Is MicroStrategy gearing up for another big investment in Bitcoin?

Michael Saylor, co-founder of MicroStrategy, has reignited speculation about the company’s next big Bitcoin acquisition.

On December 28, Saylor took to social media platform

Is there a hint of more Bitcoin to come?

In his post, Saylor stated that the mark had “disturbing blue lines,” leading to speculation that another large-scale purchase may be imminent. During recent weeks, Similar hints from Saylor It preceded official announcements of major investments in Bitcoin.

“Worrying blue lines on SaylorTracker,” Saylor male.

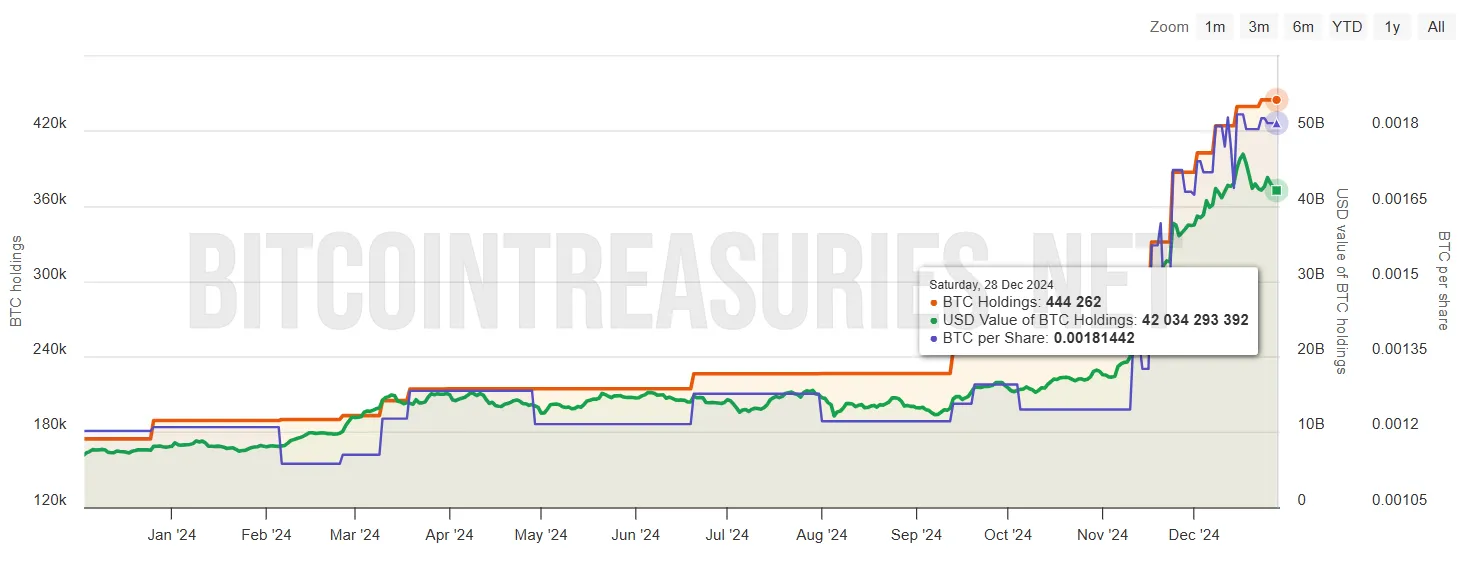

MicroStrategy went on a Bitcoin buying spree, amassing over 192,042 BTC at an estimated cost of $18 billion. During this time, Bitcoin’s price has risen from $67,000 to $108,000, while MicroStrategy’s stock price has risen more than five-fold this year, and now trades at around $360 – up 400% on year-to-date metrics.

MicroStrategy stock performance Included in the Nasdaq 100 index It was great. The company’s shift from its core business of analyzing enterprise data to a heavy focus on Bitcoin accumulation has put it in a leadership position. The largest public holder of cryptocurrency. But this aggressive strategy has faced its share of criticism.

Some market participants argue that Saylor’s announcements about buying Bitcoin created… Volatility. Critics claim that once the purchases are revealed, day traders short sell Bitcoin, sending prices tumbling and the value of MicroStrategy shares falling.

“The problem with Saylor’s purchases is that he announces them, and then the day traders start immediately shortening BTC because they know that the big buyer client has finished buying. Then the Bitcoin price goes down, and the MSTR stock price goes down, not up,” says one cryptocurrency trader He said.

Moreover, some have suggested that the purchasing pattern has been affected by it Plan for a blackout period in Januaryduring which Bitcoin acquisitions will be temporarily halted.

However, early indications suggest that Bitcoin buying will not stop anytime soon. Instead, MicroStrategy is preparing for its next steps, which include… Increase its authorized shares of Class A common stock. and preferred stocks. The proposal seeks to expand Class A shares from 330 million to more than 10 billion shares and preferred shares from 5 million to 1 billion.

Market watchers believe the move will significantly increase its ability to issue shares in the future, allowing it to allocate more funds to purchasing Bitcoin.

Disclaimer

Commitment to Trust Project In accordance with the guidelines, BeInCrypto is committed to providing unbiased and transparent reporting. This news article aims to provide accurate and timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content. Please note that we have Terms and Conditions, privacy policyand Disclaimer Updated.

https://beincrypto.com/wp-content/uploads/2023/05/bic_MicroStrategy_neutral_1.png.webp

2024-12-30 02:05:00