Trump’s legal paradox

Where presidential power meets digital finance: a constitutional crisis in the making?

In an unprecedented move that sent shock waves through political and financial circles, President-elect Donald Trump launched the initiative Trump cryptocurrency $ Just four days before his second inauguration.

Within 48 hours, the value of the meme coin Tripled from $20 to $70 per tokenstimulating a trading volume of over $24 billion and pushing its market capitalization to over $14 billion. While crypto enthusiasts are celebrating this as a watershed moment for digital assets, the launch raises profound legal questions about the intersection of presidential power, securities law, and market integrity. Not only is the future of cryptocurrency regulation at issue, there are fundamental questions about the boundaries between the Politburo and private institutions in the digital age.

Screenshot of GetTrump coin from the home page.

Securities law considerations

The structure of the TRUMP meme coin, especially with the 80% ownership concentration in Trump’s CIC Digital LLC, raises critical questions under the known law. amateur test, In the Supreme Court’s landmark decision to determine whether an asset constitutes a security. Despite the disclaimer trying to position the tokens as “Statements of support” Rather than securities, several factors indicate possible classification as securities:

- Investing funds: The public purchasing tokens in fiat currency or other cryptocurrencies obviously satisfies this first prong.

- Joint Enterprise: The concentration of 80% ownership in Trump-affiliated entities (CIC Digital LLC and Fight Fight LLC), coupled with a planned expansion from 200 million to 1 billion tokens over three years, suggests a joint enterprise in which the fortunes of investors are intertwined. Through the efforts of promoters.

- Expecting profits from the efforts of others: Several factors explain this crucial element:

- The timing of the launch just four days before the inauguration suggests the profits are tied to Trump’s political stance

- Dramatic price movement ($20 to $70) indicates speculative investment expectations

- Active management of the Trump Organization’s signature sourcing and marketing efforts

Disclaimer attempts to describe the token as “It is not intended to be…an investment opportunity.” It seems insufficient given the substance over form approach that courts and regulators consistently apply to cryptoassets.

Furthermore, the structure of the $TRUMP token raises additional red flags:

- CIC Digital LLC and Fight Fight Fight LLC control 80% of the token supply;

- Plans to issue an additional 800 million tokens over three years indicate potential dilution risks;

- The disclaimer’s attempt to distance the token from political office seems at odds with the timing and marketing.

- Meme currencies have no economic or transactional value and are often viewed as a means of speculative trading.

In a message posted on the Truth Social and

The SEC has repeatedly emphasized that designations such as “meme coin” or “expression of support” do not override the economic realities of the investment scheme.

Regulatory oversight concerns

The imminent transition of leadership at the SEC heralds a potential shift in cryptocurrency regulation, as the nomination of Paul Atkins as SEC Chairman, replacing Gary Gensler, signals a markedly different regulatory approach. A co-chair of the Digital Chamber’s Token Coalition since 2017 and known for championing relaxed regulation during his previous tenure at the SEC (2002-2008), Atkins represents a stark departure from Gensler’s strict oversight.

However, the basic legal principles remain unchanged and the personal and political preferences at the top of the SEC cannot override applicable securities law.

supreme court Amateur testa cornerstone of securities regulation for more than 75 years, transcends individual administrations and political appointments. Although the SEC’s enforcement priorities may evolve under new leadership, its legal obligation to apply the Howey Test remains absolute. This enduring framework for evaluating investment schemes operates independently of the crypto-friendly stance of any president or industry connections.

The challenge for Atkins’ SEC is to balance innovation in the industry with investor protection. Despite its background suggesting a more flexible approach to cryptocurrencies, the Commission must fulfill its mandate of enforcing securities laws based on economic substance rather than form. This tension becomes especially acute in cases like the TRUMP token, where political connections and market enthusiasm cannot exempt an offering from basic securities law analysis.

The intersection of commercial and political forces

The launch of Trump Coin represents more than just another addition to Trump’s business empire — it signifies an unprecedented escalation in the mingling of political power and private enterprise. Unlike Traditional goods Like Trump-branded perfumes and watches (which are priced at up to $100,000), or even signed guitars worth $11,500, this cryptocurrency project creates… Direct financial incentives that can influence presidential policy making.

with I mentioned $7.2 million in revenue from NFTs and $4.6 million from guitar sales Already demonstrating the lucrative nature of leveraging a political brand for profit, the dollar token TRUMP raises much greater concerns about conflicts of interest.

There are two main factors that distinguish this project from previous promotional efforts.

- the timing The launch a few days before the inauguration signals a well-designed attempt to maximize the value of the token through the imminent assumption of presidential power. Unlike passive merchandise sales, the value of a token can be directly affected by presidential policy decisions. Creating a constant conflict between public duty and private gain.

- the Trump family members involved Through World Liberty Financial adds another layer of complexity. And it’s not just about selling branded products — it’s about creating a financial instrument controlled by a family foundation, which can directly benefit from presidential decision-making, especially regarding cryptocurrency regulation and policy. The family’s deep involvement in both the commercial and political spheres adds another layer and blurs the lines between public service and private enrichment in ways that traditional merchandise sales never could.

This progression from selling branded merchandise to launching a cryptocurrency before taking office represents a significant escalation in potential conflicts of interest. While selling Trump-branded products may raise ethical concerns, controlling a financial instrument whose value can be directly affected by presidential policies creates a more serious conflict between public duty and private gain.

Divided industry response

Launching $TRUMP has generated Division within the cryptocurrency community. While some celebrate it as a watershed moment for mainstream adoption, others see it as a dangerous precedent. The polarization reflects deeper concerns about the intersection of political power and cryptocurrency markets:

- Closed meetings with major Bitcoin miners at Mar-a-Lago before the launch indicate careful coordination;

- The timing of SEC Chairman Gensler’s resignation adds another layer of regulatory uncertainty.

- The dramatic swing in the token price and subsequent decline within 48 hours of launch validates industry concerns about market manipulation;

- The unprecedented $130 million spent by cryptocurrency executives in the 2024 election raises questions about the industry’s control over regulators.

Politics meets crypto: old games, new ledgers

The launch of the $Trump token reveals a fundamental tension in contemporary American politics. While Trump presents himself as a champion of the cryptocurrency industry, promising to make America “Cryptocurrency capital of the planet” The structure and timing of his digital token project suggest a troubling mix of personal enrichment and political power. The concentration of token ownership in Trump-affiliated companies, coupled with the precise timing of the launch before the inauguration, raises questions about whether this represents a real boost to cryptocurrency innovation or just a sophisticated attempt to further monetize the presidency.

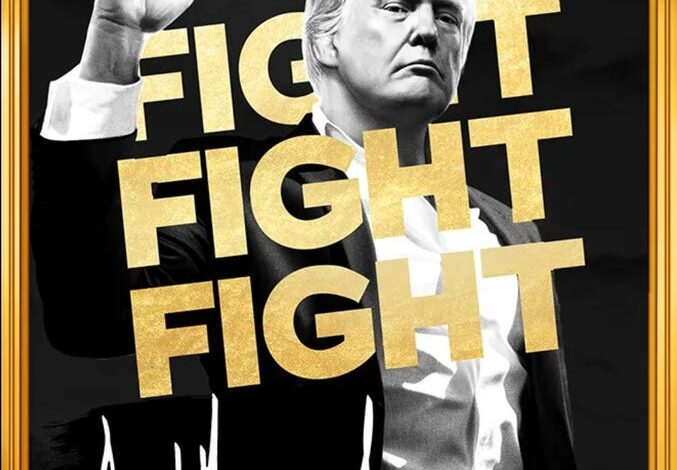

“The new official Trump meme is here! It’s time to celebrate everything we stand for: winning!”

Donald Trump booksWhen he launched the cryptocurrency.

As cryptocurrency venture capitalist Nick Tomino male, “Trump owning 80% of his shares and timing his release hours before his inauguration is predatory and many will likely be hurt by it.”

This observation gets to the heart of the matter: in the digital age, the line between business acumen and political exploitation has become increasingly blurred. Perhaps the real question is not whether business and politics can be separated, but whether we as a society have become too complacent to accept their complementarity.

https://imageio.forbes.com/specials-images/imageserve/678da7f6e02d7cbc97e00d63/0x0.jpg?format=jpg&height=900&width=1600&fit=bounds