereum more difficult.”

He pointed out that the solutions of the Ethereum-2 layer-optimism, definition and polygons-have decreased more than 50 % this year. “These signals are wider, as the L2S was supposed to pay the ETH adoption and use, however they failed to generate a constant momentum.”

On the total front, investors collect the US Treasury’s observations amid a threat to a possible commercial war, which causes gold to a new increase of $ 2,877 an ounce, with a wonderful increase of 10 % for this year. Historically, the increasing preference for Bitcoin gold was not preferred.

As if this was not sufficient, the rise in the return of the Japanese government’s bond for 10 years has reached its highest level since April 2011. In addition, the employment report in the United States could today increase the fluctuations in the market. It is time to stay alert!

What do you see?

- Checks:

- Macro

- February 5, 9:45 AM: Global S&P Global Services Services Report in January (Final).

- February 5, 10:00 AM: The ISM Institute (ISM) launches ISM Services report in January on business.

- PMI EST services. 54.3 against the previous. 54.1

- Services previous commercial activity. 58.2

- Previous recruitment services. 51.4

- Services new orders are caused. 54.2

- Previous services prices. 64.4

- February 5, 10:00 am: The US Senate Banking Committee’s listening session on “Investigating the true effects of Dibnking in America”, which includes four witnesses, including Nathan Moguli, co -founder and CEO of Anchorage Digital. Livestream link.

- February 5, 3:00 pm: A letter to the Federal Reserve Michelle W. Bowman delivered a letter entitled “Short Economic Modernization and Banking Organization”.

- February 6, 7:00 am: BOE Bank versions (BOE) Summary of monetary policy and the lecturer of the Monetary Policy Committee meeting Likewise, February Monetary policy report. The press conference is live feed After 30 minutes.

- EST interest rate decision. 4.5 % against the previous. 4.75 %

- February 6 /

- Initial unemployment allegations. 213k against the previous. 207k

- Non -agricultural productivity (preliminary) EST.1.4 % against Prev. 2.2 %

- Unemployment demands continue to be east of the United States. 1870K against the previous. 1858k

- The unemployed claim 4 weeks in the previous average. 212.5k.

- February 6 /Puffer Point 2.0: Two of the witnesses are Paul Ghrouwal, the chief legal official of Coinbase, Farid Thil, CEO of Mara Holdings. Livestream link.

- February 6 / Livestream link.

- Profits

- February 5: Microstrategy (MstrAfter the market, -0.09 dollars

- February 10: Canaan (He can), Before the market, -0.08

- February 11: Digital Cell Techniques (cell), After the market, -0.11 dollars

- February 11: Exit Movement (exit), After the market, $ 0.14 (2 ESTS.)

- February 12: Cotton 8 (hut), Before the market, break

- February 12: Irene (IreneAfter the market

- February 12 (TBA): Metaplanet (Tyo: 3350)

- February 12: Redit (RDDT), After the market, $ 0.25

- February 12: Robinhood Markets (Hood), after the market

- February 13: Cleanspark (CLSK), $ -0.05

- February 13: Coinbase Global (currency), After the market, $ 1.61

Symbolic events

- Voices of governance and calls

- Lido Dow is discussion Distribution of bonuses on LDO Stakers based on the net protocol revenue, as well as using a percentage of its annual revenue for LDO.

- February 5, 10 am: Livepeer (LPT) to Hold Talk about the treasury about “SPE updates, governance and treasury financing for artificial intelligence video projects.”

- February 5, 11 am: USDX and Irrivation to Hold Ask me anything (Ama).

- February 6: Introduction Hold An open call about the use of artificial intelligence to enable decentralized financing applications.

- to open

- February 5: XDC (XDC) network to unlock 5.36 % of $ 81.58 million.

- February 5: KASPA (KAS) to open 0.67 % of the $ 17.29 million trading offer.

- February 9: Movement (move) to open 2.17 % of the trading offer of $ 31.84 million.

- February 10: APTOS (APT) to open 1.97 % of the trading offer of $ 69.78 million.

- Launching the distinctive symbol

- February 6 /

Conferences:

Distinguished symbol speech

Written by Francisco Rodriguez

- Solana Memeco Juggernaut Pump.fun’s monthly revenue reached the highest level in January, with $ 121.3 million, while the platform is said to affect the “destruction of Altcoin Market”.

- The speculative capital, which would have been flowing into the main altcoins during “Alt Season” in this course, was converted into low -capital symbols launched on the platform, according to the analysis of Miles Deutscher, which Indicate Retail investors obtained “stuck in non -liquid ames on the chain” that quickly lost most of their value.

- However, the outstanding appearance of Altcoin also led to a significant decrease due to the sector’s dangers and fluctuation. Lokonchain referred to a merchant from lost $ 2.6 million of fear of losing the distinctive symbol of VVV in Venice lost 21 million dollars on Mimikoin Donald Trump.

- Even the largest altcoin in terms of market value, ETHER, witnessed the return of the show to pre -motion levels, and the performance of Bitcoin has decreased dramatically, as the ETHBTC ratio decreased to less than 0.03 for the first time since 2021 this year.

- Meanwhile, the success of Pump.fun, after surpassing Serkel, the second largest source of Stablecoin, USDC, in revenue 24 hours, according to Deflalama. Data.

Locate the location of the derivatives

- The permanent financing rates of XLM, TON, SHIB, BCH and ONDo are still negative, which is allowed to prejudice the short strictures. These symbols can see a short pressure that should rise BTC and revive the risks in the encryption market.

- The moderate cumulative size Delta has turned OI for SHIB in the past 24 hours, which alludes to the basic purchase pressure.

- BTC, the basis of futures futures on CME is still near 10 %.

- BTC and the front ETH continues to show a bias of landing options. ETH is still more batch than BTC.

Market movements:

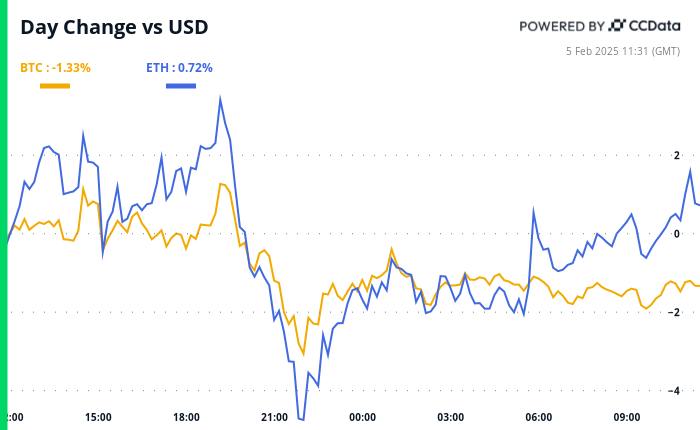

- BTC decreased by 0.35 % from 4 pm on Tuesday at 97,862.66 dollars (24 hours: +1.08 %)

- ETH increased by 2.4 % at 2,2,783.87 dollars (24 hours: +0.86 %)

- Coindesk 20 decreased by 0.34 % in 3,286.48 (24 hours: -1.41 %)

- The CESR 73 -bit survey rate decreased at 3.18 %

- BTC financing is 0.0011 % (1.21 % annual) on Binance

- DXY decreased 0.5 % in 107.42

- Gold rises 0.9 % at $ 2,868.45/ounces

- Silver increased by 0.15 % at $ 32.37/ounces

- Nikkei 225 closed unchanged at 38,831.48

- Hang Seng -0.93 % closed at 20,597.09

- FTSE has not changed at 8,571.57

- Euro Stoxx 50 decreased by 0.21 % at 5,253.52

- Djia closed on Tuesday +0.3 % at 44,556.04

- S & P 500 closed +0.72 % in 6,037.88

- Nasdak closed +1.35 % in 19,654.02

- Closed S&P F/TSX Complex +0.15 % at 25,279.35

- S & P 40 America America closed +1.06 % at 2,401.76

- The Treasury in the United States has decreased for 10 years by 3 4.48 %

- E-MINI S&P Futures decreased by 0.52 % at 6,031.75

- Mini-Mini Nasdaq-100 futures decreased by 0.88 % at 21,479.25

- Medium average futures in the E-MINI Dow Jones index decreased from 0.18 % at 44,615.00

Bitcoin Statistics:

- BTC dominance: 61.24 (-0.21 %)

- ETHEREUM ratio to Bitcoin: 0.02833 (1.43 %)

- Retail (seven -day moving average): 817 EH/s

- Hashprice (spot): $ 56.3

- Total fees: 5.03 BTC / 509,298 dollars

- CME FUTERES Open benefit: 168,549

- BTC at gold price: 33.9 ounces

- BTC market roof for gold: 9.64 %

Technical analysis

- The return of the treasury in the United States for 10 years is about to violate the upper trend line for five months.

- A continuous slice can support risk origins.

Encryption

- Microstrategy (MSTR): Closed on Tuesday at $ 348.31 (+0.35 %), a decrease of 0.9 % to $ 345.05 in the pre -market.

- Coinbase Global (COIN): Closed at $ 280.39 (-1.41 %), a decrease of 0.14 % to $ 280 in the market before the market.

- Galaxy Digital Holdings (GLXY): Closed at $ 27.67 (-1.25 %).

- Mara Holdings (MARA): Closed at $ 17.65 (-1.67 %), a decrease of 0.45 % to $ 17.57 in pre-market.

- Riot platforms (RIOT): closed at $ 12.29 (+2.5 %), a decrease of 0.41 % to $ 12.24 on the market before the market.

- Core Scientific (Corz): Closed at $ 12.21 (-0.97 %).

- Cleanspark (CLSK): Closed at $ 10.84 (+2.36 %), a decrease of 0.65 % to $ 10.77 in pre -market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 22.57 (-0.53 %).

- Seemler Scientific (SMLR): Closed at $ 51.24 (+1.55 %), a decrease of 2.01 % in the pre -market.

- Exit (exit) movement: closed at $ 56.77 (-4.73 %), an increase of 5.69 % in the market before the market.

Etf flows

BTC Etfs Stain:

- Daily net flow: $ 340.7 million

- Cutting net flow: 40.60 billion dollars

- Total BTC Holdings ~ 1.173 million.

ETH ETFS spot

- Daily net flow: 307.8 million dollars

- Cutting net flow: 3.15 billion dollars

- Total Eth Holdings ~ 3.693 million.

source: Farside investors

It flows overnight

Today’s scheme

- It seems that the DXY index, which tracks the value of the US currency against the main commercial partners, has reached its climax. The question is, will the followers of Bitcoin follow?

- Both assets rose in the weeks before and after the American elections held in early November.

While you sleep

- The stock-chipo relationship is likely to weaken the long term. (Coindsk): Crypto is likely to decrease with arrows, with the upcoming institutional adoption and the upcoming American organization helps reduce bitcoin fluctuations.

- Bitcoin risk losing 90 thousand dollars- 110 thousand dollars, as these three development can put the brakes at the following break (CoINDESK): The opposite winds to unify Bitcoin from tightening liquidity in dollars, and the Trump administration approach to caution in the BTC Reserve and signals of weakening of the bullish momentum.

- Oondo Finance reveals the premium symbol platform to bring stocks, bonds and ATFS Onchain (Coindsk): Oondo Finance, the confiscation of leaders of assets in the real world, has revealed a symbolic platform aimed at making for us in the securities that he publicly circulated in what Stablecoins did for dollars.

- The demand for the world on gold reached another digital level last year; The appetite for alloys in 2025 is still firm (CNBC): With the rise in gold prices, the World Gold Council reported that global demand had reached 4,974 tons in 2024, driven by the purchases of the central bank and strong demand for investment funds traded in gold and alloys.

- The European Union is preparing to strike large technology in revenge on Donald Trump’s tariff (Times of the Financial Times): Officials say that the European Union can take revenge on the potential American definitions through the “Arch Control Tool”, which was presented during the first period of Trump, although the bloc is unlikely to be able to respond to the speed that enjoys It has Canada and Mexico.

- The American postal service is suspended Chinese parcel shipments (Wall Street Journal): The American Postal Service said it will not accept the parcels received from China from the mainland and Hong Kong until further notice, and the move is likely to affect Chinese traders online such as Shin and Timo.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/7f99847faf61a3a5ba028d72199ceff1d201ec0f-700×430.png?auto=format