The encryption was suddenly launched for a large earth

05/10 update below. This post was originally published on May 9

Bitcoin and encryption prices rose to the top of this week An ideal storm that brings together the origins of risk.

Bitcoin destroyed $ 100,000 per bitcoin for the first time since February, with the façade traders from US President Donald Trump Crypto Czar David Sacks issued a rare prediction in Bitcoin price.

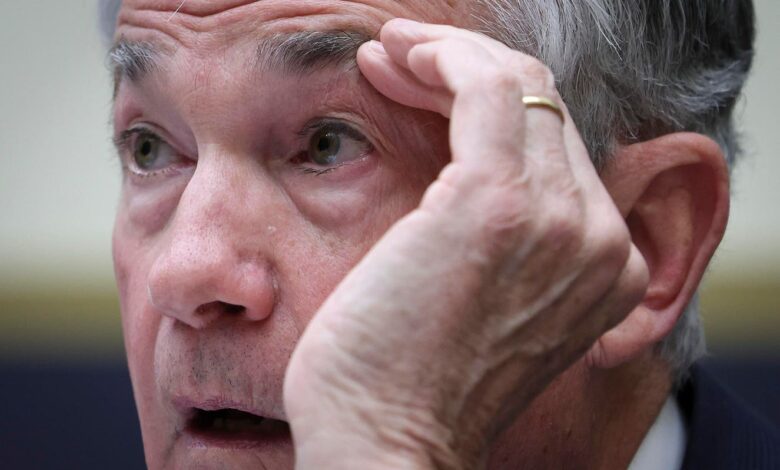

now, While merchants are preparing for the change of the Wall Street game, at a value of $ 10 trillionThe Federal Reserve Chairman was warned that 2.5 trillion dollars is suddenly heading to the US dollar, which can help in the head of Bitcoin prices towards the market value of 20 trillion dollars.

Subscribe now for the free time Cryptocodex–A five-minute news message for traders, investors and Crypto-Curious, which will make you update and keep you advanced on Bitcoin and Crypto Market Bull Run

Federal Reserve Chairman Jerome Powell was warned of “Avalanche” of $ 2.5 trillion … more

“We still believe that the risk of investors on explosions through such a non -linear sale in the dollar is still rising,” Stephen Jin, CEO and employee participating in the Eurizon Slj Capital, economist Joana Freire in a note, warned visual by Marketwatch Referring to the recent sudden rise in the value of the Taiwanese dollar and other Asian currencies that they warn can be provided for sale in dollars.

“There will be others, as we expect,” the couple wrote, adding, “The frequency in the liquid dollar possesses is too much if the dollar is weakened, and the interest rates in the Federal Reserve, and China and the stages of China are periodic stages.”

The Federal Reserve, which left the prices it left this week, will be widely expected to reduce interest rates this summer after the mitigation course was placed in September, with increasing expectations for discounts totaling 75 basis points in 2025.

05/10 update: Bitcoin and Crypto market closely seen the beginning of the start of the American -American trade talks after US President Donald Trump indicated that the United States may be open to lower the huge customs tariffs that the United States slapped in China at the beginning of April, causing the price of Bitcoin to decrease sharply with the wider markets and tanks.

“It seems that the 80 % tariff for China is right,” Trump has actually posted on his social account, adding that “Treasury Secretary Scott Bessent” who will be in Geneva, Switzerland for talks.

“After carefully an evaluation of American messages, China decided to agree to hold discussions,” said a spokesman for the Embassy of the People’s Republic of China in the United States this week. “The conversations take place at the request of the American side.”

Bitcoin price rose to $ 100,000 per bitcoin this week, as it turned over the level that was closely monitored for the first time since February.

““”

“The feelings got an additional elevator of the possibility of trade talks this weekend between the United States and China,” David Morrison, chief market analyst at Trade Nation, said in the comments via e -mail. “Although it is understood that these are preliminary discussions, investors hope that these negotiations will be constructive, and lead to a timely resumption in bilateral trade.”

However, Morrison added, “There is a lot of good news that has already been priced. It is also that it takes some time to reach trade agreements, and it has already been caused by major damage to global trade, with relations between the United States and China alike unconfirmed. In other words, it will not take much disappointment for investors to start exposure to shares.”

Analysts have warned that trade partners in the United States can start throwing huge stores of dollars and assets offered by the dollar, as the Federal Reserve Bank of floods through the Kovid era clips, and analysts warned of a number of dollars at risk that China, Taiwan, Malaysia, Asia in Vietnam and others Asia.

Meanwhile, some believe that the sale of American and American assets will flow to Bitcoin, which has been recovered again nearly $ 110,000 to May.

“The dominant story has changed on Bitcoin again,” Jeff Kendrick, head of Crypto Bank, wrote Crypto Bank.

Subscribe now CryptocodexFree daily news message for encryption

Bitcoin price has returned to nearly $ 110,000 per bitcoin yet … more

“Everything is related to the flows:” It was a risk connection. It has then become a way to re -customize strategic assets of assets.

Kindrik added: “I apologize for the second quarter goal of $ 120,000 may be very low,” Kindrik added.

Other Bitcoin price bulls are more optimistic, with the chief investment officials and president of Miller Value Partners, Bill Miller IV, Saying CNBC Bitcoin will continue to climb until it exceeds the market value of $ 20 trillion.

Miller said: “Bitcoin’s return in the six numbers with a large area to go.

https://imageio.forbes.com/specials-images/imageserve/633c2741f081733a2a78b209/0x0.jpg?format=jpg&height=900&width=1600&fit=bounds