Bitcoin is not ready as a living fence of inflation

Welcome to US Cripto News Morning Briefing – Your basic processing of the most important development in Cripto for the day ahead.

Take coffee as we dissect the place of Bitcoin in the main finances. The narrative of the Pioneer Cripto separation of traditional capital markets gets significant attention, but is it ready for the next step?

Cripto News about the day: Bitcoin and further diversifier, not a reliable hedge, says Redstone Ekec

Beincipto’s recently USA Cripto News The series in April explored whether digital gold is narrated as gold reminded of new heights while Bitcoin was behind.

The report came after an extensive advocacy for Bitcoin as digital goldWith many representing it as a safe asset against negative market prices.

“Primary use case for Bitcoin appears to be a value store, aka” digital gold “in decentralized finances (Defi) the world, “US cash register listed recently.

However, the recent Nalance asked the question: is that time finally here? Beincriticto contacted Redva To set: is Bitcoin a hedge fence for traditional markets?

The response was considerable, with key separation from the Marcin Kazmierczak, co-founder and COO leading data in transverse chains Oracle Provider Redstone. According to Kazmierczak, the role of Bitcoin support for a fair portfolio diversifier.

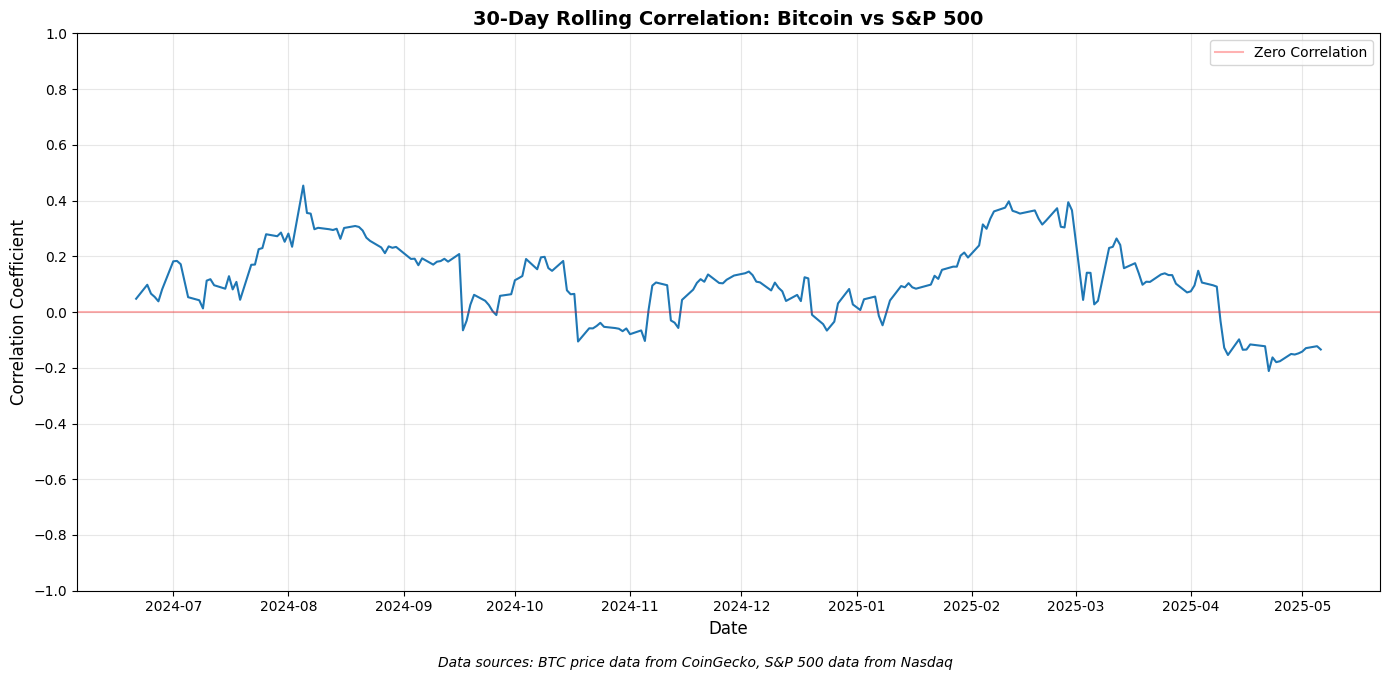

Kazmierczak quoted the analysis of Bitcoin and S & P 500 data from the past 12 months of open American market days. They analyzed weekly and monthly time frames.

For 7 day correlation, which provides a short-term look, noticed F-in when the BTC showed a strong negative correlation with the American stock market.

“These are periods when many invited BTC separation from the wider market,” he explained.

However, 7-day aggregation is a short metric, which makes it a susceptible impact on the marketplace. The 30-day chart provides clearer presentation.

This time frame reveals several shifts between modest positive, almost zeros and some negative correlations for 12 months.

Bitcoin may not be ready to replace traditional hedges

He explained that Bitcoin exhibited trial correlations with S & P 500 (SPX) over the past year.

This variant, said, does not support positioning bitcoin as a replacement of traditional hedges such as gold or bonds.

“With correlations ranging from -0.2 to 0.4, Bitcoin shows a variable relationship with capital relations, not to provide a consistent negative correlation, really needed for effective portfolio protection,” Kazmierczak told the interview.

It noticed that institutional players continue to classify Bitcoin as a wealth. According to Kazmierczak, this range shows that Bitcoin is doing business with a periodic independence than traditional capital markets.

It believes that the correlation is generally modest enough to provide the benefits of portfolio diversification. However, the variance cancels Bitcoin from functioning as a reliable fence against movement.

“This connection sets Bitcoin into the category of diversifiers, not about Asset … Bitcoin can add variety to a portfolio, but will not reliably protect against crashes on the stock exchange because it is not consistently moving in the opposite direction, “he added.

However, Redstone erence articulated that if Bitcoin really crossed it to be treated as a safe, risk-free property, it would mark the longest narrative transformation in modern financial history.

“I believe it is possible. But not in such a short time as the crypto believers would like to be,” Kazmierczak concluded.

Chart of the day

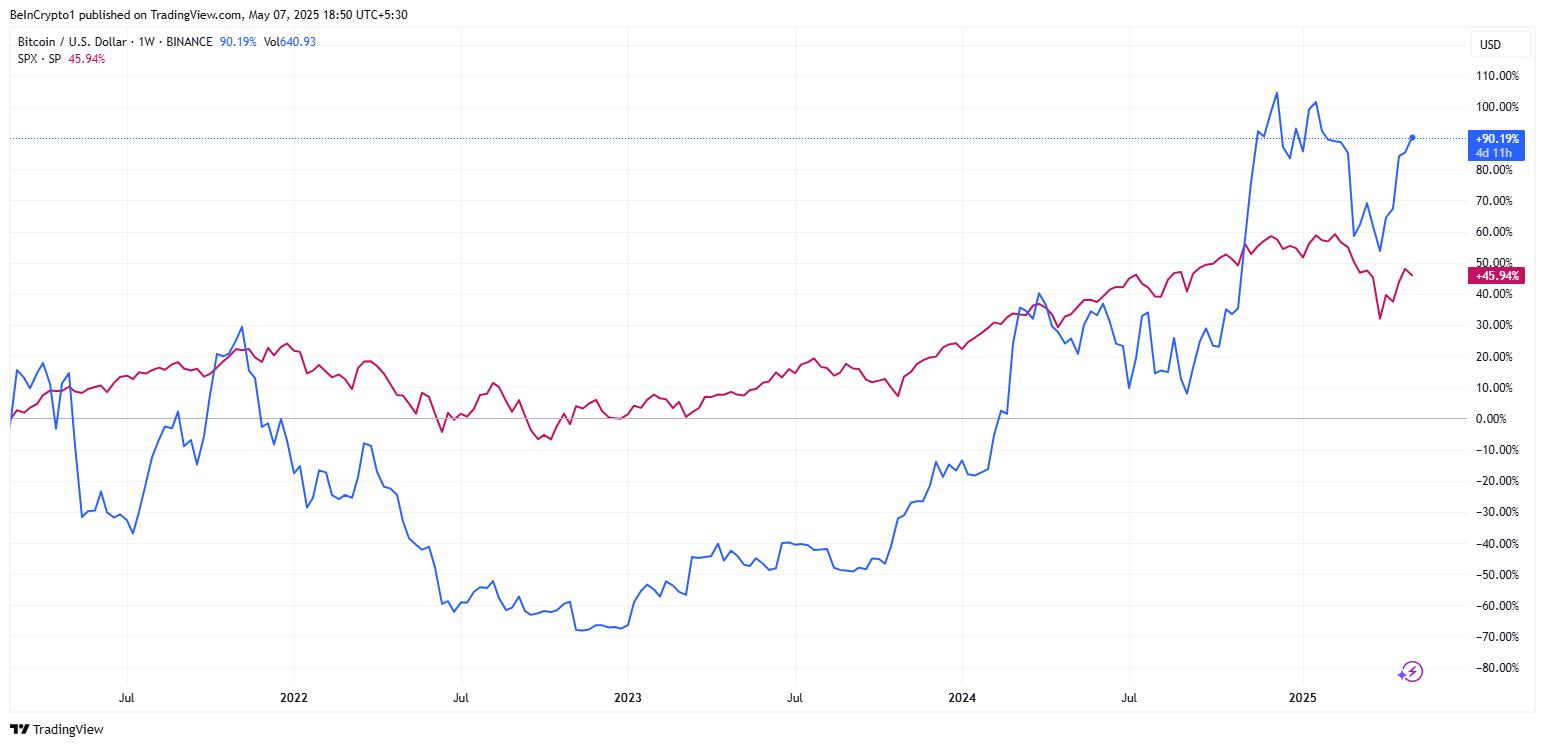

The graph suggests that the representations of Bitcoin are often diverging with traditional markets in equity, especially in 2024-2025.

However, it definitely does not point to permanent separation or consistent negative connection with capital.

While Bitcoin sometimes completed, the correlation periods are still showing periods with S & P 500, which indicates his role in portfolio protection remains insecure and dependent on the context.

Recently USA Cripto News The publication indicated what could pass as a context for these variations. Beinciptura stated political tension and concerns about Independence of the Federal Reserve (Fed).

Bytes of Alpha

Here is a summary of us more news about us crypto we follow today:

Crypto Equally Overview Review before market

| Company | At the end of 6th May | Review of the previous market |

| Strategy (MSTR) | $ 385.60 | $ 396.94 (+ 2.94%) |

| Global Coinbase (coin) | $ 196.89 | $ 200.79 (+ 1.98%) |

| Galaxy digital fundings (glksi.to) | $ 25.90 | $ 25.30 (-2.3%) |

| Holding Mara (Mara) | $ 13.15 | $ 13.60 (+ 3.42%) |

| Riot platforms (riots) | $ 7.86 | $ 8.10 (+ 3.05%) |

| Core Scientific (Corz) | $ 8.99 | $ 9,19 (+ 2.22%) |

Waiver

In compliance Trust Project Guidelines, Beincypta is dedicated to impartial, transparent reporting. This article on news aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with professionals before making any decisions based on this content. Note that ours Terms and conditions, Privacy policyand Disclaimer have been updated.

https://beincrypto.com/wp-content/uploads/2025/04/BMTUSDT_E7334A_2025-03-11_11-54-20-39.png

2025-05-07 17:40:00