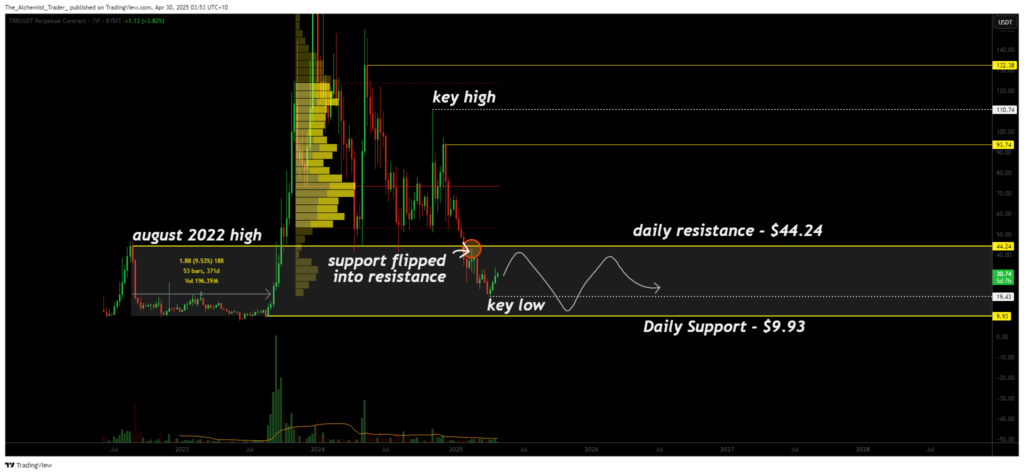

TRB reintroduces a macro range because the accumulation phase looks likely

The TRB returned back to his macro trading between $ 9.93 and 44.24. The acceptance of the price within this zone suggests a prolonged phase of accumulation can be the next great development.

Merchants (TRB) It is currently traded in a historically significant range, which previously had funds over 370 days. It was once again accepted within this region, traders carefully observe the signs of either extended consolidation or crucial burglary.

The recent drop of volume and current bear structure adds a theory only that this market can enter into a slow accumulation phase, not preparing for direct expansion.

Key technical points,

- Macro range established: The key support of $ 9.93 and 44.24 USD resistance defines the historic range.

- Bearish Volume Profile: The strength remains below average, signals weak torque.

- Previous Form Echo: The TRB has previously started here 371 days before the break.

SHRB’s return to this range emphasizes the probable scenario of the extended side movement. The market has shown more weekly closes within this band, confirming price acceptance. From a technical point of view, this opens the door for rotation in this range for a significant period – potentially up to 337 days if history is repeated.

This bear consolidation supports the volume analysis. Current volume remains significantly underlined, with rumors nodes formed below average levels. This lack of market participation often indicates indifference, not accumulation or distribution, favoring movements related to the continuing range.

Structurally, the TRB remained weak, publishes lower and lower and lower lower, and has yet to show any signs of power or bullow revers. The upper limit of this range, about 44.24 dollars, remains critical resilience. While this level does not interrupt with clear condemnation and supported volume, the probability is still distorted according to the extended consolidation.

For bulls, the only sign of hope would come from a higher level return with a growing amount and switching swing indicators. However, that scenario is currently lacking accompanying data.

What to expect in the upcoming work of price,

As things stand, traders should expect multiple rotational movement between 9.93 and 44.24 dollars. Until the volume and resistance, the accumulation within this macro range is the most likely way forward.

https://crypto.news/app/uploads/2024/01/crypto-news-Tellor-option02.webp

2025-04-29 22:24:00