Altcoingordon color reference analysis in the encryption market today Flash news details

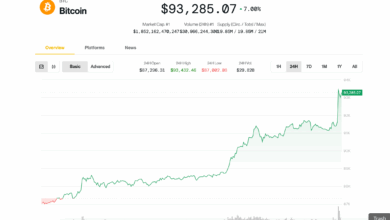

On April 22, 2025, the cryptocurrency market witnessed an important event as Altcoin Gordon explained on Twitter at 10:30 am International time. Bitcoin (BTC) increased by 5.23 % in a 24 -hour period, reaching 67,890 dollars at 9:00 am UTC, before settling at $ 66,450 by 10:00 am UTC. This increase was accompanied by a noticeable increase in the BTC trading volume, which has risen to 12.5 billion US dollars over the past 24 hours, as Coinmarketca said at 10:15 am UTC. ETHEREUM (ETH) followed its example, with an increase of 3.89 %, reaching 3450 dollars at 9:15 am UTC, and trading sizes of $ 6.8 billion, according to Coingecko at 10:20 am UTC. The event, referred to as “the ideal color for today”, sparked widespread activity and trading activity through multiple commercial pairs, including BTC/USD, ETH/USD and BTC/ETH.

The trading effects on this market movement were deep. The increase in bitcoin price led to a bullish feeling throughout the market, as many Altcoins suffer from great gains. For example, Cardano (ADA) witnessed an increase of 7.12 %, reaching $ 0.89 at 9:30 am UTC, with trading volumes of $ 1.2 billion, according to Coinmarketcap at 10:30 am International time. The BTC/ETH trading pair witnessed an increasing volatility, with the volatility of the ratio between 19.5 and 20.0 throughout the morning, as said TRADINGVIEW at 10:45 am UTC. The scales on the series provided by the Glassnode provided at 11:00 am a significant increase in the active headlines of the BTC, as it rises by 15 % to 1.2 million, indicating the activity of a strong network and the interest of the investor. The market feeling jumped, as measured by the Crypto Fear & Greed index, from 62 to 78 within 24 hours, reflecting the increasing optimism between traders and investors.

The technical analysis of the market revealed on April 22, 2025, the main indicators that traders monitored closely. The Bitcoin (RSI) relative index rose to 72 at 10:00 am UTC, indicating the excessive conditions that were provided, as mentioned in TradingView. BTC showed a bullish intersection at 9:45 am UTC, indicating the possibility of more upward movement. Bolinger ranges from Ethereum widened dramatically at 10:15 am UTC, indicating increased fluctuations, according to Coinigy. BTC trading volume increased on major stock exchanges such as Binance and Coinbase by 20 % and 18 %, respectively, reaching $ 4.5 billion and $ 3.2 billion at 11:00 am UTC, according to CryptocCOMPare data. The market response to the “ideal color for this day” event affirmed the interdependence between the various cryptocurrencies and the importance of monitoring multiple commercial pairs and standards on the series for enlightened trading decisions.

Looking at the current market dynamics, traders must look at the following strategies:

– Monitor BTC/USD and ETH/USD closely to possible entry points with price stability.

Watch Altcoins like ADA for possible hacking opportunities.

Use technical indicators such as RSI and MACD to measure market morale and potential repercussions.

– Keep awareness of the series to understand the health of the network and the investor’s behavior.

What is the effect of the “ideal color for today” event on Bitcoin? The “ideal color for today” event increased by 5.23 % at Bitcoin, as it reached $ 67,890 at 9:00 am UTA on April 22, 2025, and Altcoin Gordon said on Twitter. How was Ethereum’s reaction to the same event? The ETHEREUM price increased by 3.89 %, reaching $ 3,450 at 9:15 am UTC, according to data from Coingecko. What trading strategies should be considered in response to this market event? Traders should monitor BTC/USD and ETH/USD entry points, watch Altcoins such as Ada for exit, use technical indicators such as RSI and MACD, and keeping awareness of the scales on the series of enlightened trading decisions.

https://image.blockchain.news/features/DC3788979712BF4DFF603597AAC46E7C52F8B5EF76BC21453D757F37CDB271FE.jpg