Dibsic in China sends the price of Bitcoin (BTC), artificial intelligence symbols, and stocks flow

Written by omkar GodBole (at all times ET unless it is indicated otherwise)

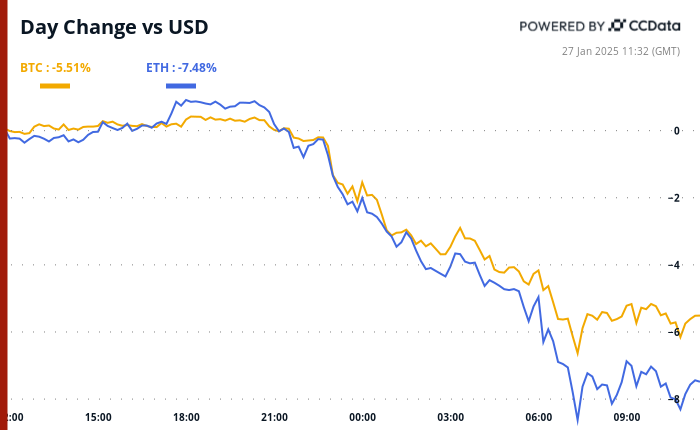

Last week, we described Bitcoin above $ 100,000 as a wrapped maker Ready to unleash Energy in either direction. Unfortunately for guts, this energy is launched down with the transformation of market morale in response to concerns about the low -cost effect The start of the Chinese AI Deepseek On the American AI sector and the American technological leadership.

Bitcoin decreased to $ 97,800 during Asian trading hours, with whale prices decreased to liquidate excessive buyers in permanent future stock exchanges. The heavy AI codes have seen GPU sales of up to 40 %, with similar pressure that affects Gamefi assets.

The future NASDAC scored 700 points, as the stocks in the NVIDIA chips (NVDA) indicated a 10 % decrease in pre -market trading. Deepseek-R1 is expected to reduce the costs of developing large linguistic models, raising questions about the validity of the rich assessments of companies related to Nevidia.

The trader and analyst Alex Krogger noticed on X, “The problem is that a few understand how to change the things.

Kruger chooses not to buy DIP, saying that he prefers short sites exceeding $ 100,000 because he expects to increase fluctuations from the upcoming Federal Reserve meeting and a possible political maneuver by President Donald Trump. The Federal Reserve is expected to repeat the waiting and vision approach, while maintaining the guidelines of the Dec hacons on interest rates.

However, not everything was lost. Paul Howard, the chief manager in Winnan, said that the institutional participation may explode in the coming months.

He said in an email: “The next wave of organic participation will come from the institutions during the next 3-4 months. I will be surprised by a sharp vision that bounces sharply to its highest levels ever before Q2.”

Howard identified the newly launched Layer-1 groups with a focus on security and transactions per second, such as SuPra, as valuable opportunities, with confirmation that for long biased money, the discovery of Alpha in a declining market involves searching for a low layer of the-1 market to The side of their peers is already established. Stay on alert!

What do you see?

- Checks:

- January 27 (temporary): Summary, A Ethereum L2, has the launch of Mainnet, which is expected to expand access Penguin birds A project behind NFTS.

- Jan 28, 1:00 pm: HEDERA network upgrade (HBAR) To v0.57.5.

- January 29: The upgrade of the thorn network fork in Kardano.

- January 29: ICE Open Network (Ion) Mainnet.

- Feb 2, 8:00 pm: Core Blockchain ATHENA Hard FORK Network Upgrade (v1.0.14)

- February 4: Microstragy Inc. (MSTR) Q4 FY 2024 Rewserings.

- February 4: PepeCoin (Pepe) half. In the block 400,000, the bonus will decrease to 31250 Pepe.

- Feb 5, 3:00 pm: Boba Network For ETHEREUM based L2 Mainnet.

- February 6, 8:00 am: Schentu series upgrade (V2.14.0).

- February 12: HUT 8 Corp. (Hut) Q4 2024 profit report.

- February 15: QTUM (QTUM) upgrade the difficult fork network It is scheduled to occur in a mass of 4,590,000.

- February 18 (after the market closure): Seemler Scientific (SMLR) Q4 2024 profit report.

- February 20: Coinbase Global (Coin) Q4 2024 profit report.

- Macro

Symbolic events

- Voices of governance and calls

- Corpound Dao votes whether the Stablecoin Circle Coal adjustments will be implemented via multiple networks, including ETAREUM and Base.

- Clover Finance Dao vote if the ClV network will be renamed to the Lucent network to comply with a axis towards building an decentralized artificial financing and intelligence platform (Defai). The brand will include deportation from Bolkadot to SVM, New Tocker, Lux.

- DAO is an introductory vote on a proposal to create a SOS strategic goal, which will allow DAO members to propose and vote on short goals to mid -time.

- to open

- January 31: Optimism (reference) to open 2.32 % of the trading offer of $ 52.9 million.

- January 31: Jupiter (JuP) to open 41.5 % of the $ 626 million bid.

- February 1: Sui (sui) to unlock about 2.13 % of its trading supplies of $ 226 million.

- Distinguished symbol lists

- January 28: Penguins (Penguins) and Magic Eden (Me) to be included in Kraken.

- January 29: CRONOS (CRO), movement (movement) and usual (usual) to be included on Kraken.

Conferences:

Distinguished symbol speech

Written by Shuria Malwa

- On Monday, the AI’s AI Factors and Memories took the powerful assumption protocol (virtual), AI16Z (AI16Z) and Elisa (Elisa) sliding by 30 %, just as Dibsic in China led to the establishment of the start of the American AI.

- The huge Sunday gatherings erupted on Jupiter Jupiter and Al Qaeda, the Mikinoin Tosi (TOSHI).

- JUP increased by 40 % when the founder of “MEOW” announced in an annual conference that the platform will burn more than $ 3 billion of symbols in JuP and start using 50 % of its fees to re -buy symbols from the market.

- Toshi doubles more than twice as the future future Coinbase is listed for the distinctive symbol, making it the only basic basis with both stains and futures for influential exchange.

- Send the subsequent demand for the distinctive symbol to the peak of the market value of $ 820 million.

Locate the location of the derivatives

- The negative permanent financing rates of BTC turned over the European watches, indicating a net bias for short purchase. Historically, this location identification tends to define local prices.

- BNB, Doge, TRX and Avax have also seen negative financing rates.

- BTC, ETH, the brief options you face now shows a bias of PUT options, providing negative protection. The expiration after February still shows a bias for calls.

- The main mass deals for this day include a short fluctuation play, including short functions in the BTC call 05 thousand dollars and 98 thousand dollars, which ends on January 10. In 3 thousand dollars, it was indicated.

Market movements:

- BTC decreased by 5.95 % from 4 pm East to 98,784.45 dollars (24 hours: -5.84 %)

- Eth 6.12 % decreased at 3,050.20 dollars (24 hours: -7.88 %)

- Coindesk 20 decreased by 9.07 % to 3,536.28 (24 hours: -9.66 %)

- The Stokeing CESR 2 -bit vehicle per second has decreased to 3.1 %

- BTC financing is 0.0006 % (0.7 % annual) on Binance

- DXY decreased by 0.26 % in 107.17

- Gold decreased by 0.21 % at $ 2,767.13

- Silver decreased 0.55 % to $ 30.48/ounces

- Nikkei 225 closed -0.92 % in 39,565.80

- Hang Seng +0.66 % closed to 20,197.77

- FTSE fell 0.21 % in 8,483.97

- Euro Stoxx 50 decreased by 1.51 % at 5,140.89

- Djia closed on Friday -0.32 % to 44,424.25

- S & P 500 closed -0.29 % in 6,118.71

- Nasdak closed -0.5 % in 19,954.30

- Closed S&P F/TSX Complex +0.14 % at 25,468.49

- S & P 40 America America closed +0.53 % at 2,322.63

- The Treasury in the United States has decreased for 10 years by 13 basis points by 4.5 %

- E-MINI S & P 500 Future decreased 2.37 % at 5,988.00

- E-MINI NASDAQ-100 4.27 % futures decreased at 20,974.75

- The E-MINI Dow Jones Industrial Indust Index has not changed at 44,216.00

Bitcoin Statistics:

- BTC dominance: 59.45 (0.60 %)

- ETHEREUM ratio to Bitcoin: 0.0392 (-1.7 %)

- Hashrate (Seven Day Average): 766 EH/S

- Hashprice (spot): $ 60.2

- Total fees: 4.19 BTC/ 439,954 dollars

- CME FUTERES Open benefit: 187,465 BTC

- BTC at gold price: 35.8 ounces

- BTC market roof for gold: 10.17 %

Technical analysis

- The Relative Power Index on the graph in an hour decreased to 20 during the Asian hours, which is the lowest level since late August.

- In other words, the declining momentum was the strongest in nearly five months.

- RSI readings are taken less than 30 to represent the terms of sale and a sign of imminent bear break.

Encryption

- Microstrategy (MSTR): closed on Friday at $ 353.67 (-5.11 %), a decrease of 4.9 % to 336.35 dollars in the pre-market.

- Coinbase Global (COIN): Closed at $ 298.00 (+0.67 %), a decrease of 4.9 % to $ 283.39 on the market before the market.

- Galaxy Digital Holdings (GLXY): Closed at $ 32.52 (-4.18 %)

- Mara Holdings (MARA): Closed at $ 19.99 (+0.2 %), a decrease of 6.1 % to $ 18.77 in pre -market.

- Riot platforms (RIOT): closed at $ 13.54 (+4.23 %), a decrease of 6.94 % to $ 12.60 in the market before the market.

- Core Scientific (Corz): Closed at $ 15.98 (-2.2 %), a decrease of 15.33 % to $ 13.53 in pre-market.

- Cleanspark (CLSK): Closed at $ 11.53 (+1.05 %), a decrease of 6.76 % to $ 10.75 in the market before the market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 26.22 (+2.22 %), a decrease of 8.28 % to $ 25.05 in the market before the market.

- Semler Scientific (SMLR): Closed at $ 55.46 (-9.3 %), a decrease of 9.48 % to $ 50.20 in the market before the market.

- Exit (exit): closed at $ 61.25 (+39.2 %), a decrease of 2.04 % to $ 60 in the market before the market.

Etf flows

BTC Etfs Stain:

- Daily net flow: 517.7 million dollars

- Cutting net flow: 39.94 billion dollars

- Total BTC Holdings ~ 1.173 million.

ETH ETFS spot

- Daily net flow: 9.18 million dollars

- Cutting net flow: $ 2.8 billion

- Total Eth Holdings ~ 3.67 million.

source: Farside investors

It flows overnight

Today’s scheme

- As BTC and Nasdaq, the gold keeper is relatively fixed, perhaps on the back of the resort.

- HAven appeared to have paid the return on the treasury note for 10 years less than nine basis points to 4.504 %. The prices of bonds and the tables move in the opposite directions.

While you sleep

- Bitcoin dives to less (CoINDESK): Bitcoin fell below $ 99,000, as traders prepared for the FOMC meeting this week, and the AI’s advanced AI model pressed on Chinese young agent Deepseek, which increased market morale and encryption prices.

- Solana, Dogecoin, XRP declines 10 % as a bloody start to the week, you see long qualifications worth $ 770 million (Coinsk): Sol and Doge decreased as the encryption markets have seen $ 770 million in the ups and the total market value decreased by 8.5 %.

- Bitcoin may be “dual” for the price slide to $ 75,000 (CoINDESK): Bitcoin’s inability to maintain gains exceeding $ 100,000 indicates twice the momentum. Analysts said that if the price decreases to less than 91300 dollars, it may reach $ 75,000.

- China’s economy in mobilizing signs stumbles more stimulation (Bloomberg): Procurement managers data in January in China showed the slowdown in contracting and services in the field of manufacturing, which indicates the stumbling of recovery amid weak demand and trade pressure. Analysts have warned of more slowdown without a stronger financial incentive.

- Fixed income investors are looking for ways to move in Trump’s presidency (The Financial Times): Empty inflation for consumers, a job market in the strong United States and uncertainty about Trump’s policies led to cabinets, although some investors see the current prices attractive to long -term gains.

- Investors on the emerging market, the assets of the borders protected from the Trump tariff threats (Reuters): Amid Trump’s threats to tariffs and global tensions, some investors turn into border markets such as Serbia, Ghana and Sri Lanka for potential growth and isolation from American commercial risks.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/74b7f08c8046cfa90926e037765a67dbdee51a05-700×430.png?auto=format