The next losing of a losing strategy?

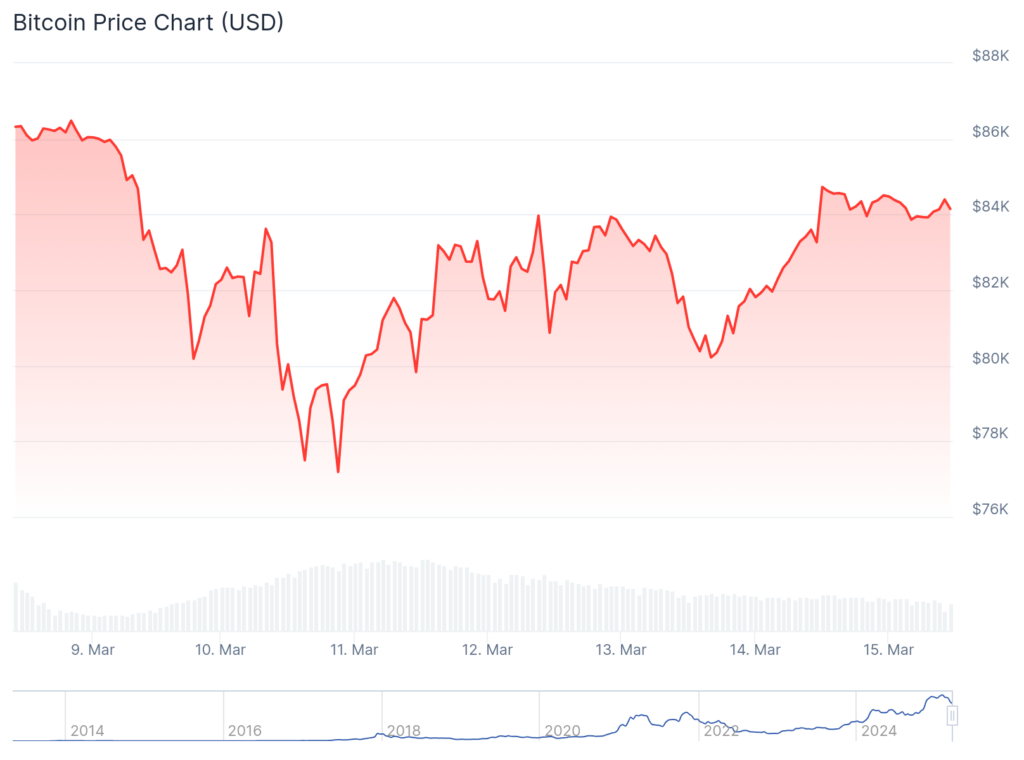

Bitcoin recovery at $ 84,500 on Friday for example, why after the stain usually leads to bad trading decisions.

Recent market movements oppose usual predictions during the period of extreme fear or greed.

Analysis of data from Santiment reveals that social media has reached superior negativity when bitcoin (Btc) It was introduced at $ 78,000 earlier in the week. There was also an online chat in connection with further decline. This sample mirror is market behavior late February when a temporary increase in price was accompanied by the trader’s bear traders.

🗣️ Bitcoin's rally back to $84.5K Friday shows what happens when the Monday crowd claims it's time to sell. Predictably, FUD hit its peak as $BTC was down to $78K, with predictions pouring in for lower prices all across social media. This same phenomenon happened at the end of… pic.twitter.com/GB72pntDb3

— Santiment (@santimentfeed) March 15, 2025

“Bitcoin’s rally Back to 84.5k in the amount of 84.5 kilonors shows what happens when they leave it on Monday that it is time to sell,” Santiment noted. “Predicted, the Food hit its peak because $ BTC was up to 78K dollars, with predictions to go for lower prices throughout the social media.”

The research emphasizes the recent bitcoin stability within the defined range, and or below $ 70,000 or violated above $ 100,000 in the past month. This stability creates clear mood markers: predictions below $ 70,000 means excessive fear, while forecasts above $ 100,000 excessive excessive value.

“Historically, markets move the opposite direction of the audience expectations,” Santiment explained. They noticed that the clusters of medvic prediction ($ 10,000 of 69K) are often accompanied in vice versa, while grouping of a bic forecast ($ 100,000 – $ 159,000) typically signal the fall.

Technical analysis supports this seliment-based approach. The CRIPTO Analytic Rect Capital pointed out that “signs on the Slow Resistance were there.”

He noted that the recent price movement fills the CME gap between $ 82,245 and approximately $ 87,000. It proposes that daily closely above the resistance can catalyze further up.

The current market structure also represents potentially bilke technical signals. Another analyst, Merchin merchant, pointed out Bitcoin approaching “Golden Cross”.

This is a technical pattern in which the average crosses are moving the average crosses before 200 days of average.

This indicator has been preceded by significant conferences:

- 139% in 2016 years

- 2,200% in 2017 years

- 1,190% in 2020 years after previous phenomena.

When the feeling reaches extremity, positions become overcrowded on one side, creating conditions for sharp reversal. As trades, collectively lean the bear, sell exhausted extensions, leaving primarily customers to influence the price action.

At the last check, Bitcoin decreased by 0.2% for the day, trading $ 84,145. The fall is 22.7% of its all times of 108,786 USD.

https://crypto.news/app/uploads/2025/03/crypto-news-Mount-Rushmore-Bitcoin-option01.webp

2025-03-15 18:15:00