The volatility of Bitcoin is in a historic lowest level. What does that lead?

Volatility has always been one of the first things mentioned in various lists of Bitcoin. According to the recent Ark Invest report, the instability of Bitcoin reached the lowest level. What are the implications of low instability?

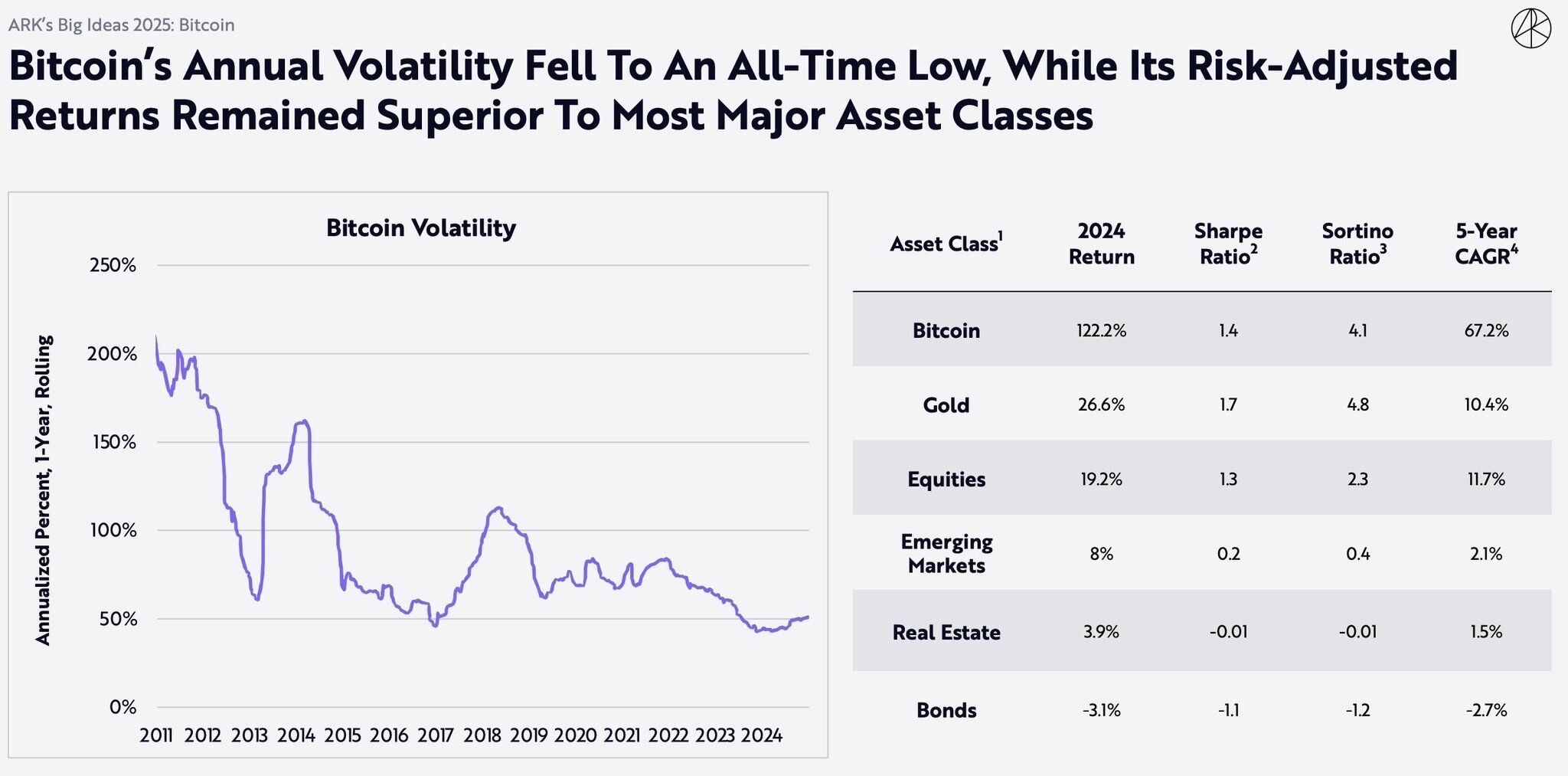

The report of the new ARK investment, called great ideas in 2025, describes that the 30-day Average for Bitcoin is generally below 50% in 2024. years and first months of 2025. years, the chart indicates a gradual decline in volatility.

Some will miss the instability of bitcoin

Volatility is considered the circumstances of investors to take great roles and risks in the hope of larger victories. Prominent advocate of bitcoin and one of the largest investors Bitcoin, Michael Sailor, once called Bitcoin volatility “gift believers”, which scares tourists, lazy and commonly rich people who have all the money. He effectively called those who wanted Bitcoin volatility to go “arrogantly” and “egotistically”.

Significant, Sailor claimed This bitcoin is digital capital, not a currency, not a means of exchanging. However, Sailor is actually a user of low instability such as a company founded, strategy (earlier known as a microstrate), it can face serious troubles if the BTC price offers.

Bitcoin price care, however, does not correspond to the lack of yield. The report of the ARK INVEST describes that despite the fall of volatility, the annual returns of Bitcoin for 2024. reached 122.2%, gold, bonds and action. More than that, Bitcoin’s sharper and justified ratios about the relationship and Sortino were just below the corresponding gold data, and at the same time in the case of the market and equality, showing market strength and relatively low risk.

However, if you look at three best years in terms of returning Bitcoin, you will discover that the reward is constantly decreasing. In 2013, in return was 5,428.7%, 2017. it brought “only” 1,336.4%, and the third best year, 2020. years, at an annual annual yield of 304.5%.

These figures Indicate that the reduction of instability is parallel to reduce short-term investment income. This can be seen as a bad news for high-risk traders, while at all, low volatility has long been expecting and experienced as the maturity of Bitcoin phase.

Bitcoin becomes mature

There are several reasons why the decline in volatility is experienced as a sign that Bitcoin matures. First, the stable price makes Bitcoin sustainable for daily transactions. Sudden spikes and busts are not healthy reasons for traders and consumers, as they change local assessment of goods and services within short periods. If you buy a laptop for $ 1,000, you don’t want to find out next week that his price dropped to $ 600 until the value of dollars changed.

Stable Bitcoin has a higher potential for a wider adoption in various companies. Growing adoption increases liquidity and pool for retail options for customers. Let’s say you’ll buy a laptop and pay it in Bitcoin and have access to only one store; You have to pay as much as the price requirements for a laptop you choose. Ten different stores would increase the probability that you will find a quality laptop at an affordable price.

In addition, the Bitcoin derivative market will further settle price fluctuations. In combination with growing adoption in retail, Bitcoin will help to establish as a reliable settlement tool, not just speculative means. None of this puts long-term growth potential in danger. Instead, it cements the higher level of support that replaces Stark fluctuations.

The wolf of all streets of Podcast hosted in its daily newsletter that Chene Bitcoin became something harmonized with high indices, “continues to stand out as disagreeable assets,” showing relative stability in such a turbulent period.

Trading war was intensified 2. April, when Donald Trump announced unconditional tariffs for dozens of countries, causing the growth of fear in investors. In the first week of months, they were marked in markets in slinging around the world unseen in years and decades and unseen liquidation rates. However, Bitcoin signaled the strong and consistent ability to recover in days or even hours.

It can be a sign that titles lose power over favorable prices. Some experts see it ironic, noting that post-election news about crypts had a lot of main titles, but they gathered relatively moderate. We now see that in the trembling period Bitcoin rarely leaves a range of 83,000 to $ 87,000, which shows a solid composition.

https://crypto.news/app/uploads/2024/08/crypto-news-Bitcoin-Ordinals-option01.webp

2025-04-21 23:13:00