Cripto market risk remained aggravated hit in Bitcoin

Cryptocuantic analysts found that the risk of the cryptocurne remains high despite the fall of Bitcoin. Analysts on chain data also noticed that only 24% of BTC circulating offers in an unrealized loss.

Analyst noted that the unrealized loss presented the historical corrections of early phase, not continuing the decline. He also said that the lack of widespread implementation of loss indicates the market has not yet entered the re-accumulation phase.

Market risk remains elevated despite the Papera Bitcoin

Market risk remains elevated in spite of BTC price crash

“There are currently 24% of circulating supply in unrealized loss, relatively low level historically related to early phase corrections, not full capitulation.” – Author @ ccrazziblockk pic.twitter.com/kztd1kp79

– Criptokuant.com (@ Criftokuant_com) 15. April 2025

Cryptocuantic analysts found that the risk of the cryptocurne remains high despite the fall of Bitcoin. The chain data analyst also noted that only 24% of BTC circulating supply in unrealized loss, relatively low level historically related to early phase, not in the side capitulation with full degree.

Crazziblockk also stressed that the unrealized component of losses grouped in the historical lower zone. He believes that this indicates that the absorption of Downside is primarily arising among the long-term owners. The analyst also claimed that the behavior was preceded by extended consolidation or further instability, not immediate recovery.

“Lack of widespread loss realization indicates that the market has not yet entered the reward phase. In such an environment, reactive trading could lead to supopptimal outcomes.”

–CrazziblockkCryptoquant analyst.

The chain data analyst also suggested the need for investors to stay aside and respect market structure develop due to current supply and low disrelded loss dynamics. It also invites market participants to allow investors to confirm the prices and behavior of the investor aimed at the decisions of the decision distribution.

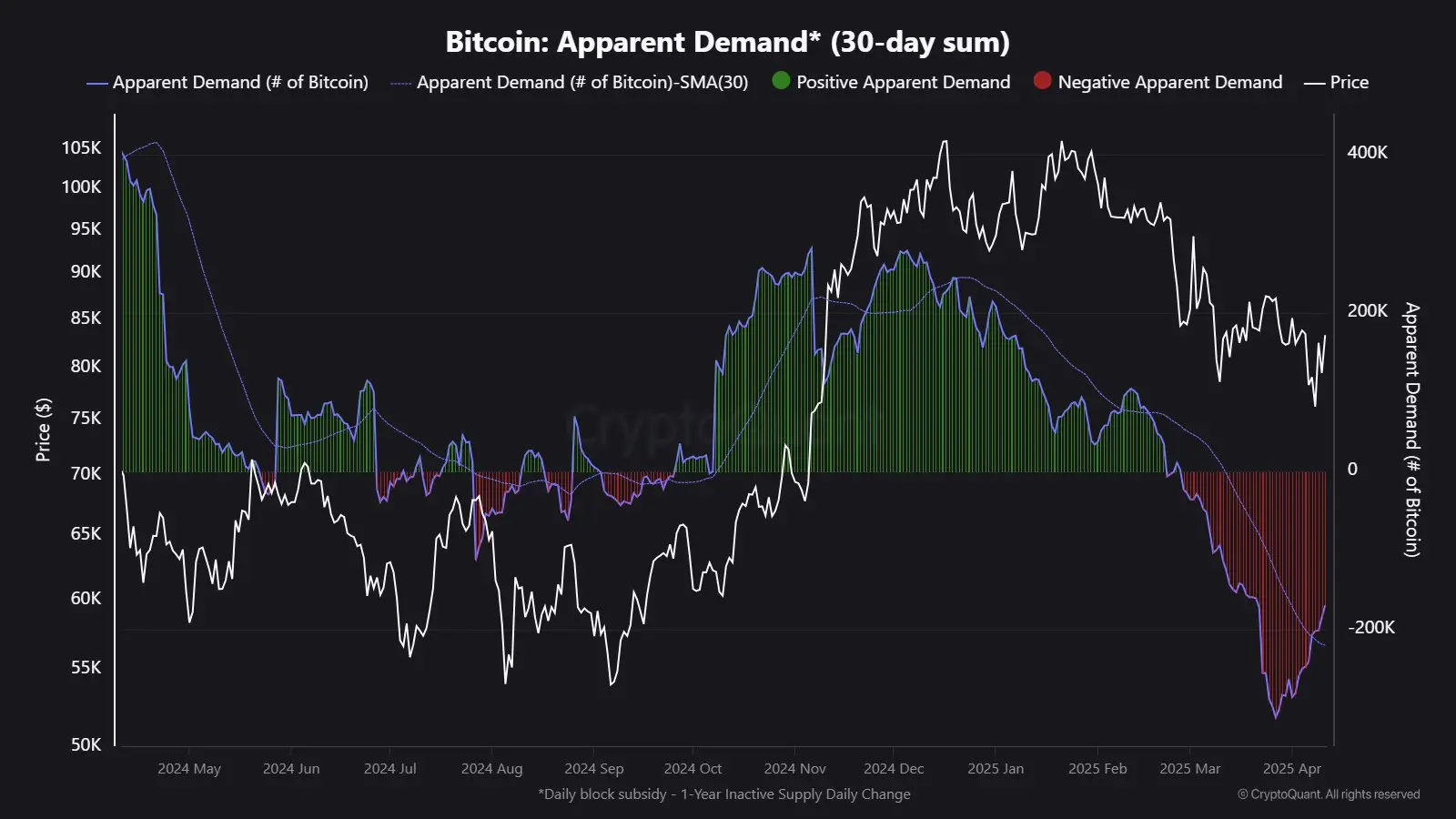

Criptokuant analyst Crypto Mevsimi discovered The chain data show the current recovery in BTC can be associated with the improvement of demand indicators. He also suggested that the wider market structure still has to confirm whether the current bounce reflects a sustainable rally or is only a temporary break in liquid correction.

Mevsmimi also addressed attention to the apparent metric metric metric, especially the 30-day amount, which began to recover from negative territory. He said the trend was seen as a potential sign of changes in market dynamics.

The analyst also warned that it took the trend as the beginning of the new cycle of bikar, drawing parallel to Bitcoin’s behavior during the last part of the cycle 2021. Years. He noted that demand was removed for extended time frame during that period, even how the prices have recovered. Mevsmimi noticed that the market had experienced a true structural shift only after the long phase of consolidation.

Short-term sales pressure decreases on binance

Criptokuant Analytic Darkfost export that the inflow of BTCs from short-term holders (STHS) existed in binding. He argued that this indicates a decline in immediate sales pressure.

Darkstost also noted that the chain data show that the average realized prices for STS currently stood about $ 92,800, which means that many recent sellers went out at a loss. The analyst pointed out that St. inflows fell from approximately 17,000 BTC in November at about 9,000 Bitcoin lately. He claimed that the sales trend could provide certain support to the current levels of digital funds.

The analyst continued to emphasize the need for market monitoring in order to determine whether the decrease in sales pressure continues. Darkstost believes that the mitigation of short-term stretched stretches could reduce the resort and contributions to market stability.

According to the CRIPTO Analyst Btcearth, Bitcoin could set the stage for the main reversal after an increase above 85K brand. Btcearth instructed into a key support zone that still holds, showing the possibility of forming the lower.

The analyst noted that the action of the price “respected a long-standing blue line of support”, which was established around “Trump Rally breakthrough”. He also claimed that the current structure proposed “possible formation near this zone, supported by volume and historical price behavior.”

Btcearth claimed that the repeated support validation indicates that the digital currency builds a strong basis. It believes that the Buk’s reversal is inevitable if the structure holds, especially as instantly and historical cost behavior, support a potential break from that area.

Criptopolitan Academy: Tired of race swings? Learn how you can definitely help you build a constant passive income. Register now

Declaration of responsibility: for informational purposes only. Last performance are not indicative for future results.

2025-04-15 16:15:00