Galaxy Research Cryptocurrency Forecast for 2025

- Bitcoin adoption by institutions and nation-states is expected to grow, driving innovation in cryptocurrency mining and financing in 2025.

- The Ethereum ecosystem will expand with stronger DeFi integration, higher storage rates, and increased Layer 2 scalability in 2025.

Based on comprehensive Galaxy Research Expectationsthe cryptocurrency space is destined for massive expansion in 2025 with Bitcoin and Ethereum coming to the fore. From Bitcoin’s price points to Ethereum’s superiority, these forecasts provide a roadmap for both investors and cryptocurrency enthusiasts. Here’s a closer examination of their predictions.

🚨 Cryptocurrency predictions for 2025 from @glxyresearch

Featuring… Bitcoin and Ether price, ETHBTC, Dogecoin and DOGE, stablecoins, defi, L2s, politics, VC, and more…

Below are the forecasts we just sent @galaxyhq Clients and counterparties 👇

– Galaxy Research (@glxyresearch) December 27, 2024

Cryptocurrency Forecast by Galaxy Research

Bitcoin momentum and growing institutional adoption

With further momentum pushing Bitcoin to test or exceed $185,000 by Q4, Galaxy Research expects it to surpass the $150,000 mark in the first half of 2025. Institutional adoption, corporate interests, and nation-state investment together will drive this massive expansion.

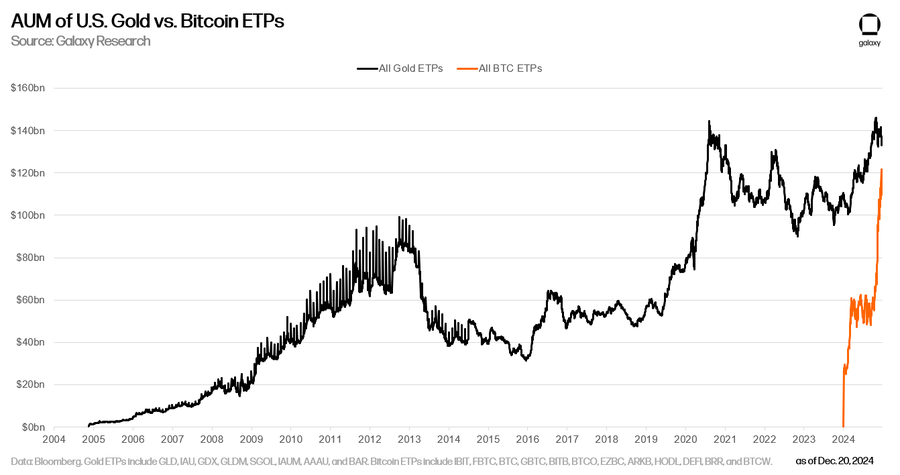

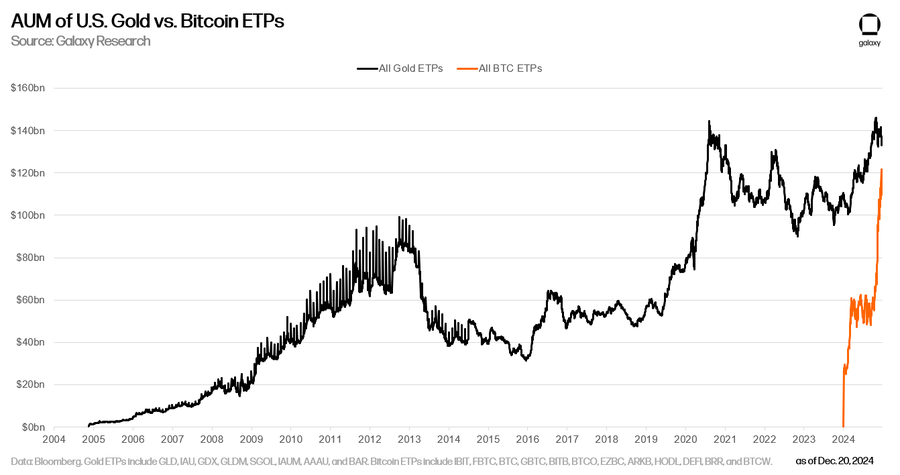

Over its lifetime, Bitcoin has regularly outperformed traditional asset classes, including gold and the S&P 500. It is expected to reach 20% of gold’s market capitalization by 2025.

Furthermore, US exchange-traded funds (ETFs) are expected to exceed $250 billion in assets under management (AUM). With net inflows of $36 billion as of 2024, Bitcoin exchange-traded products It has emerged as the most successful group in launching ETP in the past years.

Along with government agencies like the Wisconsin Investment Board, major players like Millennium and Tudor Investments have helped significantly drive this expansion.

On a risk-adjusted basis, Bitcoin will also remain among the best performing assets of all assets worldwide. especially Accurate strategya company known for its Bitcoin holdings, displays the best Sharpe ratio among all assets. At least one large wealth management platform endorsing a 2% Bitcoin allocation in recommended investment model portfolios will serve to offset increased flows into Bitcoin-related products.

Furthermore, Bitcoin will find a place on the balance sheets of five nation-states and at least five companies included in the Nasdaq 100. Strategic portfolio diversification as well as trade settlement needs will drive this acceptance. Competition between nation-states — especially those that are not aligned or hostile to the United States — will accelerate plans to acquire Bitcoin, including mining.

The Rise of Ethereum: DeFi Expansion and Layer 2 Growth

Ethereum, the foundation of decentralized finance (DeFi), is set to reach all-time highs trading above $5,500 by 2025, and new alliances between DeFi and traditional finance (TradFi) platforms, as well as regulatory clarification, are expected to… Promote this expansion. .

As companies explore proprietary L2 solutions for scalability and cost-effectiveness, Ethereum Layer-2 networks will find more acceptance.

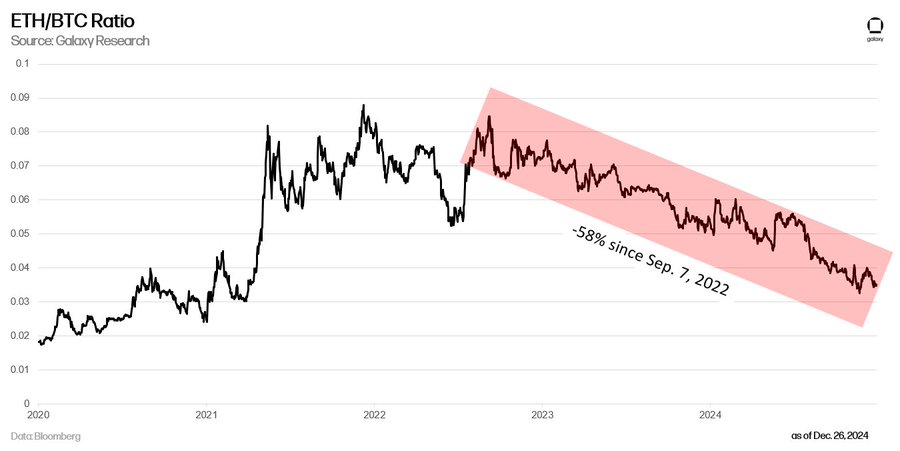

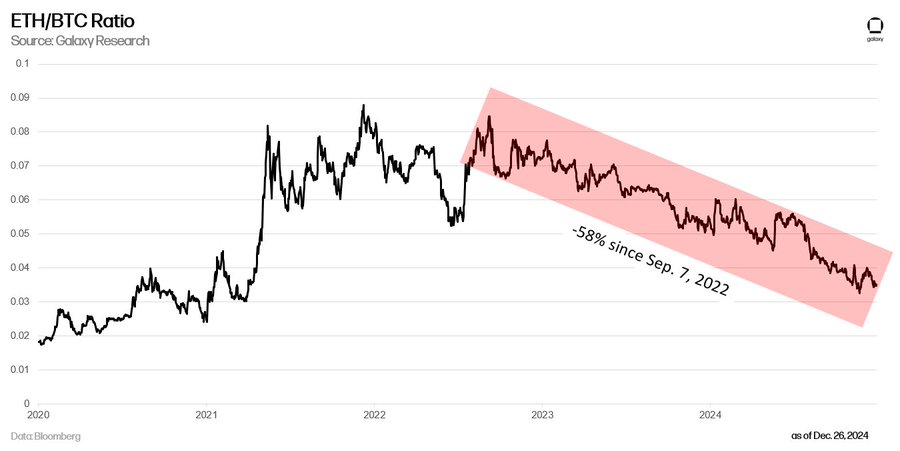

A leading indicator in the cryptocurrency space, the ETH/BTC ratio will bounce back from its downward trend and end 2025 above 0.06. Additionally, Ethereum staking rates are expected to exceed 50%, indicating strong demand for staking systems like Lido and Self layer.

This increase in staking will cause Ethereum developers to start discussing potential adjustments to the network’s monetary policy.

Furthermore, new regulatory sandboxes will help the Ethereum ecosystem allow traditional capital markets to explore public blockchains. Additionally, NFT trading volumes are expected to rebound; Games using Ethereum-based technologies can reach the product market niche.

Dogecoin: Trip to $1

Dogecoin (Doug) Crossing the $1 mark and achieving a market value of $100 billion will represent a turning point in the memecoin industry. Although this increase highlights the continued appeal of memecoins, other variables such as fiscal cuts made by the Department of Government Efficiency (DOGE) could overshadow Dogecoin’s soaring market valuation.

Stablecoins and decentralized finance are entering a transformative era

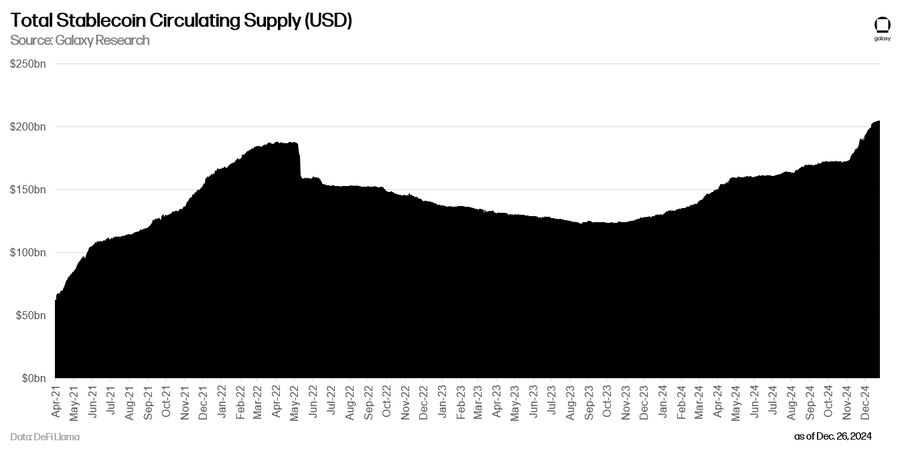

With total supply expected to triple and approach $400 billion, stablecoins will maintain their explosive growth. Regulatory clarification and the introduction of new TradFi-backed stablecoins will be crucial to this expansion.

Prominent players such as BlackRock’s BUIDL and Ethena’s USDe are poised to threaten Tether’s market supremacy, thus potentially reducing Tether’s market share to less than 50%.

Through treasuries and revenue sharing schemes, the DeFi industry is poised to usher in the “era of dividends,” thus distributing over $1 billion in value to token holders and consumers. Leading the charge are apps like Aave and Ethena; Protocols such as Uniswap are investigating related methods.

Regulatory clarity and competitive constraints will drive this trend toward adopting more cautious revenue-sharing policies.

Convert Bitcoin mining and develop protocol upgrades

By 2025, nearly half of the 20 largest publicly traded mining companies will create alliances with high-performance computer companies and super AI companies, thus changing the nature of… Bitcoin mining. This change will slow down the hashrate increase and cap it at 1.1 zettahash by the end of the year. The growing needs for artificial intelligence and other high-performance computer uses are driving this development.

Furthermore, Bitcoin developers are expected to agree on long-discussed protocol improvements, including increased transaction programmability via opcodes such as OP_CTV and OP_CAT. Although these improvements will not take effect until 2025, their consensus signals a turning point in Bitcoin’s technical development.

Stablecoin legislation and expanding institutional integration

The US government will enact comprehensive stablecoin regulations to create registration and monitoring systems for issuers. This measure, along with easing regulations for financial institutions, will help stablecoins become more fully integrated into global financial systems. Meanwhile, more general market structural laws for token issuers and exchanges remain unresolved.

Strategically, the US government will increase its Bitcoin reserves using existing ownership rather than purchasing new coins. Globally, custodians such as JPMorgan Chase and BNY Mellon will begin offering digital asset custody services, signaling mainstream financial acceptance.

Furthermore, it is planned to introduce at least 10 additional stablecoins backed by TradFi alliances that have better integration into the global payment system. Initiatives of Japanese banks working with SWIFT and PayPal BUSD Solana will change the stablecoin landscape.

Layer 2 Networks: Driving Economic Activity and Scalability

With approximately 25% of total fees by the end of the year, layer 2 networks will overtake alternative layer 1 blockchains in economic activity.

Maintaining transaction cost efficiency when demand rises will depend critically on scaling solutions and ideas like Arbitrum Stylus. Although creative technical solutions will solve these issues, L2 fees are expected to increase and necessitate changes in gas restrictions and market factors.

Insights from Galaxy Research show a future driven by invention and adoption as the cryptocurrency industry is ready for radical change. From the institutional embrace of Bitcoin to the supremacy of Ethereum DeFi and the rise of stablecoins, 2025 promises to redefine the boundaries of blockchain technology.

https://www.crypto-news-flash.com/wp-content/uploads/2024/12/Cryptocurrency-2.jpg

2024-12-28 12:00:00