Solana Selloff continues with the approaching $ 1 trillion

Solana Price fell sharply during the weekend even when the network crowned a digital mark of $ 258 billion in January.

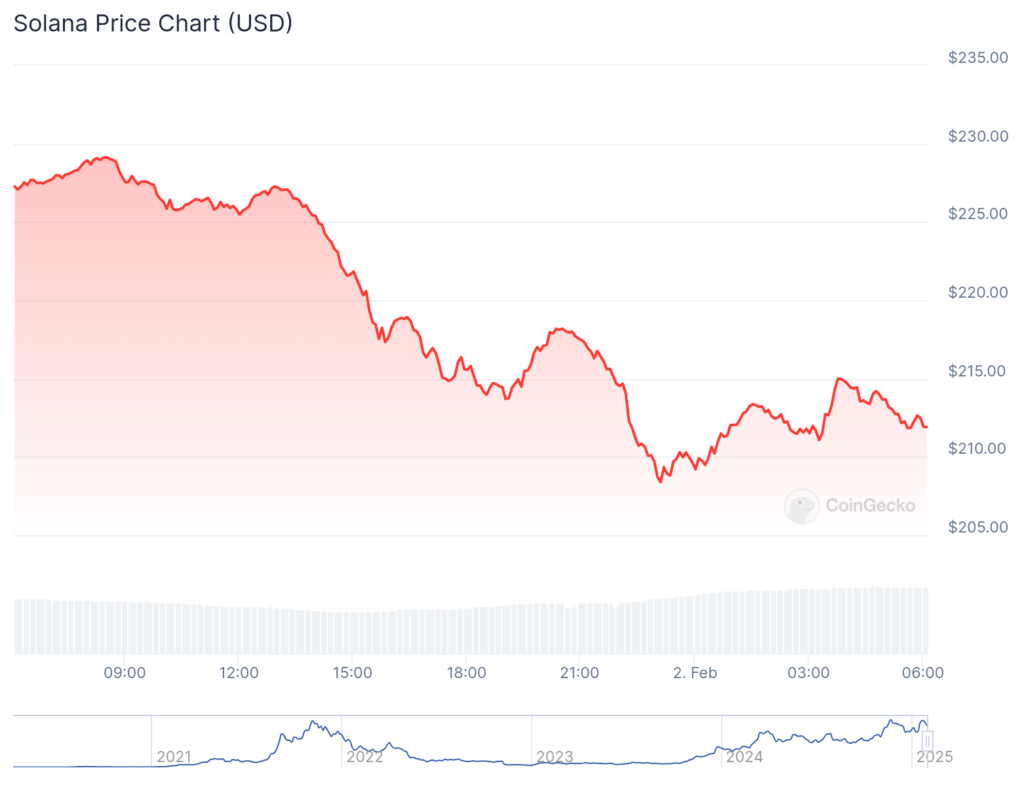

Solana (TellerIt decreased to 210 dollars on Sunday, a decrease of approximately 30 % from its highest level this year, up to the maximum market to $ 103 billion.

In the last check, Seoul hovering at about 212 dollars. See the graph below.

It is not just Solana…

The continuous sale of the encryption industry sent most of the coins to red. Bitcoin (BTCHe moved shortly to less than 100,000 dollars, while the total number of markets for all cryptocurrencies decreased by 4 % to $ 3.4 trillion.

Solana’s currency decreased even after the most successful network was crowned. according to Davi Lamaand Protocols in the ecosystem of Solana dealt with more than $ 258 billion in January. This is a high standard.

The increase in the total treated in the network brought more than $ 969 billion. If this trend continues, Solana expected a trillion dollar teacher in February. After all, it deals with more than $ 40 billion a week.

The largest players in Solana Dex were OCA, Meteora, LifeInity and Raydium (opinion), Which was 30 days in size of more than $ 120 billion during the month.

Mimi currency launch

Various Meme Coin launch operations have led to growth over the network. President Donald Trump launched the official (Trump), Which has become one of the largest launching of Mimi currency ever, as the market ceiling rose to more than $ 15 billion.

It has currently decreased by 70 % of its peak.

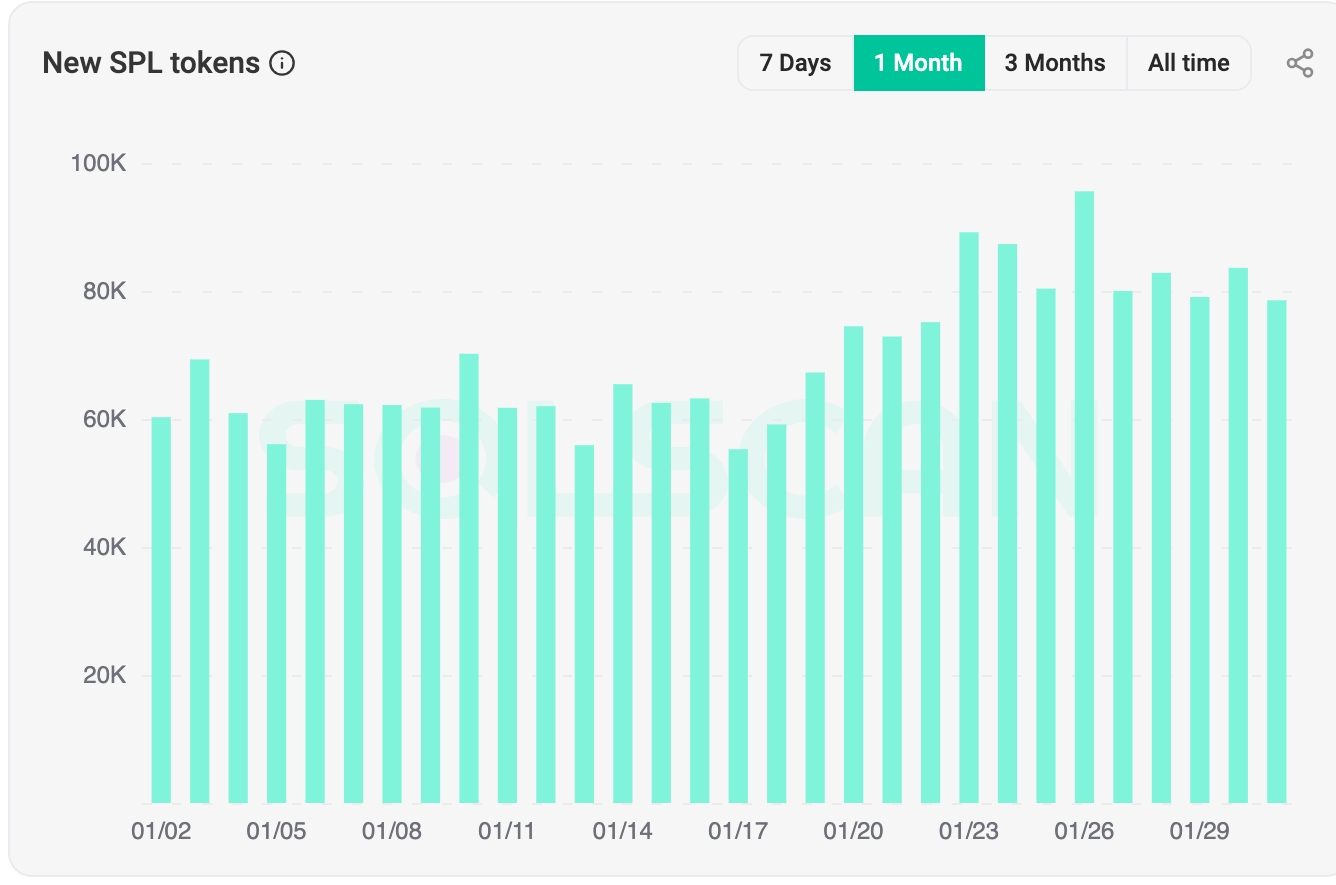

The other coin in January was Melania and Karma. As shown below, more than 78,000 new Solana symbols are created daily.

Solana loses momentum

Solana’s active governor decreased to 3.6 million. This fell from 6.5 million on January 19.

Also, the maximum market slides for all Solana Mimi currencies to 14 billion dollars From the highest level in the past month of $ 25 billion.

The daily graph shows that the Sol price has been shattered in the past few days. It has declined from the highest level from the year to the date of $ 295.4 on January 19 to the current $ 213, which is the slightest swing since January 17.

The currency, which was established by former Qualcomm Engineer Anatoly Yakovenko in 2017, moved to less than 50 days moving average and the main support at $ 223, the highest swing on January 6.

Less than the moving average has moved for 50 days, and he approaches the main support at 210 dollars, its highest level on March 18 last year.

The next price point for watching is $ 170-neckline for double pattern.

We hope for Solana Etf

Recently, CBOE BZX Re -drafted requests For multi -asset managers, including BitWise, Vaneck, 21shares and Canary Capital. This represents the second attempt by CBOE after a previous rejection, as the US Securities and Stock Exchange Committee is now reviewing deposits in light of what the White House is a friend of encryption.

The new SEC chair, Mark Uyeda, is seen as more support for encryption, raising expectations for approval.

Polymarket betting on the possibilities of Solana ETF approval by 57 % by July 31, although the Bloomberg analyst indicates that Litecoin can be in the following line.

Meanwhile, the investment funds circulated in Bitcoin and Ethereum have already withdrew billions of dollars, indicating a strong demand for investment products in encryption. The main question remains: Do organizers adopt more inventory investment funds, or keep waiting for altcoins?

At least one expert believes in Solana: Analyst Nox Ridley I/o box..

The unique Solana Protocol “Proof of History” will make it a pioneer in the market, Ridley He says. POH of Blockchain highs high productivity of 65,000 transactions per second without second layers, making it faster and more efficient than ethereumThe S Protocol, evidence of the share, which is racing with a maximum TPS registered of 62.34, according to form.

https://crypto.news/app/uploads/2024/12/crypto-news-Solanas-DEX-transactions-belong-to-Pump.fun-option02.webp

2025-02-02 14:31:00