Top 5 crypto charts that define Trump first 100 days in the office

CRIPTO prices retreated in the first 100 days of the Trump administration, because its tariff policies have affected market feelings.

Bitcoin (Btc) And most Altcoins dropped even while Donald Trump administration conducted positive policies, including support moves to the CRIPTO reserves. The Securities and Exchange Commission ended lawsuits against prominent companies, including unisvap (Uni), A tavern and a scrubbing laboratories.

However, the CRYPTO prices are mostly due to the macro factor, because Trump dragged a trade war with countries like Canada, Mexico and China.

This article emphasizes the top 5 crypto charts that defined the first 100 days of Donald Trump.

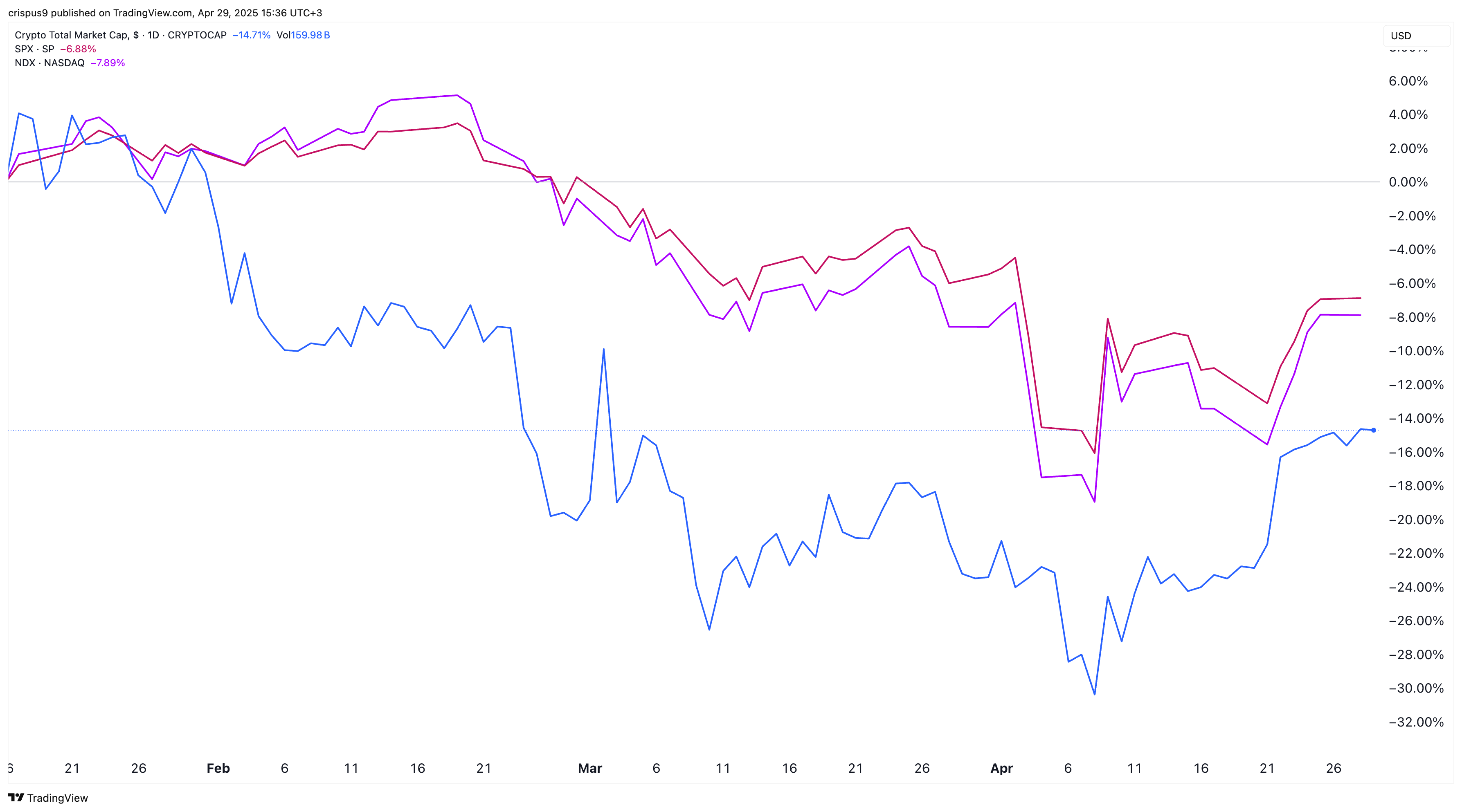

The Cripto Market Cap knocked down by 14.7%

The first chart below shows that the broader crypto market is significantly behind the stock market, because Trump took office. The total market capitalization of all cryptocurries fell by 14.7%, compared to a decrease of 6.9% for S & P 500 and 7.9% for Nasak 100.

This performance is noticeable, taking into account Trump, which in the US campaign was “most pro-crypto presidents” in the history of the United States, and its policies are largely supported. Positive Note, Cripto Market Cap is somewhat somewhat, on the rise with $ 2.3 trillion earlier this month to $ 2.9 trillion.

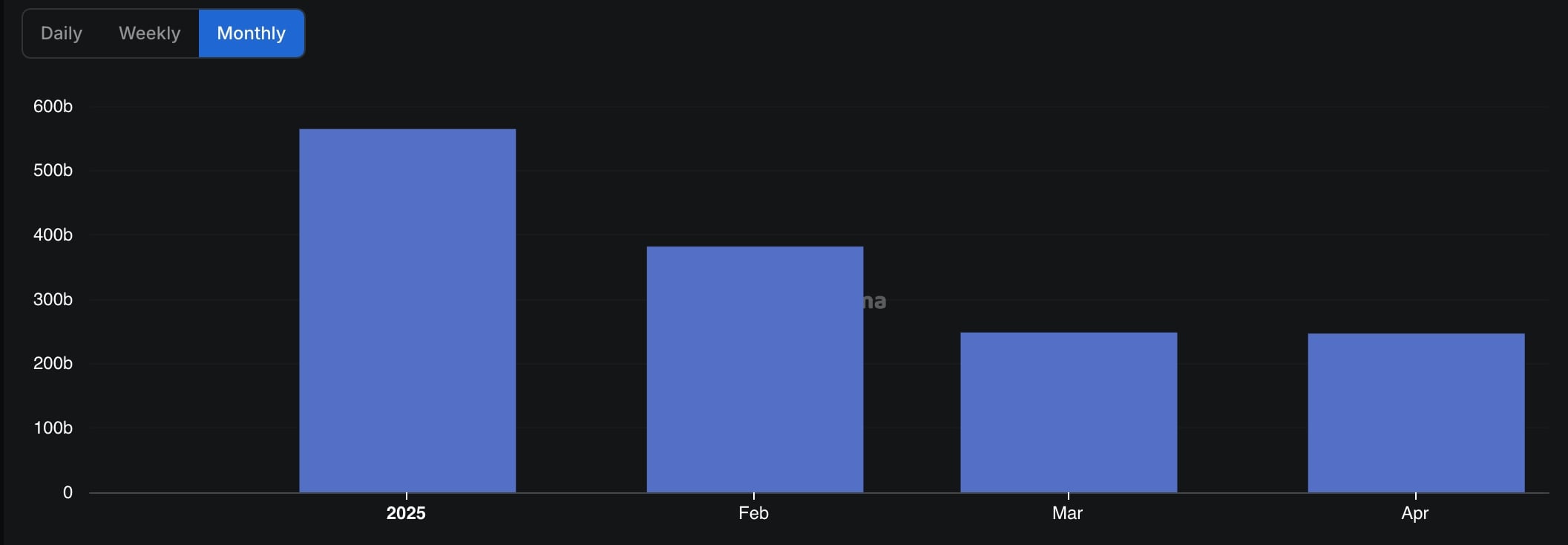

Dex volume was moderated

Decentralized exchanges saw strong performance in January, with a fueled nailed memoric. A large part of this initial miting was launched by Donald and Melania Trump who launched their own tokens before the inauguration.

Dex volume reached $ 564 billion in January, before in March and $ 248 billion in March and March in March and March and April, in March and April, faded and faded in March in March and April.

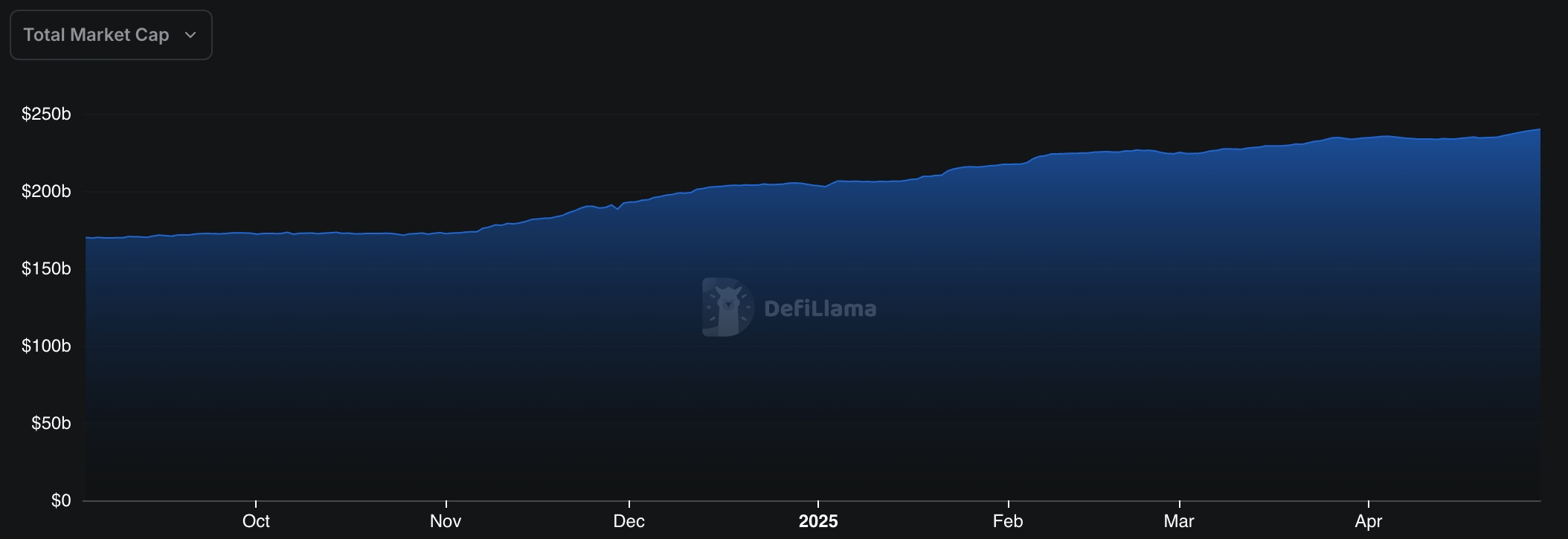

Stablecoin Market Cap jumped

Stablecoins are still rising under Trump administration. The data show that the total Stablechoin market hat resurrected to over $ 240 billion, which was led by Tether, Coin, Di, Ski Dollar and Athena. Since Trump took office, Stablecoins added 40 billion dollars in total market capitalization.

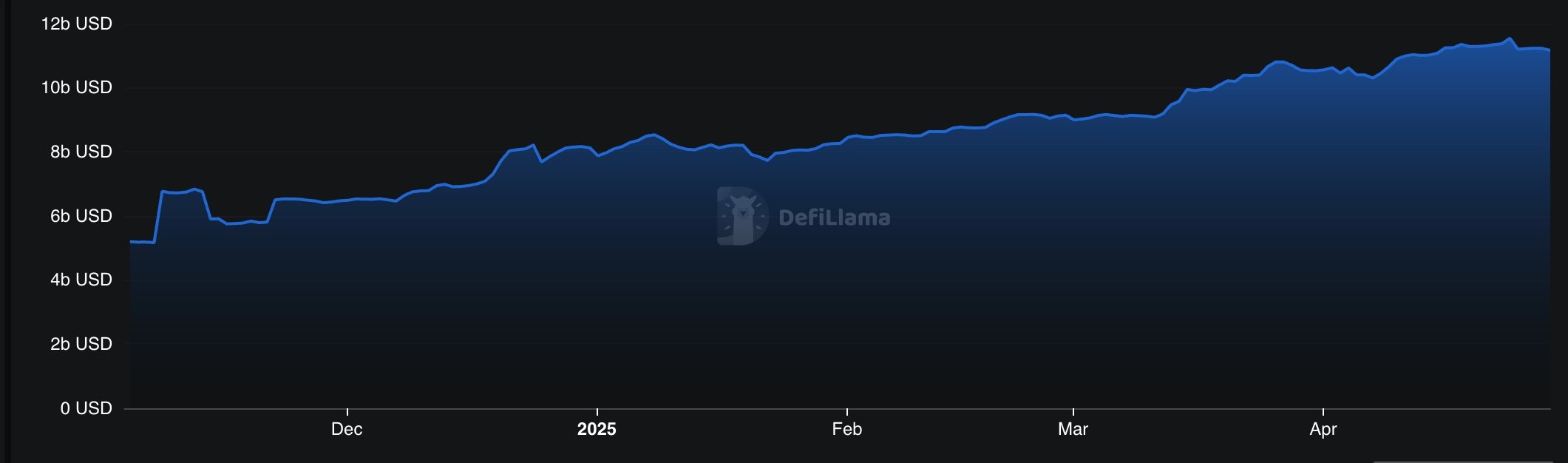

RWA growl accelerated

Meanwhile, demand for real world medium tokenization has grown into record high. The market value of all Ra tokens jumped to over $ 11.97 billion, more than $ 7.92 billion when Trump took office. The biggest players in the RVA industry are Blackrock Buidl, Athena USTTB, Ondo Finance, Tether Gold and Pakos Gold.

One of the best stories in RWA was Collapse Mantra, One of the largest chains in the industry.

Bitcoin ETFS had a net inflow of 3.73 billion dollars

Spot Bitcoin ETFS recorded $ 3.85 billion in a net inflow under Trump’s management so far. After seeing 5.25 billion dollars in January, the ETFS experienced two months of outflow, but this month bounced from $ 2.85 billion in inflow this month.

Etherum ETFS, on the other hand, is Net outflow of $ 132 million. It happened while Etherum price fell against the US dollar and other property, including Bitcoin and Solana.

https://crypto.news/app/uploads/2025/02/crypto-news-Donald-Trump-option28.webp

2025-04-29 17:32:00