Over 30% of rich Koreans prefer crypto as a long-term wealth of strategy

The new data show that over 30% of the rich investors of South Korea, a crypto for long-term growth of values, interest rates for gold or property interest.

South Korean Investors – especially the younger crowd – tilted hard in the CRIPTO, and the new report of Han Banking Banking aims, it could be more than just a trend.

According to a recent The report of Hane Bank, one of the largest banks of South Korea, the digital means could mark the shift of the paradigm in investment forms, especially how the traditional financial systems disappear the expectation of younger investor expectations. Thind Grax has noted that these funds should get the function of solutions and legal status as a financial investment product, the probability that the new financial order increases. Although it is not a prediction, it can definitely act as a flag.

It is also a moment of reconstruction. Although the report has not declared the CRIPTO future finance, it noticed that the share of rich investment was more than 10 million (about $ 7,000) in Kriptou “surpassed by 70%, and the average amount of investment is more than twice” as other investors.

Young Koreans ignore stock

Some of this is already visible on the field. Young Korean deviates from the domestic stock exchange. And quickly. “I never invest in Kospy (Korea Compitite Index of Stock),” One office worker in his 20s told Korea Joamang that everyday in the middle of April interview. The others in the 30s resonated the feeling, saying they were moving towards American capital and more aggressively, in the cripto.

The report, referring to the data on the deposit of securities, discovered that until 2023. only 11% of investors in the Korean market were in the 20ths. This was reduced from 14.9% in 2021. For investors in the 30s, it fell 20.9% to 19.4% compared to the same period.

And crypto? It’s flourishing among the same group. Almost 48% of Crypt’s investors in South Korea was in their 20th and 30s last year, according to the Commission for Financial Services.

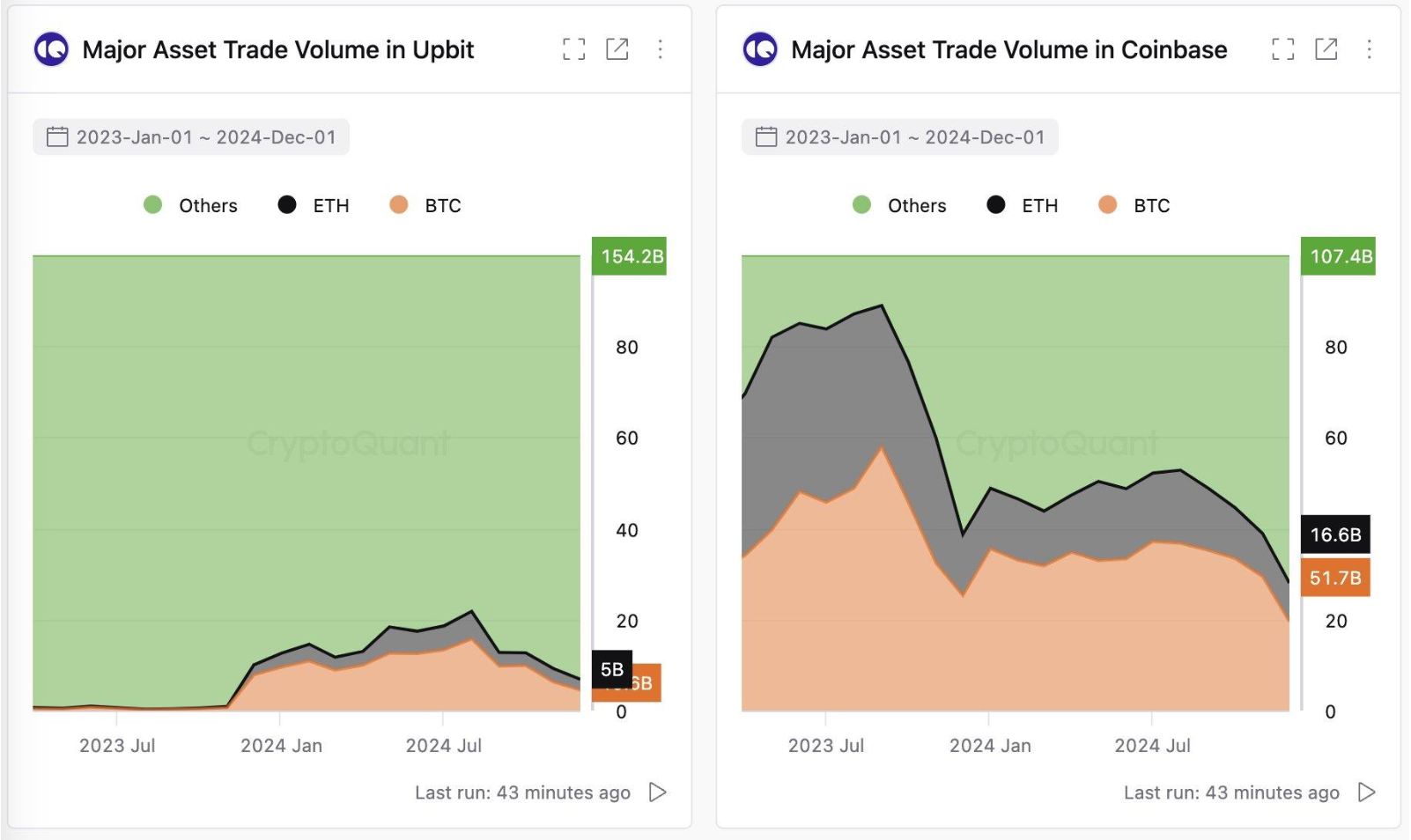

Only five main exchanges – Upbit, Bithumbum, Coinone, Corbit and Gopax – their trading volume is a total of “2.52 square won (or about $ 1.76 trillion),” said the report reads. “It is now general knowledge in the industry that cryptocurrency such as Bitcoin are reducing retail investment funds from the stock exchange,” said an intermediary industrial insider.

Cripto.News also appeared on the Upbit and Bittumbum for comment, but neither reacted at the time of publication.

CRIPTOCUINOVAN CEO KI Young told Crypto.News strong demand that probably comes from Korean retail investors, which “have a much higher appetite for risky assets compared to those in the United States”

“The crypto volume of trading in Korea has long exceeded that the Local Market Stock Exchange (Cossak) is leading the world. By the end of 2024. Year, amounted to 107 billion dollars – additional hit $ 104 billion.”

Qi Young her

Hanain report does not support any crypto. But his researcher Ion Seon-Young noticed that the rich group expects the growth potential in Kriptou “signals the maturity of this field.”

“However, institutional safety networks are still insufficient and not lacking the understanding of new technologies, which led to a clear department of virtual assets. However, rich are thoroughly under investment and prefer to invest in areas that will continue to invest in areas they understand.

Yoon Seon-Young

Although this does not mean that Crypto is safe, although it means that more serious – even inheritance players.

Change of regulatory landscape

Southern Korea regulators also catch themselves. Recent Financial Services Commission said He plans to publish comprehensive guidelines for the investment for CRIPTO in the third quarter of 2025. years.

It is part of a wider effort to close the CRIPTO formal financial system. Universities and non-profit information can be left soon to sell their farms. Institutional rules are in works. Even Spot ETFS – once forbidden – peacefully reviews.

At the policy of the policy this month, the FSC Vice President Kim said that Korea moves faster faster to “encourage his crypto market”, noting that the United States accelerates the globally CRIPTO adoption. The upcoming rules will focus on “best practices” with standards around discovering, reporting and trading.

Double-sided sword

It’s a tightrop. On the one hand, potential. On the other hand, instability. South Korea – home one of the most active most common markets in the world – trying to walk these lines.

Politicians also begin to notice. Chairman Candidate Hong Joon-Pio recently said He wants to transfer the cropto regulations, comparing it with deregulatory strokes under Trump Administration. Such a type of conversation could echo with younger voters, many of which already see crypto as a long-term show – or at least a better alternative from the cospia.

This shift is not limited to Korea. But here is especially sharp. Approximately 30% of the population trade cripto, according to Korea’s economic daily. It is a stunning figure – and one regulators, banks and political leaders cannot ignore.

https://crypto.news/app/uploads/2025/01/crypto-news-South-Korea-Bitcoin-option03.webp

2025-04-21 14:45:00