BTC is 4% down, but macro pressures and bear signals indicate a further drop

The price of Bitcoina took 11% during the weekend after the Trump Executive Order to use the seized BTC for reserves, while wider macroeconomic pressures and bear technical signals indicate further wit.

7. Marta, Donald Trump signed Executive order to use Bitcoin (Btc) seized from criminal cases for strategic reserve, not buying it from the market. The announcement started a decline in Bitcoin’s price, which opened strongly to $ 90,000. March, but shaved about 11% of her value during the weekend, closing only $ 80,751 9. March, 9. March Coongecko. However, he has recovered over $ 82,000, currently trading for $ 82,154, for 4% in the last 24 hours.

This market reaction was probably due to unrealistic expectations, which would expect to buy the government to buy BTC, inject more money on the market. This is said, the order did not fully exclude the purchase of future Bitcoin, but they should be “budget neutral”, without burdening taxpayers.

In addition to disappointment regarding the reserve, price bitcoin remains under pressure on macro concern, mainly refers to tariffs. Specifically, the trading war between the United States and China is intensified, with Beijing imposed Tariffs on a certain American agricultural commodity as a retaliation for a recent increase in Trump in Chinese import duties. In addition, the President of the Jerome Powell Federal Reserve confirmed on Friday that the Central Bank will keep Wait for access to interest interest rates. This came in a weak us Report on Nefarm of Payrolls and expectations of at least three reductions of supply rates this year.

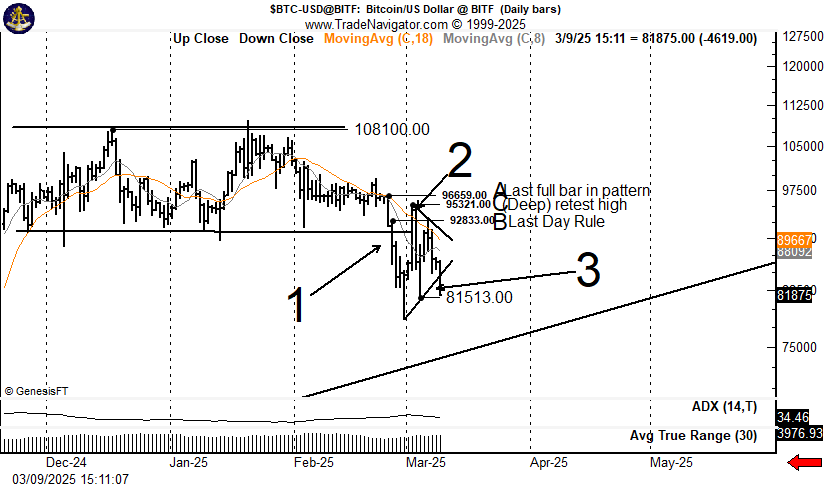

On the technical side, Peter Brandt Chart Analyst prominent If the price of Bitcoin ended the double top pattern, with the tops at about $ 108,100. After the top, it interrupted below the key support (previous range) near 95,321-96,659. After the break-up, the price formed a bear flag (consolidation sample), which pulled the breakdown zone around 95,321-96,659), but failed to recover it. Pennant finished, and the price broke down, signaling further. Support to 81,513 is now a critical level. If broken, further fall will probably be followed.

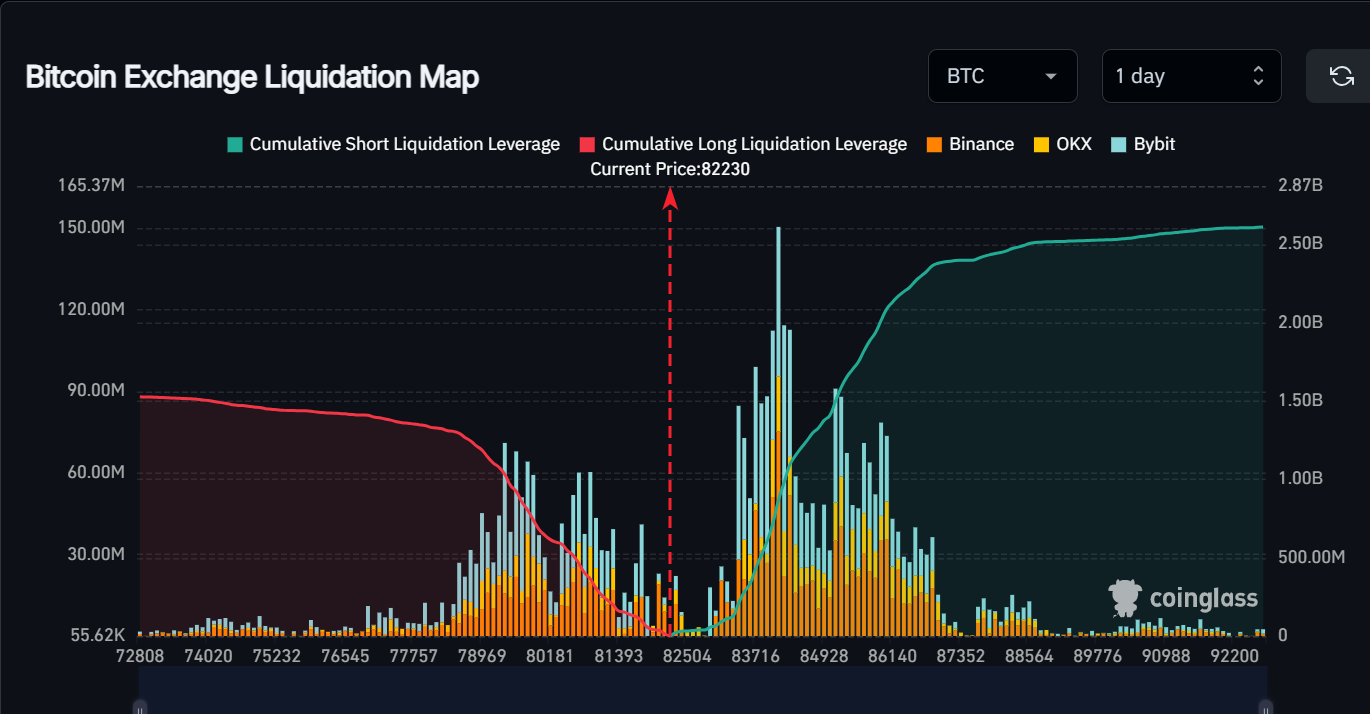

If the price falls below this level, it could cause about $ 1.3 billion long liquidation on length Koigulama data. Such a massive wipeout will undoubtedly cause a strong pressure downward pressure.

Arthur Haies’s Recent analysis It can offer insight into what the following could happen. In his recent post in X, he said Bitcoin would probably climb a level of $ 78,000, and if it doesn’t work, it couldn’t be the next target. He added that a lot of investors set the bet options about $ 70,000 to 75,000 price price. “If we enter that scope, it will be violent,” he noticed.

Silver lining

With the light side, some experts believe that Bitcoin news is long-term and that the market response to the news that consisted of the lost BTC (at least in the near future) the result of inflated expectations. Like Matt Hougan, the main investment officer in Bobra and asset management funds, said CNBC “The market is short-term disappointed” that the government did not say that he would immediately begin to acquire 100,000 or 200,000 Bitcoin, he added. Hougan pointed to Ai Czar Statement David Sacks on XHe said that the United States will seek “budget-neutral strategies for acquisition of additional bitcoin, provided that these strategies do not have incremental costs on American taxpayers.”

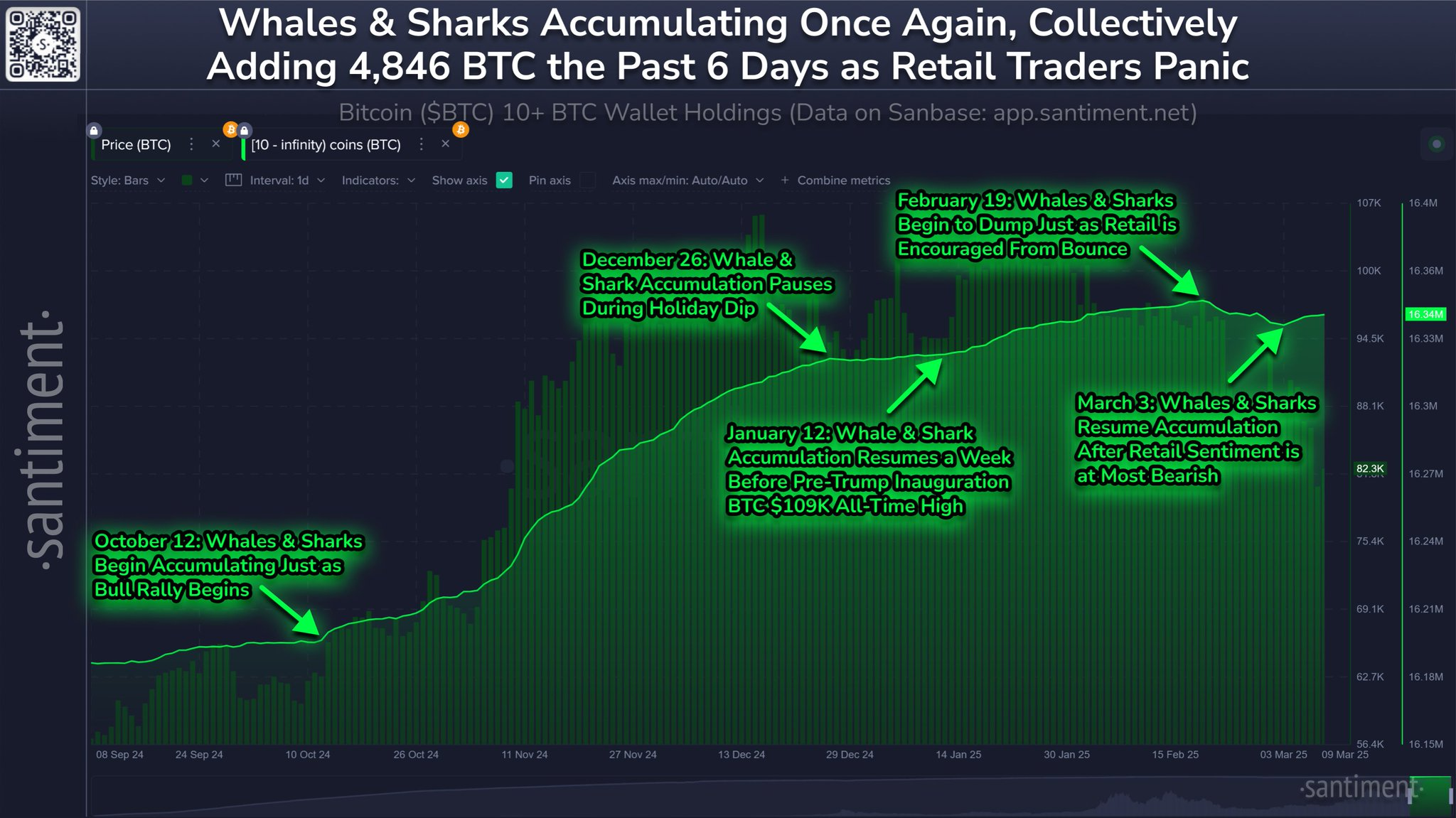

Another positive development (small smaller compared to the macro bacon) is that the wallets holding through Bitcoin, from 3. March, is stated from 3. March. Sounder. Although prices have not yet reflected that, if whales continue to build, the other half of March can be better than “Bloodbath”, that the market saw that BTC has reached its new peak of 100 thousand dollars 7 weeks ago.

https://crypto.news/app/uploads/2025/02/crypto-news-Trump-is-right-to-ban-CBDCs-option03.webp

2025-03-10 13:38:00