Fx Markets Signal BTC ascending as the definitions dominate feelings

Written by omkar GodBole (at all times ET unless it is indicated otherwise)

If you follow the financial markets, the conditions of “risks” and “risk” may encounter. Now we seem to enter a new era of “tariffs on/tariff”.

In a risk environment, sensitive assets such as stocks and cryptocurrencies tend to rise due to the expectations of economic expansion or comfortable monetary policy. On the contrary, the risk positions reflect the investor’s lack of confidence, which leads to sales and the most secure assets.

But this week, President Trump’s announcement was directed alone. Early on Monday, Bitcoin (BTC) decreased to nearly $ 91,000 as Canada and Mexico retaliated from Trump’s tariff. This was a “tariff” trading.

Later, it flourished over $ 100,000 after Trump stopped the Mexico tariff for 30 days and announced the creation of a sovereign wealth box, which led to hopes in potential investments in BTC. It was a “tariff”.

Steam’s bullish momentum has run out early on Tuesday as China has retaliated from Trump’s import tax, as it revived the “tariff”. BTC fell more than 3 % to $ 98,000, and ALTCOINS lower. The dollar made Huffin bids.

Bitcoin and the broader Crypto market may return that Trump announces a 11 -hour deal with China, just as he did with Mexico and Canada on Monday. The activity of the foreign exchange market indicates this. AUD/CAD decreased by only 0.3 % for this day, marking traders do not expect a long tariff war between the United States and China. (The Australian dollar is widely seen as a agent of China).

“The cross must be traded like Aud/CAD sharply in this position given that Canada has escaped from the customs tariff and China, but it is only 0.5 % less per day. These signals are pricing good markets at a good opportunity for the United States and China and said G in a memorandum of customers .

However, you cannot be sure of Trump. Therefore, expect increased fluctuation and stay on alert!

What do you see?

- Checks:

- Macro

- February 4, 10:00 am: The US JoleTs Survey Report.

- Job opportunities 7.88m against the previous. 8.098m

- The start of the previous job. 3.065m

- Feb 4, 2:30 pm: AI holds the White House and Crypto Czar David Sacks, along with four leaders in Congress, a press conference on the cooperation of digital assets. Livestream link.

- Feb 4, 7:30 pm: Vice President of the Federal Reserve, Philip N. Jefferson is a letter entitled “US Economic Expectations and Monetary Policy”.

- February 5, 9:45 AM: Global S&P Global Services Services Report in January (Final).

- February 5, 10:00 AM: The ISM Institute (ISM) launches ISM Services report in January on business.

- PMI EST services. 54.3 against the previous. 54.1

- Services previous commercial activity. 58.2

- Previous recruitment services. 51.4

- Services new orders are caused. 54.2

- Previous services prices. 64.4

- February 5, 10:00 am: The US Senate Banking Committee’s listening session on “Investigating the true effects of Dibnking in America”, which includes four witnesses, including Nathan Moguli, co -founder and CEO of Anchorage Digital. Livestream link.

- February 5, 3:00 pm: A letter to the Federal Reserve Michelle W. Bowman delivered a letter entitled “Short Economic Modernization and Banking Organization”.

- February 4, 10:00 am: The US JoleTs Survey Report.

- Profits

- February 5: Microstrategy (MstrAfter the market, -0.09 dollars

- February 10: Canaan (He can), Before the market, -0.08

- February 11: Digital Cell Techniques (cell), After the market, -0.11 dollars

- February 11: Exit Movement (exit), After the market, $ 0.14 (2 ESTS.)

- February 12: Cotton 8 (hut), Before the market, break

- February 12: Irene (IreneAfter the market

- February 12 (TBA): Metaplanet (Tyo: 3350)

- February 12: Redit (RDDT), After the market, $ 0.25

Symbolic events

- Voices of governance and calls

- Dow’s compound is discussion Create a Moro lending cellar on the sponsorship of the glove. Polygon Labs is scheduled to offer $ 1.5 million in Pol, and is compatible with $ 1.5 million in companies to stimulate use.

- Dow’s arbitrary is Voting About if 1,885 ETH will be transferred in NOVA transaction fees to its treasury through the infrastructure to collect modern fees shown in the OVA fee proposal.

- AAVE DAO is close to the end vote When publishing AAVE V3 on Sonic, a new layer of Layer-1 ETHEREUM Virtual Machine (EVM) with high treatment productivity.

- Lido Dow is discussion Distribution of bonuses on LDO Stakers based on the net protocol revenue, as well as using a percentage of its annual revenue for LDO.

- Feb 4, 1 pm: Ton Dao and Cryptoquant Goverting the network review Dive into performance, adoption and main standards.

- February 4, 12 pm: Star to Host A quarter of an annual quarterly review.

- to open

- February 5: XDC (XDC) network to unlock 5.36 % of $ 81.58 million.

- February 5: KASPA (KAS) to open 0.67 % of the $ 17.29 million trading offer.

- February 9: Movement (move) to open 2.17 % of the trading offer of $ 31.60 million.

- February 10: APTOS (APT) to open 1.97 % of $ 68.20 million trading offer.

- Launching the distinctive symbol

- February 4: Karma (Karma), Pew Protocol (Pio), Sands (swarms), and SVM (Sonic) to be inserted on Kraken.

Conferences:

Distinguished symbol speech

Written by Shuria Malwa

- The entities behind President Donald Trump Mimikoin Trump raised nearly $ 100 million in trading fees within two weeks of the forefront of January 17.

- The fees were created on meteora, which is the DEFI exchange where the Trump initial coins were traded. Here, fees are imposed on liquidity, which benefits creators in the currency by allowing them to earn trading activities indefinitely, according to Reuters.

- He sent a decrease in the market on Monday to more distinctive symbol to the bottom, causing peak loss to amazing 75 %.

- The president continues to support the distinctive symbol on his social media platform, Truth Social, where he published “I love $ Trump !!” In addition to a link to buy the distinctive symbol during the weekend.

Locate the location of the derivatives

- The permanent financing rates of the Sol, DOGE, Ada, Link and Avax are negative, indicating the bias of short functions. These metal currencies may see great gains in the back of the short area if the market environment has passed to the “tariffs” during the American watches.

- The ETH Deribit fluctuations index decreased to 70 % above 100 %. BTC fluctuations fade from Monday to 61 %.

- The permanent future contracts that open the cumulative delta to pay attention to most large symbols, with the exception of TRX, are negative over the past 24 hours. This raises a question about the sustainability of price recovery.

- BTC continues in Deribit, which ends the validity of ETH options this month to show negative concerns. The broader bias remains intact.

- The block flows are characterized by the spread of the bear call in Sol, the spread of a BTC calendar and long sites in ETH $ 3K and $ 3.2,000.

Market movements:

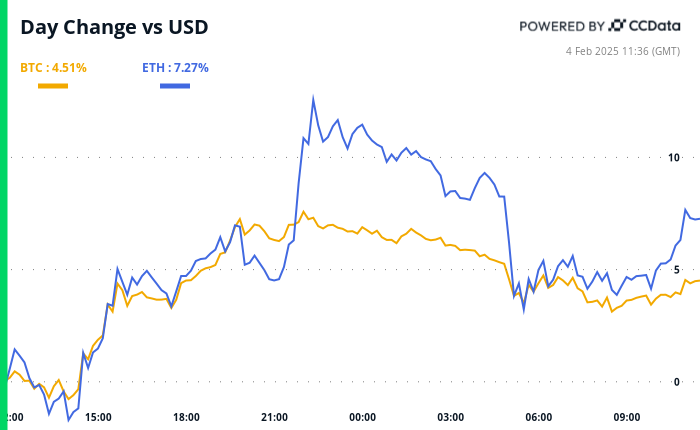

- BTC decreased by 1.85 % from 4 pm East time on Monday at 99347.23 dollars (24 hours: +4.4 %)

- ETH increased by 2.3 % at $ 2,777.08 (24 hours: +7.45 %)

- Coindesk 20 decreased by 2.21 % at 3,154.76 (24 hours: +5.33 %)

- Cesr survey rate of 88 points per second in 3.91 %

- BTC financing is 0.0035 % (3.76 % annual) on Binance

- DXY decreased by 0.39 % in 108.57

- Gold decreased by 0.16 % at 2,814.16 dollars/ounces

- Silver increased by 0.18 % at $ 31.65/ounces

- Nikkei 225 closed +0.72 % in 38,798.37

- AGN SENG is closed +2.83 % in 20789.96

- FTSE fell 0.12 % in 8,572.97

- Euro Stoxx 50 is 0.13 % in 5,224.71

- Djia closed on Monday -0.28 % in 44,421.91

- S & P 500 closed -0.76 % in 5,994.57

- Nasdak closed -1.2 % in 19,391.96

- Closed S&P F/TSX Complex -1.14 % in 25,241.76

- S & P 40 Latin America closed +0.25 % in 2,376.48

- The Ministry of Treasury in the United States increased for 10 years by 2 points per second

- E-MINI S & P 500 Future decreased 0.16 % in 6012.75

- Mini Nasdaq-100 futures did not change at 21,398.50

- The E-MINI Dow Jones Industry Indust Futured Index decreased by 0.21 % at 44,472.00

Bitcoin Statistics:

- BTC dominance: 61.70 (1.06 %)

- ETHEREUM ratio to Bitcoin: 0.02750 (-3.27 %)

- Retail (seven -day moving average): 833 EH/s

- Hashprice (Stain): $ 57.5

- Total fees: 6.1 btc / 592,574 dollars

- CME FUTERES Open benefit: 164,925 BTC

- BTC at gold price: 35.0 ounces

- BTC market roof against Gold: 9.94 %

Technical analysis

- Bitcoin’s daily chart shows the classic “staircase”, characterized by high prices, followed by monotheism, representing accumulation periods.

- The latest unification ranges between $ 90,000 and $ 110,000 is the third style since 2023. The collapse means continuing the upward trend.

- However, he noticed that the gains seen after the second monotheism ranged between $ 50,000 and $ 70,000 were much lower than those seen after the first penetration in late 2023.

Encryption

- Microstrategy (MSTR): Closed Monday at $ 347.09 (+3.67 %), a decrease of 1.35 % to $ 342.40 in the market before the market.

- Coinbase Global (COIN): Closed at $ 284.41 (-2.38 %), a decrease of 0.47 % to $ 283.08 on the market before the market.

- Galaxy Digital Holdings (GLXY): Closed at 28.02 Canadian dollars (-1.62 %)

- Mara Holdings (MARA): Closed at $ 17.95 (-2.13 %), a decrease of 1.23 % to $ 17.73 in pre-market.

- Riot platforms (RIOT): closed at $ 11.99 (+0.93 %), a decrease of 0.58 % at 11.92 dollars on the market before the market.

- Core Scientific (Corz): Closed at $ 12.33 (+0.49 %), a decrease of 1.05 % to $ 12.20 in pre -market.

- Cleanspark (CLSK): Closed at $ 10.59 (+1.44 %), a decrease of 0.85 % to $ 10.50 in the market before the market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 22.69 (+0.62 %).

- Semler Scientific (SMLR): Closed at $ 50.46 (-2.89 %).

- Exit (exit) movement: closed at $ 59.59 (+19.47 %), without changing the market before the market.

Etf flows

BTC Etfs Stain:

- Daily net flow: -234.4 million dollars

- Cutting net flow: 40.26 billion dollars

- Total BTC Holdings ~ 1.177 million.

ETH ETFS spot

- Daily net flow: 83.6 million dollars

- Cutting net flow: $ 2.84 billion

- Total Eth Holdings ~ 3.648 million.

source: Farside investors

It flows overnight

Today’s scheme

- Trends Google Trends for the Worldwide Search “How to Buy Crypto” cools the retail investor’s interest in digital assets since it reached its peak 100 last month.

While you sleep

- Ethereum raises the boundaries of gas for the first time since 2021, which enhances the Call of ETH (CoINDESK): The ETHEREUM gas limit has risen to approximately 32 million units, which must help increase network productivity and decrease the costs of transactions during high demand periods.

- The lending protocol treats $ 200 million in liquidation without adding a debtor burden (Coinsk): AAVE processed $ 210 million in the liquidation on Monday, which is more than August, without adding new debts. Strong risk controls have reduced current obligations by 2.7 % amid market fluctuations.

- TON, the movement laboratories deny the “Plated Symbol” deal to integrate the world freedom (Coinsk): Representatives of Tron and Movement Labs rejected allegations of the distinctive symbol swap deals to include the cabinet with World Liberty Financial (WLFI).

- Yuan extends the loss with Chinese agents with the formulation of the American trade war (Bloomberg): The Chinese coal for American coal, liquefied natural gas, oil and agricultural equipment in the Asia and Pacific markets, which presses the Chinese yuan abroad. Talks between the United States and China can help cancel the trade war.

- Stock erasing gains after China’s retaliation against us. (Financial Times): shortly after Trump’s pre -tariffs were raised by 10 % on all Chinese goods on Tuesday, Beijing fell by imposing an import tariff on various American goods, causing global shares to restore some gains on Monday.

- The euro remains the weaker among the dangers of tariff (The Wall Street Journal): Stephen Melin is likely to keep Danske Bank that Trump’s threats to definitions on European Union imports are likely to keep the euro under pressure during the next few weeks although this may be a “negotiating tool in the first place” .

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/0bd5c567e1ca72d76f0588128f604e1301249d38-700×430.png?auto=format