Singapore is ahead of Hong Kong in the race to become a cryptocurrency hub

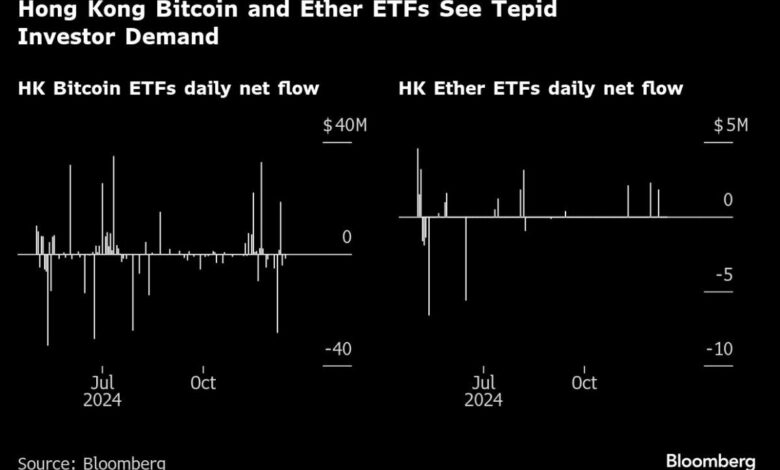

(Bloomberg) — Singapore has pushed ahead with its efforts to form a digital assets hub in 2024, while rival financial hub Hong Kong is struggling to gain traction.

Most read from Bloomberg

Singapore has distributed 13 cryptocurrency licenses in 2024 to a group of crypto operators including top exchanges OKX and Upbit, as well as global heavyweights Anchorage, BitGo and GSR. This is more than double the licenses granted by the city state the previous year. A similar licensing system in Hong Kong has been slow to advance.

Both cities are seeking to attract digital asset companies to their shores through dedicated systems, tokenization projects and regulatory sandboxes. Local authorities see cryptocurrencies as potential to boost their jurisdictions’ appeal as global business hubs, but progress has been uneven.

“Hong Kong’s exchange regulatory regime is more restrictive in a number of important ways – such as custody of client assets, token listings and delisting policies,” said Angela Ang, senior policy advisor at consultancy TRM Labs. This may have tipped the scales in favor of Singapore.”

Approvals in Hong Kong have been slower than expected, and regulators have indicated their intention to allow more exchanges by the end of the year. The city has now obtained a full license for seven platforms, with four of them given the green light – with some restrictions – on December 18. Seven other platforms hold temporary permits. Prominent exchanges such as OKX and Bybit have withdrawn their applications for Hong Kong licenses.

The city only allows trading in the most liquid cryptocurrencies such as bitcoin and ether, preventing investors from betting on smaller, more volatile tokens, known as altcoins.

“It’s a very high bar to meet and make a profit,” said Roger Lee, co-founder of One Satoshi, a Hong Kong chain of stores that offers over-the-counter transfers between cash and cryptocurrencies.

Another factor driving digital asset executives to consider expanding into Asia is the influence of China, where cryptocurrency trading is banned. David Rogers, regional CEO of market maker B2C2 Ltd, which has applied for a license in Singapore, said Hong Kong’s special administrative system has different risks compared to other countries.

Rogers said Singapore’s supportive digital asset environment makes it a “safe and long-term option” for a regional hub. “It’s a risk-adjusted approach that we take here.”

https://s.yimg.com/ny/api/res/1.2/fz0N3.qdhzlkQ.LrdVBanA–/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MTU-/https://media.zenfs.com/en/bloomberg_markets_842/d3f6ec825f58fe3683cf5e499d94a89a