“Open’-Bitcoin and Cripto Turning Brace in the amount of $ 9

03/19 Update below. This post was originally published in March 18

Bitcoin is stuck in the holder for holding samples in recent weeks, The struggle to regain the momentum after the “panic that” raised fears of the great fall prices Bitcoin.

The price of Bitcoin fell from its all times of almost $ 110,000 per bitcoin, falling to about $ 80,000 Despite a leak that reveals Russia peacefully leaning in Bitcoin and Cripto.

Now, As traders speculate Donald Trump White House could be violated to buy as much bitcoin as possibleThe CRIPTO TRADER ARTHUR HAIES was carefully observed that the Federal Reserve will enter to stabilize the markets, potentially launching the price priced boom.

Sign Up now for free Criptocodek–The daily village for five minutes for traders, investors and crypto-curious that will introduce you to you in front of Bitcoin and the cryptic market.

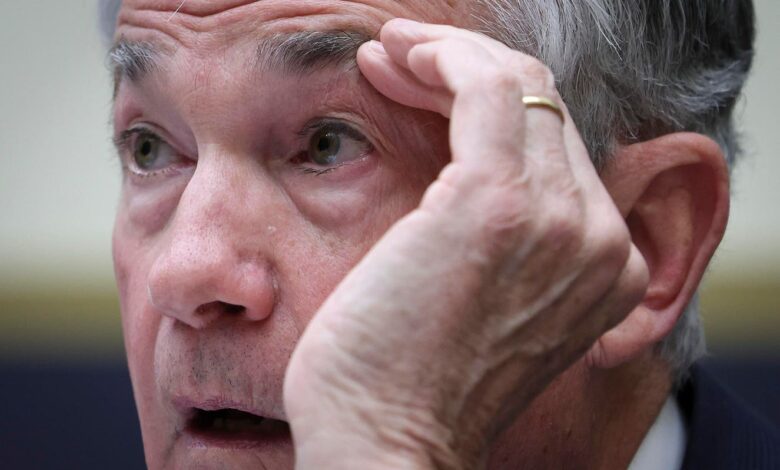

The Jerome Powell’s Federal Reserve Could Support Markets, including Bitcoin price … (+)

“When there is financial trouble, they always print money. It does not matter political backrests,” haies, Cofaunder of Cripto Deiki Pioneer Bitmek who set out to launch the company Investment Maelstrom, said In a wide interview with Bitcoin News.

The price of Bitcoin and the wider CRIPTO market followed the stock exchanges in the last weeks, because traders react to US President Donald Trump, re-excluded international trade tariffs and a growing risk of recession.

03/19 Updating: The Jerome Powell’s Federal Reserve is “Between the rock and the hard place” Wells Fargo’s main economist said Wall Street JournalWith a foster man who is likely to maintain stable rates today while struggling with the perspective of the Donald Trump’s Tramping War to encourage inflation inflation, but also the dimming of economic growth.

Traders whisper that Powell could announce the end of the IB balance sheet, known as quantitative tightening, which could increase the price of Bitcoin, crypto and stock exchange.

“Our strategic rates will make a statement to pause quantitative tightening until the upper ceiling of debt is solved, as it was proposed in the January meeting,” American bank analysts wrote in notes sighted from COINDESK. “They don’t expect to restart after the ceiling of debt, but the announcement will not be made until later this year.”

The Fed will announce its decision on the interest rate in 2PM ET, followed by Powell Print Conference.

“At the end of last year, Powell used to come in 2025. If he was mentioned in a new monetary regime, and that ads would be re-set to the Fed Standing Required again” quantitative relief, and now has become the Cripto editor again. The Newsletter, he wrote in e-mail Note.

“While rebuilt (quantitative relief) will soon be additional liquidity from large customers (Fed) to replace the maturation of domestic,” Acheson wrote, is facing $ 9 treasure within the due date of this year, and quantitative tightening can disrupt.

“When the flood opened, it was time,” Haies said, referring to the return of liquidity on the market and predicting “they would measure and print more money than anyone was ever printed.”

The last blossom of Bitcoin, which saw the price of Bitcoin rise to about $ 70,000 in late 2021. The huge mistress came in order to encourage encouragement shares with a coversion and printing money.

“We experience low in the generation of liquidity money,” Haies said.

Haes predicted that the price of Bitcoin would reach $ 250,000 by the end of the year, because Fed was forced to transfer the brings and moves to take over the economy and property prices.

Sign up now for Criptocodek-Frequiped, Daily Crypto newsletter

The price of Bitcoin dropped from recent high people of about $ 110,000 per bitcoin, dragging … (+)

“All eyes are at a meeting of the Federal Reserve Policy this week,” Blackkrock analysts wrote note.

The Federal Reserve starts its two-day policy meeting, and tomorrow’s decisions on bringing interest rates left unchanged despite the campaign of President Trump to see them to see them.

Traders prices in two or three reductions in prices later this year, but this could change with the food comprehensive press conference. Division of Jerome Powell.

(Tagstotranslate) Federal Reserve

https://imageio.forbes.com/specials-images/imageserve/633c2741f081733a2a78b209/0x0.jpg?format=jpg&height=900&width=1600&fit=bounds

2025-03-19 15:06:00