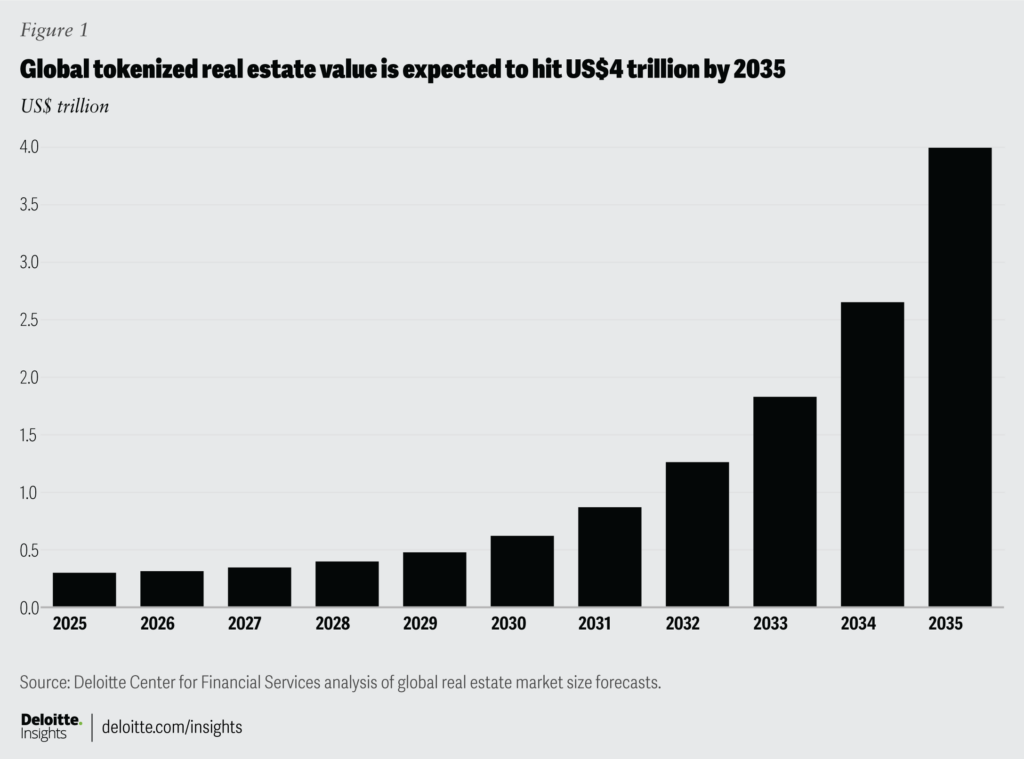

Tokenized real estate could reach $ 4 trillion to 2035. Years: Deloitte

Deloitte report explains that the tokenization of property opens great opportunities for real estate investment.

The tokenization of assets is one of the largest potential cases for crypto. On Thursday, 24. April, Global Management of Consulting Firm Deloitte has published its own FSI forecasting 2025 ReportFocusing on growth potential Real-World Asset Real estate industry.

Deloitte predicts that the value of tokenized real estate will reach $ 4 trillion to 2035. years, reflecting 27% complex annual growth rate from current levels. Even today, a tokenized real estate is already a big deal, and the value of the property in the amount of $ 300 billion in 2024. Years.

From a three-trillion-dollar digit, $ 1 trillion will probably be in tokenized private real estate. So far, these funds have only been available to accredited investors. However, the tokenization of property could make them available to all types of investors.

Tokenized real estate shows great potential: Deloitte

Instead of traditional actions, investors would get tokens representing property in the fund. Tokens could represent a certain portfolio of the Fund’s real estate portfolio and can be easily lasted. This would facilitate entry and exit from investments.

Another $ 2.39 trillion is expected to be related to tokenized loans in securitization by 2035. years, capture about 0.55% of the market. It is equivalent to securities, the main segment of financial markets. Deloitte suggests that tokenization can allow real-time payment data, reduce costs and improve traceability.

Tokenization in this market offers great advantages over the traditional model, explains Deloitte. For a single BlickChain technology, it can significantly reduce administrative costs, which are the main burden for industry. At the same time, it expands access to investors, which gives funds available to global and retail investors.

However, Deloitte also emphasizes certain risks and questions in the industry should be addressed. For one, there are concerns about custody, accounting practices and what happens in case of default value. In addition, ciberity can represent a great threat to emerging the tokenized real estate industry.

https://crypto.news/app/uploads/2024/11/crypto-news-RWA-sector-up-20-option02.png

2025-04-25 20:14:00