XRP News today: XRP mention below key levels because Ripple’s market report suggests on major institutional moves

The KSRP Prices Moferum hit the wall this week, and the digital means of sliding below key technical levels in the middle of growing macroeconomic pressures and moving feelings.

7. Maja 2025. year, the CSRP price tested for a two-week low from $ 2.08 – a fifth straight session in red. While the recent drop increases Short-term concernRipple’s latest market report reveals to appear institutional interest that could play a critical role in shaping cryptocurrent long-term trajectory.

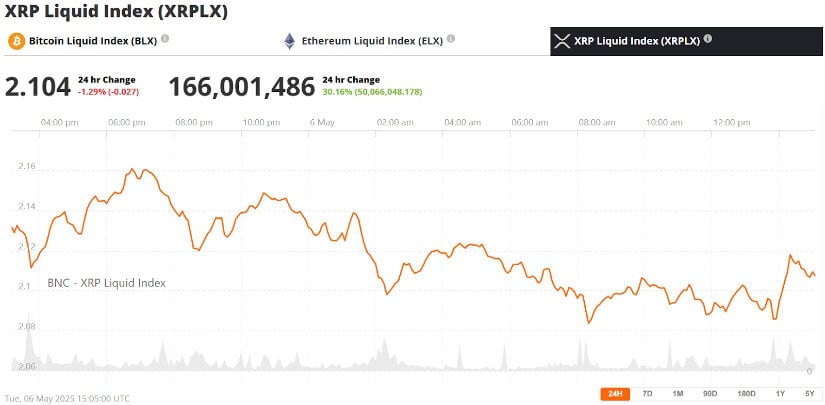

XRP price slips to $ 2.10 as sales pressure is boosting

The value of the XRP fell over 7% in the last five days, closing to key support between 1.77 and $ 1.90. Data Tradingview show that the downtable triangle that is formed on the daily chart – a bear signal that can indicate additional drop to $ 1.20 $ if Current levels of support Failure.

XRP traded around $ 2.10, in the last 24 hours in the last 24 hours at the time of pressure. Bitcoin Liquid Index (BLKS) via Brave new coin

“This is not only on the market in the form of a market,” said Paul Howard, director in Vincent. “The CSRP is increasingly separated from the CITCOIN price and now responds more to the seashotic of ecosystemstem.”

The contribution of weaknesses of the price is a noticeable decrease in RIPPLE activity. Daily active addresses on the XRPL decreased to about 30,000, according to Santiment, and whales are shown by distribution behavior – a sign that large owners cash in the middle of instability.

Fast market disorders and regulatory uncertainty fuel caution

The CSRP drop does not exist in vacuo. The wider crypto market revolves a meeting of FOMC meeting from May 7, and the Mart’s PCE inflation data, which were both monetary policy. In addition, the newly adopted trading tariffs under the president Trump Administration China’s retaliation measures injected further, further economic tension.

“Volatility crawls back and uncertainty about tariffs Tkalački,” Markus Thielen, General Manager 10K Research. “This is not a time for a blind risk.”

These macroeconomic risks have already launched a Significant correction In digital property, with Ripple XRP news that reflects almost 45% drop from april high height of $ 3.20.

Taking a profit comes after a massive rally

After an increase in 600% in late 2024 – from 0.50 to over $ 3.00 – XRP became mature to take profits. At the beginning of April, more than $ 1 billion XRP position was liquidated in an average price of $ 2.10, according to coigent-ults. This aggressive repositioning in short-term traders added pressure down, increasing losses even in the face Positive Fishermen News.

CSRPs to the price of the price of the entire controlled institutional accumulation via Twap / VVAP, probably in preparation for the location of the ETF approval. Source: Max Avery over x

Despite the recent turbulence price, some investors remain optimistic to make the latest achievements in the KSRP lawsuits and ecosystem upgrades can eventually be able to Support recovery.

Ripple ends the format of market report in the middle of an institutional increase

Riplle Report K1 2025 XRP markets, published 6. May, he stirred interest in the project development strategy. The company announced that the set of its existing three-month format after K2, referring to the need to offer deeper institutional insights. The report noted that transparency, originally power, was sometimes used against Ripple, especially during the conflict with former RIPLJE leadership.

“In many cases, Ripple transparency was used against the company,” the report said. “As more institutions deals with XRP, additional perspectives and insights are expected to follow.”

The movement time aligns with the completed institutional appetite for RIPPLE CRYPTO products. During K1, investment vehicles based on K1 approaching $ 214 million approximately $ 214 million. Along with April was also launched in April, while more than one place of ETF ETF XRP SEC approval.

Rlusd stablecoin shift start speculative insecurity

Another factor of weighting of investors is RIPPLE’s strategic focus on RLUSD, its new price currency currency price. While rlusd plays a crucial role in Cross-border transactions And he already reached a $ 90m market, his rise caused concern that XRP could lose his central rope in Ripple long-term vision.

Ripple’s $ 25 million is a lot of credibility of increased, in order to establish its realistic program despite skepticism because of its small market cap. Source: Alva over x

The posts that cyniaper on X questioned whether the KSRP would remain a basic utility token in the ecosystem. Although RLUSD can improve the General KSRPL utility, it also mud from water for speculative interest in KSRP.

XRP update: Resolution comes, but ETF delays still exist

Ripple’s Legal Battle with SEC reached a milestone Recently, with a settlement of $ 50 million, bringing the end of a four-year regulatory conflict. While news about XRP expected Trigger Bullish MomentumThe market reaction was dim.

Analysts suggest that the outcome has already been at a price, while delays in ZSRP ETF approvals continue to frustrate investors. SEC delayed decisions on several key applications – including those from Franklin Templeton And the Bidnino, pushing potential time limits of approval in late K2 and K3.

XRP Forecast Price: Hinge Recovery on Resistance Pause

Despite recent weakness, analysts believe that XRP could Back to stage If certain conditions are met. The decisive pause above $ 2.28 resistance would signal a Bullish Reversal. In parallel, long-term catalysts such as Spot ETF approvalIncreased KSRPL fee for fee and support The regulatory management could re-establish institutional demand.

After a mass 600% of the rallies, the KSRP’s recent drop in investors locked in gains, with over 1B from 1. April 1.10. Abc_trades At Tradingview

Current data show that XRPL fees increased by 38% per week, reducing circulating token supply. In addition, President Pro-Cripto Sec Paul Atkins can rub the road more Favorable regulatory climateCritical for XRP’s next chapter.

Looking forward: Market in progress

The CSRP is under pressure, and its price falls to $ 2.08 from 6. May 2025. Years. This drop is running with a complex mixture FaultMacroeconomic insecurity, taking profits and moving the priorities within Ripple’s ecosystem. However, the company’s move into the overhaul of reporting its strategy and growing institutional demand can offer a silver lining.

How merchants still look at developing events in Scrubbing lawsuit And the ETF space, the road in front remains uncertain, but not without potential. The following weeks will probably test resistance to XRP investors and adaptability of Ripple’s wider strategy.

https://bravenewcoin.com/wp-content/uploads/2025/05/Bnc-May-7-175.jpg

2025-05-06 20:00:00