Hyperliquid faces $ 340m Dress SaveCriff in the middle of Jelena Controversy

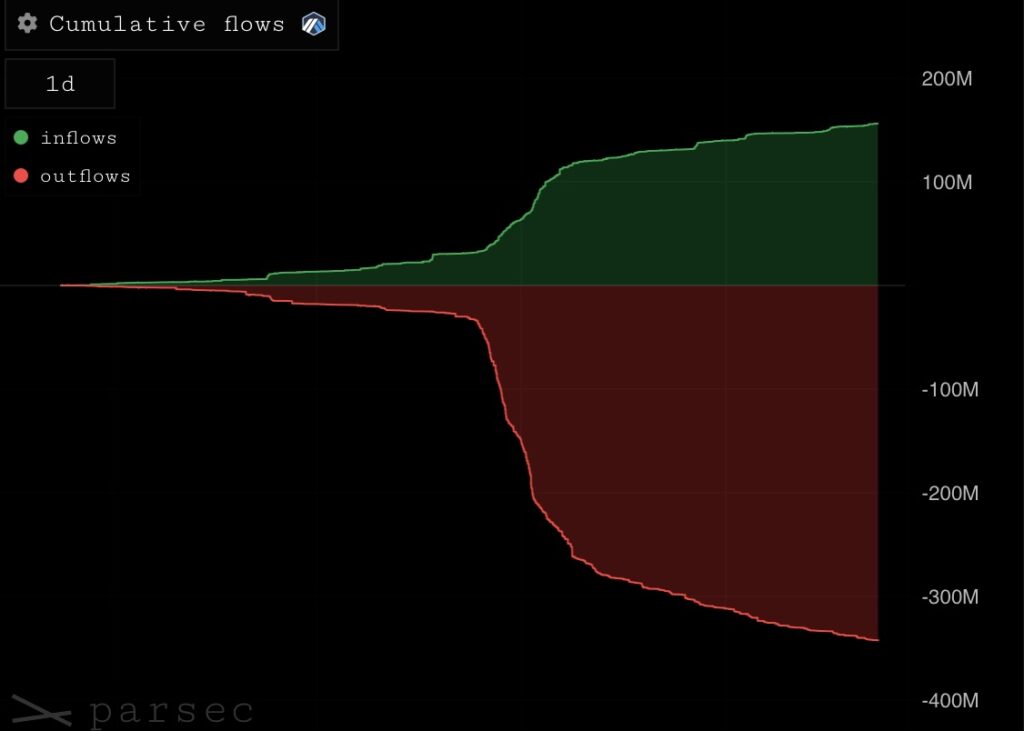

Hyperlikuid saw over $ 340 million in USCs outflows after the controversy around Jel, token, which rose 429% before there was.

Toward data From Blockckain Analytics Parsec, the latest castings occurred in the liquidation liquidation, echoing similarly from the 300 million dollar outflow during the previous bitcoin (Btc) Kit liquidation an event. As a result, hyperliquid (Hyper) USER reserves fell from high 2.58 billion dollars to $ 2.02 billion in the last 30 days.

Jelly controversy Started when the hyperlicidid box office took over 5 million dollars of short positions in jelly. As the price of tokens unexpectedly spished, unrealized loss increased to $ 10.63 million. If Jelly reached $ 0.17, the hyperlicuide treasury faced a potential loss of $ 240 million.

The price of spikes seems to be manipulated. The address identified as 0Xde95 has opened a massive 430 million dairy short position on hyperlikuidk, just to remove its margin soon.

This action has led to a series of liquidations, and losses absorb hyperlicuid vault. Another wallet, 0x20e8, opened a long position in ate time in jelly, which caused the price to increase even more.

To stop additional damage, the Hyperliquid Validator Committee decided to be destroyed by wanting and forcibly settled at 0.0095 USD. The platform has provided users that short positions are solved at the initial intake price and that the hyper foundation will fully compensate for influential users.

However, the way the incident was solved drew criticism. The Bitget of the whole of Maljia Chen called on hyperlicoidal actions “Immediately, unethical and unprofessional,” drawing comparisons with FTX. According to Chen, the platform seems less like a decentralized platform and more like an unregulated offshore exchange.

Meanwhile, hyperliquid source token, hype, 10% reduced in the last 24 hours, according to crypto.news price trager. The trading volume increased by 443%, reaching 466 million dollars, which shows an increased market activity. HIPE remains 58 %% below its all time in the amount of $ 34.96, but it is still 284% of its lowest price.

The total value locked in its hyperliquitiveness vault, protocol vault, which is the market and liquidation and liquidation, and fell from the top of $ 540 million. To $ 195 million per day 27. Marta, according to the defiles data.

https://crypto.news/app/uploads/2025/01/crypto-news-Hyperliquid-option04.webp

2025-03-27 06:18:00