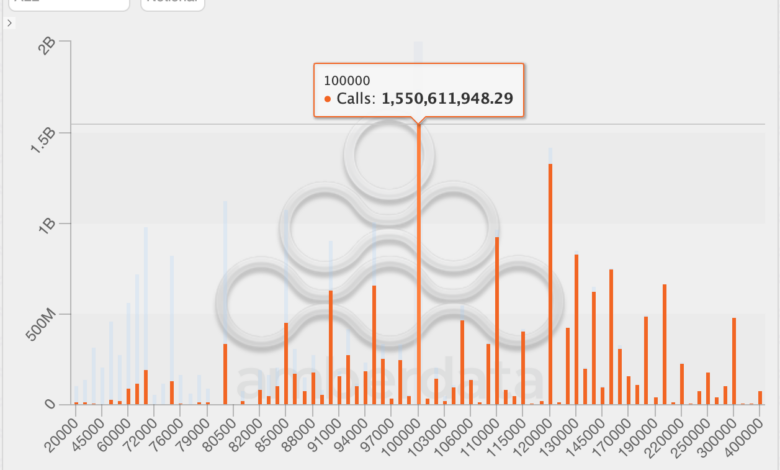

Bitcoin’s 100K call of $ 100,000 takes a crown of 120k bets as the most popular PLAY options on deribit

The recent dropping crypto market caused $ 120,000 (BTC) options to lose crown in a $ 100,000 bet that traders review their expectations of their bakers.

At the time of pressure, calls to $ 100,000 was the most popular BTC options for the Stock Exchange, praised with a methynal open interest of 1.55 billion dollars. An uninal open interest represents the value of the dollar number of active options contracts at some time.

Meanwhile, $ 120,000 calls, former leader until last monthThey stood in position two, with at the same time an open interest of $ 1.33 billion.

The call gives the customer properly, but not an obligation to buy a basic means at a predetermined price later. The call customer was implicitly in the market. Therefore, the open interest in a higher strike out-money calls, such as 100,000 and 120,000 dollars, reflects Bukres expectations.

The shift lower in the most preferred $ 100,000 strike is probably showing traders who decide for a more conservative bet in awakening recent price drop to less than $ 80,000. In addition, it can signal a wider reconsideration of fluctuations.

Cancellation in 25 Delta risks, which measures the difference between the default volatility (demand) for higher calls in terms of lower strike, show negative readings or bias for protective problems with the end of May. It is representative of the fears of the extended price on the market.

Prices remain bullash in favor of call options after May. In addition, the value of dollars in the total number of calls open at the time of the press was over $ 16 billion – almost twice as much as $ 8.35 billion.

https://cdn.sanity.io/images/s3y3vcno/production/c96f274b1ab925a1d81f509c782831f48d434916-1257×1045.png?auto=format

2025-03-11 15:02:00