China’s economic woes provide hope as Fed BTC rate collapses

By Omkar Godbole (All times are Eastern time unless otherwise noted)

Keep an eye on the Far East It was our motto Recently, the latest news from the Chinese bond market explains why. Just today, the one-year Chinese government bond yield Dropped below 1% for the first time since the Great Financial Crisis, which increases the contraction since the beginning of the year. The benchmark 10-year yield fell to 1.7%.

How does this affect risk assets like Bitcoin, which fell overnight? Well, there are two main reasons to feel optimistic. For starters, the continued decline in yields suggests that Beijing will have to introduce more aggressive stimulus measures We saw it earlier this year.

Jeroen Blokland, founder and manager of the Blokland Smart Multi-Asset Fund, put it succinctly: “This suggests that China’s economic problems are far from over, and that the government will do what aging economies often do: increase government spending, and allow economic growth.” “. Larger deficits and higher debt levels, pushing interest rates down toward zero.

There is more to consider. This situation in China also raises questions about Federal Reserve Chairman Jerome Powell’s recent ultimatum on interest rates, which saw Bitcoin fall to $95,000 from $105,000.

China, the world’s factory, is facing a worsening deflation, having already witnessed the longest period of falling prices since the late 1990s. This could limit PPI and CPI readings around the world, including the United States, a major trading partner.

BNP Paribas noted The phenomenon erupted earlier this year, with analysts saying that China had already contributed to lowering core inflation in the eurozone and the United States by about 0.1 percentage points and commodity inflation by about 0.5 percentage points.

What this means is that Powell’s fears about stubborn inflation may be unfounded and begs the question of whether he will really commit to just two rate cuts for 2025 as he hinted at on Wednesday? Many experts believe there may be more.

“The Fed’s concerns about inflation are misguided. Interest rates are still very high in the US, and liquidity is about to increase, pushing Bitcoin higher,” said Dan Tapiero, CEO and CIO of 10T Holdings. On XIn reference to the decline in Chinese bond yields.

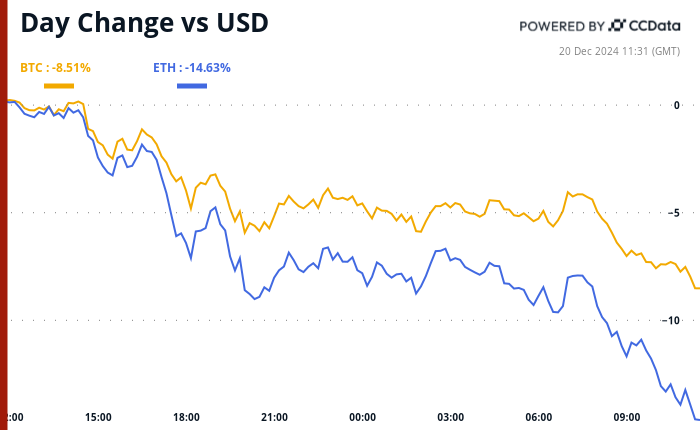

Right now, the markets are not thinking about this bullish angle. Bitcoin fell below $95,000 and Ethereum fell to $3,200. All top 100 coins flash red. Futures linked to the S&P 500 index fell 0.5%, indicating a negative open and continued risk aversion after the Fed.

Sentiment could worsen if the core personal consumption expenditures index, the Fed’s preferred measure of inflation, comes in hotter than expected later today. This could have markets pricing in another rate cut, leaving only one on the table for 2025. Be careful!

What to watch

- Encryption:

- December 23: MicroStrategy (MSTR) stock will be available It was added to the Nasdaq 100 index before the market opens, making it part of funds like the Invesco QQQ Trust ETF that track the index.

- December 25, 10:00 PM: Binance Plan to write off WazirX Token (WRX). Two other tokens are being deleted at the same time: Kaon (AKRO) and Bluzelle (BLZ).

- December 30: European Union meeting Regulation of Crypto Asset Markets (MiCA). becomes Completely effective. The stablecoin provisions went into effect on June 30.

- December 31: Cryptocurrency exchange Gemini closed its operations in Canada. in Email The letter, sent on September 30, said that all customer accounts in the country would be closed at the end of the year.

- January 3: The day Bitcoin was created. The 16th anniversary of the mining of the first block of Bitcoin, or Configuration blockby the inventor of blockchain with the pseudonym Satoshi Nakamoto. This came approximately two months after it was published Bitcoin white paper On an online crypto mailing list.

- Macro

Symbol events

- Launch tokens

- Binance Alpha announced the fourth batch of tokens, including BANANA, KOGE, BOB, MGP, PSTAKE, GNON, Shoggoth, LUCE, and ODOS. Binance Alpha is the pre-defined aggregator of Binance listings.

Conferences:

Symbolic discussion

Written by Shaurya Malwa

Fartcoin (FART) just reached $1 billion.

The mysteriously named artificial intelligence agent token jumped more than $1.1 billion in market cap early Friday even as the broader market saw a second straight day of losses, becoming one of the few tokens in the green.

The rise of FART is as much about human psychology as it is about economics. In a market where basic investments are faltering, it has become a symbol of absurd rebellion against the bleak financial outlook.

Its platform allows users to submit relevant memes or jokes to earn tokens. It features a unique transaction system where each transaction produces a digital buzz.

People invest not for the promise of benefit or groundbreaking technology, but for the joy of the moment, and a shared laugh over a coin whose name alone is enough to break the daily stress.

But it’s not just about jokes. The token is part of the growing crypto sector of AI agents, a sector that claims to use AI-powered entities to perform tasks on blockchain networks autonomously under the memecoin brand.

Determine the position of derivatives

- BTC’s one-month basis fell to 10% on the CME while the three-month basis fell to around 12% on offshore exchanges. ETH futures display similar behavior.

- Most major symbols show a persistent negative cumulative volume delta over the past 24 hours, which is a sign of net selling pressure. DOGE saw the most intense selling.

- Front-end BTC and ETH show a strong put bias, but calls expiring on January 31st and later continue to trade at a premium.

- Block trading in options trended slightly bearish, with large trades involving a $75,000 standalone long position expiring on January 31st.

- Someone sold a large amount of ETH worth $3,000.

Market movements:

- Bitcoin fell 2.55% from 4pm EST on Thursday to $94,947.95 (24 hours: -7.92%).

- ETH price fell 5.41% to $3,232.19 (24h: -14.06%)

- CoinDesk 20 fell 5.14% to 3196.80 (24h: -13.12%)

- The signature yield on Ether increased by 7 basis points to 3.19%.

- The BTC funding rate is 0.01% (10.95% per annum) on Binance

- The DXY index fell 0.25% to 108.14

- Gold rose 1.11% to $2,621.1 per ounce

- Silver rose 0.65% to $29.28 per ounce

- The Nikkei 225 index closed down 0.29% to 38,701.90 points.

- The Hang Seng Index closed down 0.16% at 19,720.70 points

- The FTSE fell 1.05% to 8,020.42

- The Euro Stoxx 50 index fell 1.36% to 4,812.53

- The Dow Jones Industrial Average closed Thursday unchanged at 42,342.24

- The Standard & Poor’s 500 index closed unchanged at 5,867.08 points

- The Nasdaq index closed 0.1% lower at 19,372.77 points

- The S&P/TSX Composite Index closed down 0.58% at 24,413.90 points.

- The S&P 40 Latin America index closed up 0.40% to 2,187.98 points.

- US 10-year Treasury notes fell 0.03% to 4.54%

- E-mini S&P 500 futures fell 0.79% to 5,822.25 points.

- E-mini Nasdaq-100 futures were unchanged at 21,112.25.

- E-mini Dow Jones Industrial Average futures fell 0.53% to 42,134.00.

Bitcoin statistics:

- Bitcoin Dominance: 59.21 (24h: +0.58%)

- Ethereum to Bitcoin ratio: 0.034 (24 hours: -1.37%)

- Hash rate (seven-day moving average): 785 EH/s

- Retail price (spot): $62.5

- Total fees: $2.3 million

- CME futures open interest: 211,885 BTC

- Bitcoin price in gold: 36.3 ounces

- BTC vs. Gold Market Cap: 10.34%

- Bitcoin held in OTC desk balances: 409,300 BTC

Basket performance

Technical analysis

- BTC is rapidly approaching the lower end of a recently expanding channel pattern.

- UTC closing below the support line could attract more chart-based sellers into the market, which could lead to a deeper drop to $80,000, a level that was widely watched after the US elections.

Crypto stocks

- MicroStrategy (MSTR): Closed Thursday at $326.46 (-6.63%), down 5.35% at $309.00 pre-market.

- Coinbase Global (COIN): closed at $273.92 (-2.12%), down 5.65% at $258.43

In the pre-market stage. - Galaxy Digital Holdings (GLXY): Close at C$24.75 (-5.93%)

- MARA Holdings (MARA): closed at $20.37 (-5.74%), down 4.52% at $19.41 pre-market.

- Riot Platforms (RIOT): closed at $11.19 (-6.36%), down 4.2% at $10.72 pre-market.

- Core Scientific (CORZ): Close at $14.48 (+0.21%), down 4.42% at $13.84 pre-market.

- CleanSpark (CLSK): Close at $10.91 (-3.62%), down 3.94% at $10.48 pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.45 (-5.56%), down 2.66% at $23.80 pre-market.

- Semler Scientific (SMLR): closed at $61.34 (-5.66%), down 4.22% at $58.75 pre-market.

- Exit Movement (EXOD): Close at $50.95 (-4.05%), unchanged pre-market.

ETF flows

Spot Bitcoin ETFs:

- Net daily flow: -$671.9 million

- Cumulative net flows: $36.310 billion

- Total BTC holdings ~ 1.142 million.

ETH ETFs

- Daily net flow: -$60.5 million

- Cumulative net flows: $2.406 billion

- Total ETH holdings ~ 3.565 million.

source: Persian investors

Night flows

Today’s chart

- The chart shows that the perpetual annual funding rates for major cryptocurrencies have reset to healthy levels below 10%.

- The market swoon has eliminated excessive leveraged bets.

While you were sleeping

- Dogecoin’s 11% decline leads to losses in major cryptocurrencies as Bitcoin’s festive mood worsens (CoinDesk): Bitcoin fell early Friday, extending a three-day decline following the FOMC decision, as hawkish Fed signals and overbought conditions led to selling. DOGE led declines among the 10 largest cryptocurrencies.

- Dozens of House Republicans are challenging Trump in a test of his grip on the Republican Party (New York Times): President-elect Donald Trump’s influence over his party failed the test Thursday as 38 conservative Republican members of the House of Representatives ignored his threats and rejected a bill to extend federal spending through 2025 and suspend the debt limit through 2027.

- As Bitcoin prices continue to fall after the Fed, this contrarian leading indicator offers new hope: Godbole (CoinDesk): Bitcoin’s decline below $96,000 has triggered a major reversal indicator – the 50 hourly simple moving average is crossing below the 200 hourly simple moving average – indicating the potential for a renewed rally above $100,000, Although risks of further declines remain.

- Hedge funds are profiting from the Trump-fueled cryptocurrency boom (Financial Times): Cryptocurrency hedge funds rose in November with 46 percent month-on-month and 76 percent year-to-date gains, as Trump’s election win sent Bitcoin above $100,000, making Brevan Howard and Galaxy Digital top performers. The distinguished.

- Central banks in emerging markets are stepping up their defense of the currency as the dollar rises (Bloomberg): Emerging market central banks are implementing tough measures, such as Brazil’s $14 billion intervention and South Korea’s easing of foreign exchange rules, to counter a rising dollar that is driving up import costs and escalating debt risks.

- Consumer prices in Japan are rising faster as the timing of interest rate hikes comes under scrutiny (Wall Street Journal): Japan’s inflation rate rose to 2.9% in November, driven by energy and food prices and expectations of higher interest rates, although lower services inflation and dovish messaging from the Bank of Japan may delay action until March.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/14aa83337e9a8c15c244029857b4688fd9daed58-700×430.png?auto=format