Animoca Research Q1 2025 Crypto Really Report: Top Trends and Trading Opports | Flash news details

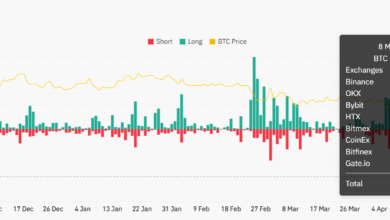

The cryptocurrency market is escalating with visions from the latest Animoca Research List for Q1 2025, which is shared by Yat Siu, co -founder of Animoca Brands, on May 7, 2025. This report provides a comprehensive analysis of emerging trends, distinctive symbol lists, and market dynamics that can form trading strategies for the scheduled quarter. As a pioneering player in Blockchain games and WeB3 ecosystem, Animoca Brands visions are important to merchants looking to take advantage of the new distinguished code opportunities and growth of the sector. The report highlights the increased interest of the distinctive symbols of games and metal symbols, with a special focus on projects that benefit from AI and the integration of decentralized financing. This comes at a time when the broader encryption market appears to be recovered, as Bitcoin (BTC) is traded at $ 62350 as of 08:00 UTC on May 7, 2025, an increase of 3.2 % in the past 24 hours, according to data from Coinmarketcap. Meanwhile, ETHEREUM (ETH) is hovering at $ 3,050, which reflects an increase of 2.8 % during the same period, indicating a renewed appetite for risks among investors. The release of the report coincides with a noticeable increase in the trading sizes of the games symbols, as the Sand Fund (SAND) recorded an increase in prices by 5.7 % to $ 0.43 and a 24 -hour trading volume of $ 85 million from 09:00 UTC on May 7, 2025, per CONINECKO data. DECENTRALAND (Mana) also witnessed an increase of 4.3 % to $ 0.39 with a volume of $ 62 million in the same time frame. These movements indicate that Animoca visions already affect the market morale, especially in the specialized sectors.

From the perspective of trading, the Animoca Research report provides practical opportunities for both the short -term projects and their long -term holders. The focus is on national symbol games and games with the wider market trends, as institutional attention grows in Web3 projects. Merchants should monitor major pairs such as sand/BTC and mana/eth, which showed an increase in volatility after the report. For example, the BTC sand increased by 2.1 % within hours of advertising at 10:00 UAE time on May 7, 2025, reflecting the high purchase pressure according to Binance orders data. Market analysis across the market also reveals a relationship between securities market movements and games associated with games. With technology indicators such as the Nasdaq Stock Exchange by 1.5 % on May 6, 2025, as it was closed at 16,350 points according to Yahoo’s funding, there was a parallel increase in encryption trading volumes of games symbols, indicating that positive feelings in traditional markets leak into specialized encryption values. This creates a unique window for traders to take advantage of the market momentum across the market, especially for the distinctive symbols in the report. In addition, the report’s focus on artificial intelligence integration in game projects may pay attention to the symbols associated with the prosecution such as FTCH.AI (Fet), which was traded at $ 2.15, an increase of 3.9 % and a volume of $ 120 million from 11:00 UTC on May 7, 2025, per CoinmentCap.

Dive into technical indicators, the RSI is standing for sand at 62 as of 12:00 UAE time on May 7, 2025, indicating the bullish momentum without entering an excessive timing area, based on TradingView data. RSI Mana is slightly lower in 58, indicating a space for more bullish direction. The scales in the chain also support this upscale view, as the active SAND addresses increase by 8 % during the past week, as Glassnode said on May 7, 2025. Trading trading these symbols is strongly associated with Actiment Bitcoin, with the Person correlation coefficient of 0.85 between BTC and Sand Pribment is likely to continue market trends. The best in influencing games symbols. From the perspective of the connection between the stocks, institutional funds flow to technical shares, especially gaming companies such as Roblox (RBLX), which rose by 2.3 % to $ 39.50 on May 6, 2025, according to Bloomberg data, enhances confidence in relevant encryption assets. This interaction indicates that traders should see ads from traditional gaming companies as possible incentives for the distinctive symbol gatherings for Web3. Moreover, the potential effect on the traditional investment funds, such as the BitWise Defi & Crypto Index Fund, can inflate institutional flows if gaming codes are attracted, as shown in the recent market updates from Coindsk on May 7, 2025.

Regarding the relationship that corresponds to the AI-Crypto market, the Animoca report on games projects driven by artificial intelligence links it directly with symbols such as Fet and Rending Token (RNDR), which saw an increase of 4.1 % to $ 7.80 with a trading volume of $ 95 million at 13:00 UTC on May 7, 2025, according to the company Coengoo. The connection between the performance of the artificial intelligence code and the feeling of the broader encryption market remains strong, as FET showed 0.78 with ETH during the past month, based on data from CryptocCcompare on May 7, 2025. This indicates that merchants can use ETH price movements as a leading indicator of trading symbol of artificial intelligence. In general, the Animoca Research report for Q1 2025 provides a road map to navigate at the intersection of games, AI and encryption markets, providing merchants an opportunity to put themselves before emerging trends while monitoring the effects of cross market and technical data.

Common Questions section:

What are the main fast food of the Animoca Research Q1 2025 report for encryption traders?

The Animoca Research report, which was released on May 7, 2025, emphasizes the capabilities of the distinctive symbols of games and Metaverse symbols, as well as the integration of artificial intelligence in Web3 projects. Traders can focus on symbols such as sand, Mana and FET, which showed a 5.7 % price increase, 4.3 %, and 3.9 %, respectively, within 24 hours of the report, according to Coingecko and Coinmarketcap data.

How does the performance of the stock market affect the waves of games that are highlighted in the report?

Positive movements in technology indicators such as the Nasdaq Stock Exchange, which gained 1.5 % on May 6, 2025, according to Yahoo’s funding, are linked to increasing trading volumes of gaming symbols. This indicates that the upscale feelings in traditional markets can push momentum in relevant encryption assets, creating trading opportunities.

What are the technical indicators that merchants should monitor for gaming symbols after reports?

Traders should see the relative strength index of symbols such as sand (currently in 62) and Mana (at 58) starting from 12:00 UAE time on May 7, 2025, for all TradingView data. These levels indicate the bullish momentum with a space to achieve more gains, with the support of activity screws on the series that Glassnode noticed on the same date.

https://image.blockchain.news/features/DC3788979712BF4DFF603597AAC46E7C52F8B5EF76BC21453D757F37CDB271FE.jpg