Bitcoin reclaims $100,000 as global risk rally resumes

(Bloomberg) — Bitcoin rose above $100,000 for the first time in two weeks, as a rally in stocks at the start of the first full trading week in 2025 boosted demand for the riskier asset.

Most read from Bloomberg

The native cryptocurrency rose as much as 4.1% to $102,504 on Monday. As of Sunday, it posted a weekly gain of 5.66%, the largest since Nov. 24, according to data compiled by Bloomberg.

Bitcoin’s record rally in 2024 ran out of steam in late December as investors looked to take profits. Optimism that Donald Trump’s pro-crypto White House will instigate a supportive regime in the US had earlier helped push the token to an all-time high of $108,315.

“A supercycle is expected in 2025 with regulatory reforms by the Trump government,” said Khushboo Khullar, investment partner at Lightning Ventures, which invests in bitcoin-related companies.

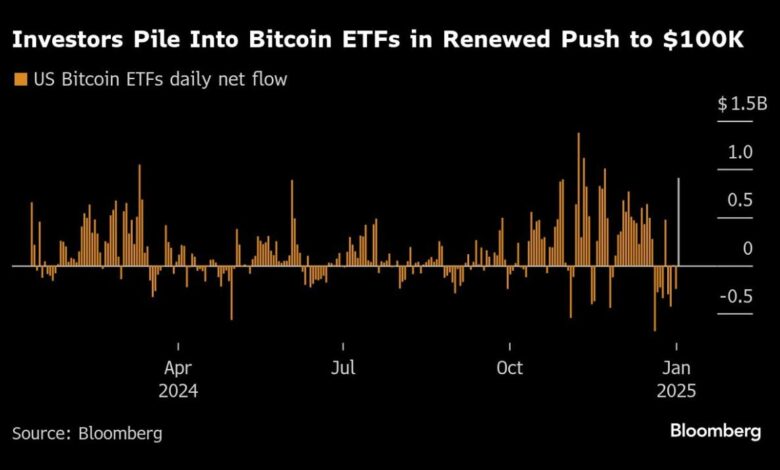

The momentum shift comes after investors pumped a net $908 million into a group of U.S. bitcoin exchange-traded funds on Friday, the group’s fifth-largest inflow since its launch in January 2024, according to data compiled by Bloomberg. These funds recorded record net outflows of $680 million on December 19.

Likewise, bullish for Bitcoin traders is the rebound in Bitcoin Coinbase Premium, a metric that tracks the spread between the price of the token on Coinbase Global Inc., the leading U.S. digital asset exchange, and global cryptocurrency exchange Binance Holdings Ltd.

At the start of the new year, the premium collapsed to its lowest level since the collapse of Sam Bankman Fried FTX in 2022, but has since rebounded, indicating stronger demand from US investors.

“Almost all ETF issuers deal with Coinbase, so they tend to pay a premium or discount based on demand for the ETFs,” said Joe McCann, founder and CEO of Miami-based cryptocurrency hedge fund Asymmetric.

MicroStrategy Inc., a software company turned Bitcoin proxy, led the Bitcoin buying. A bitcoin treasury company bought $101 million of the cryptocurrency last week, marking its ninth straight week of purchases, according to a U.S. Securities and Exchange filing on Monday. But that’s a significant decline from the more than $1 billion in purchases in the weeks in November and December.

Bitcoin’s prospects in 2025 will depend in part on how well Trump sticks to his cryptocurrency pledges, which include creating a national stockpile of bitcoin. Some doubt whether this rise can continue. In a January 6 MLIV Pulse poll that asked which investments were winners in 2024 and which were likely to turn losers in 2025, 39% of respondents chose Bitcoin, giving it the largest share of votes.

https://s.yimg.com/ny/api/res/1.2/66kNnLl2XpsJm4WYgZ42Vw–/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD03MTI-/https://media.zenfs.com/en/bloomberg_markets_842/1e4399bcd988fbae4fbec334671252ae