Bitcoin (BTC) rises before FOMC with fluctuation “explosion”

Bitcoin (BTC) tightened her grip in the encryption market on Tuesday, as hegemony rose at the highest level in four years as encryption traders alternated in the market anchor before the main federal reserve policy meeting in the market.

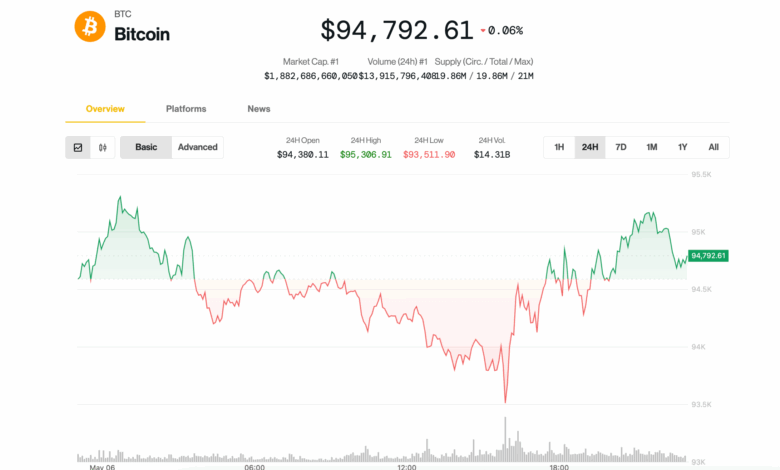

BTC has kept stabilizing about 94,000 to $ 95,000, an increase of 0.4 % over the past 24 hours and extending the range of narrow range that has continued from the weekend.

Meanwhile, the wide Coindsk 20 index on the market decreased by 0.7 %, with ether (ETH), original symbols from SUI (SUI), Aptos (APT) and Polygon (POL) pulling the bottom standard.

A traditional market examination showed that stocks book successive losses, as the S&P 500 and NASDAQ technology closed 0.7 % -0.8 %, again BTC.

Despite the lack of price procedures, the focus has increasingly turned into a growing Bitcoin share of the total encryption market: exceeded the so -called bitcoin domination scale by 65 %, which is its highest reading since 2021 January, according to TradingView data, the capital signals that were unified in assets that were perceived as more straight MacroEConomic.

Joel Kruger, the market strategy expert in the LMAX group, described the current scene as one of the stoppage and expectation. “The cryptocurrency market has been largely stagnant since the open week, with prices stabilizing in a decade pattern where investors are waiting for a pivotal catalyst,” he said. “This motivation may arise from traditional markets, driven by updates on the economic effects related to tariffs or FOMC’s expected decision for the Federal Reserve on May 7.”

The Federal Reserve is widely expected to maintain fixed interest rates, according to CME Fedwatch toolBut merchants on the brink of the abyss of any transformation in the tone of the President of the Federal Reserve Jerome Powell, which may affect the appetite of risk.

Bitcoin fluctuation erupted on the horizon

Vetle Lunde, head of research at K33, said that since the recent procedures of the Bitcoin price are very flat, the upcoming FOMC meeting “visits it to cause great fluctuations.” He pointed out in a Tuesday report The short -term BTC fluctuation is “abnormally compressed”, as an average of 7 days decreased to the lowest level last week in 563 days.

“Low fluctuations in BTC tend to be short -term,” Lund said. “Violent explosions usually follow this type of stability as soon as the prices begin to move, as interest trading is not binding and merchants are re -activated in the market.”

He said that a significant decrease in the important consecutive is unlikely, because financing rates for permanent bodies are constantly negative. Longy added that historically similar periods have offered good purchase opportunities for medium and long -term investors, preferably “aggressive exposure to the spot.”

https://cdn.sanity.io/images/s3y3vcno/production/c98a10e0c5df9f061e24f4368baf6936e051593c-2182×1354.png?auto=format