Solv Founder See Btcfi Outpacing Etherum Defi On $ 2T Potential

Given the Bitcoin’s market hat near the dollar, Ryan Chow Chow says Btcfi could reduce far beyond Etherum decentralized finances if even faction becomes productive.

Bitcoin’s (Btc) Decentralized finance space – it is better known as BTCFI – it is still in the early additions. But some see a huge opportunity to form a form. For example, the American Cripto Focused Hedge Panter Fund, for example, propose It could unlock as much as $ 500 billion worth, if it gets the main adoption.

Solv protocol, a platform that helps the owners of Bitcoin to do more with their BTC, it seems to be one of the players who bet on that future. The project has already crossed $ 2 billion in the total value of locked, whose goal is to bring strategies that apply to bitcoins in a way that reflects what Lido did for Etherum.

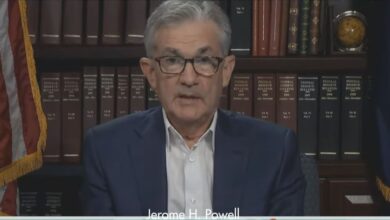

In an exclusive interview with Crypto.News, Solv Founder Ryan Chow talks about why Btcfi could eventually grow Etherum Deficide – Although it admits that there is a long way. It also strives on transparency standards such as “evidence-TVL”, the possibility of embarrassing Bitcoin ETF and what will need to attract institutional capital in the Bitcoin’s Bitcoin economy.

CN: Bitcoin’s definitive space is still in the early days, but Panther thinks it could unlock the opportunity of $ 500 billion if trust. Solvo has already hit $ 2 billion in TVL, and Etherum’s Lido is sitting at over $ 16 billion. How much do you think Bitcoin Market Bitcoin could get if Bitcoin Defiles to Ethereum?

RC: While comparisons with the Etherum’s stage market, they provide a context, the opportunity in BTCFIs a much larger factor: Bitcoin status as a prime global class funds.

With a market cover that is closer to $ 2 trillion, Bitcoin strengthened its place as a significant value store. For the wealth of this size, the sophisticated financial ecosystem is inevitable. The opportunity lies in unlocking the huge part of this three trillion of dollars that remains idle. If BTCFI effectively funded a significant part of the Bitcoin market cap, its size could be exponentially greater than Etherum definite, the Bitcoin’s scale was initiated as a means. Solv builds essential infrastructure needed to significantly become a really productive force in a global financial landscape.

CN: In view of regular updates for the total value of locked web2 platforms, such as the legal protocols, such as “evidence” to increase transparency and prevent confusion for increasing transparency and prevent confusion to increase Transparency and confusion prevention for user improvement?

RC: Transparency is absolutely basic for building trust and long-term ecosystem growth, especially in BTCFI. Metrics such as TVL, evidence of reserves and potential evidence of TVL are valuable tools and believe that standardized approaches are necessary for clarity.

In SOLV, our commitment is unshakable. We actively implement multiple layers of transparency: providing public meetings, supporting third party verification such as Chainlink POR, working directly with precise data such as defiles for accurate reporting, etc. We are committed to exploring any sustainable method that truly improves transparency. We support cooperation in the industry on these standards. Verified transparency and integrity are most important for attracting the institutional participation required for the highest expansion of the BTCFI.

CN: Do you think Bitcoin ETF stops would follow if SEC approves Etherum devotion to ETFS? How big could it be the market?

RC: If SEC approves Ethereum Staking EtfsIt could open the door for similar products in the ecosystem, however, the Bitcoin Facing of the ETF would face unique implementation challenges such as Bitcoin’s Mechanism in Bitcoinov does not support suffering like Etherum’s bet. Instead, Bitcoin Filving of the ETF should rely on third-party solutions to produce yields, such as Bitcoin LSTS (Fluent token commitment), Creating additional regulatory considerations around the security and basic mechanics.

The market opportunity for such products could be significant given the precedent of the set video Bitcoin ETFS, which soon seen billions in inflows shortly after approval. Traditional financial institutions seeking and exposure to bitcoins and generations of yields can find such products convincing, especially as the wider market becomes more comfortable with digital funds investments. However, the regulatory trail is likely to require robust safety measures and full transparency about how the yield is generated.

https://crypto.news/app/uploads/2024/12/crypto-news-Bitcoin-dollar-option02.webp

2025-05-05 21:44:00