Top three tokens to be 3x in Bitcoin Bull

Bitcoin returned above $ 85,000, and the dominance of the BTC climbs towards his four-year peak. This may be the perfect time for Altcoyne with a high BTC correlation at the rally while driving a bull. Altcoin tokens with real use of use, breeding adoption and movement on chain and technical indicators can double or climb into three times their value of this cycle.

SUI prices, XRP and FartCoin are likely to cook

Sui (Sui), Mother-token 1 Platform BlocCchain, KSRP (XRP) And Fartke (FartCoin) are the first three chooses for AltCOINS that could get during this ride. Tuesday, 15. April, Sui announced the spread of integration with the Bavilon Bitcoin protocol Bitcoin. As part of integration, Bitcoin holders can provide a SUI network without giving up their BTC funds.

Bitcoin (Btc) Showcase Protocol deepens connections with a layer 1 Blockoin, because SUI is preparing to lock steps with BTC price trend. Bitcoin is floating near the $ 85,000 support, looking at the return above the $ 90,000 resistance.

SUI has gained 5% in the last seven days, a token is almost 3% in the last six months, while the token decreased by 48% since January 2025. Year in the amount of $ 5,3777.

SUI was in a trend down from her January top. SUI could get 25% and testing on the upper limit of the fair value (FVG), to $ 2.6069. If SUI sees the daily closure shutter above this level and turns it in support, it faces resistance to R1, R2 and R3, 50%, 100% and 127.2% of the fumbonation of their fall from January to 2025. Years.

R1 to $ 3.5473, R2 at $ 5,3772, and R3 at $ 6,3766 are three key resistance. Rally to R3 means 201.84% or greater than 3K Gains for SUI.

XRP, the KSRpledger’s parent token, was previously considered that security in transactions participated by the US institutions. End Sec versor in the settlement, KSRP ETF Modernator Giants and asset management funds, and Ripple’s StableCoin has launched key catalysts running token profit in Token 2025. Years.

Bitcoin’s rally on his dressing of $ 100,000 in December 2024. He followed XRP’s running to the goal of $ 3. Since then, XRP is 16. January hit $ 3.40, 16. Dana before New Bitcoin in Bitcoin. Bitcoin and the second largest Altcoin recovered from Flash Padua and previously corrections of the steep market, making the token probably a candidate for further gain of this cycle.

XRP could receive 18% and testing on the top limit of FVG to $ 2.50, 50% Fibonaci indenting its fall from its 2025 top to cycle low. 42% of mything could push the XRP to test a turning point resistance of $ 3 as seen in the chart below.

XRP / USDTT and BTC / USDT Daily Map | Source: Cripto.news

FartCoin, Meme token built on the blocks of Solana, has over 834 million dollars of market capitalization. Meme trays are traded near 0.9074 USD keys, from 50% of the fibination indentation of its crash in the amount of $ 1.61.50 to $ 0.199 low. 54% of the rally could push Fartken to test resistance at a key level, $ 1,2911. The MACD signals the probability of further gains in Memena, and RSI reads 63, at the level of “exceeding” at 70.

Altcoin season is unlikely to happen that could happen

The Bitcoin domination is on the road to 64%, a four-year peak. This implies the Altcoin season or period in which 75% of the best 50 Altcoins surpassed Bitcoin in the 90-day time, it will probably be postponed. However, traders can expect key Altcoyne who enjoy high correlation with Bitcoin, a higher service program, a proven case and traction among market participants to get winnings for owners.

Cryptocurrency such as Solana (Salt), Dogecoin (Exaggerate) and salt-based tokens that gained favorable for institutional investors and whales could see the increase in inflow. This could catalize the winnings in several Altcoin during the current BitCoin BULL.

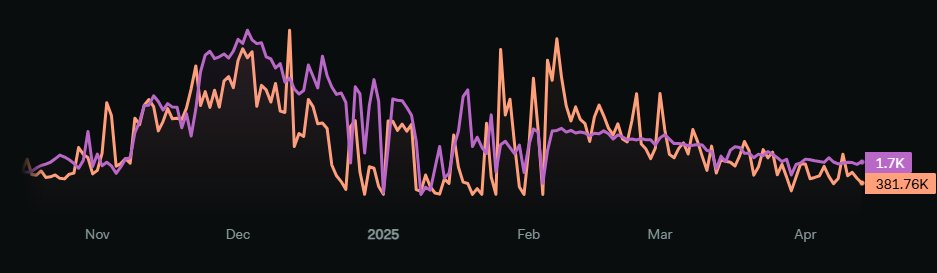

Social data from LunarCrush.com show that “Altcoin Season” from its top is 100% in January to 77%, and then in the right of a small retailer and Altcoin had during Bitcoin Flash since November 2024.

Will Bitcoin climb past the gold?

Discussions about whether the AllCoin Season will be inevitably leading the leads of the Morovo Champion whether Bitcoin will regain their position next to gold as “Safe refuge” as “safe refuge”. The golden rise is significant, consistent and stable in the middle of global insecurity.

Merchants who are looking for a safe haven for protection of funds from insecurity on the market once again began to look at gold, after almost half a decade of bitcoin as “safe refuge” as “safe refuge”. It is no longer about a piece of codes against shining metal, the debate leads deep in the middle of money supply, debt and instability of global markets.

Between November 2022. and November 2024. Bitcoin and gold enjoyed relatively narrow correlation. The metal has earned 67% by the miting of 400% bitcoin. While both funds were locked in the same direction, analysts expected the relationship to stay. Gold was maintained by the void against inflation, while Bitcoin dissolved, in the middle of Trump moving tariff announcements, executable orders regarding CRIPTO and the relationship was most violated in 2025. Years.

At the end of March, the gold earned another 16%, Bitcoin erased over 6% of its value and closed the worst first quarter of the year. It remains to be seen whether Bitcoin will regain its edge and characteristic in portfolios as a hedge of inflation.

Cripto market cycles could change forever with Trump crypto pushing

Previous Cycles Crypto on the market followed a four-year sample, with the new Bitcoin-tall and Allcoin season. Market cycle disorder 2024. Follow the rapid institutional adoption of Bitcoin and upper cryptocurries, large flows of capital and influence of whales market on site and derivation.

As they are now taking steps towards cementing its strategic cryptic reserve and policy, institutionalization pushes deeper in the CRIPTO ecosystem and threatens to disturb the four-year cycles.

In a podcast with a galaxy, analyst behind the lever @ _checkmatei_ explained that the range of $ 70,000 to $ 75,000 a critical point for Bitcoin, and psychologically and structurally. Further removal of bitcoin prices This cycle depends on whether the range is held and how the BTC price is performed.

Merchants are cautiously bear mood, sentimental views

The index of crypto fear and greed, used to identify feelings among participants in the cratted market, reads 38 at the time of writing. This shows that traders in medical mood, however, feel improved between last year, last week and yesterday.

The extreme fear that the traders eventually relieves, while market participants will probably find their footers and “buy DIP” to keep Bitcoin to keep the key support from $ 85,000.

James Toledano, Coo in the unity wall, said Cripto.news in the exclusive interview that the fears of recession that intensified, but it was probably that we couldn’t see the bottom yet. Toledano said,

“In spite of these coverings, Bitcoin is more than 25% in the past six months, even if the recession is to hit and bite and bite and tense in exhausted property, but people will guess and that the recession will guess and the recession will hit and bite the recession Tracks.

However, it feels that the merchant appeal as decentralized assets is growing, especially as traditional markets that can be volatile. Although the Trump policies have introduced significant macroeconomic insecurity, they can paradoxically encourage the recent rise of bitcoin – although risks remain eliminated for all markets, including cripto involved. “

Detection: This article does not represent investment advice. The content and materials presented on this page are only only for educational purposes.

https://crypto.news/app/uploads/2025/04/crypto-news-Sui-XRP-Fartcoin-option01.webp

2025-04-15 23:33:00